When choosing where to invest their money, people look for a few key features from any given provider. Increasingly, investors want the ease of access, control, quality advice and a portfolio that fits their goals. As both technology and understanding develop, these priorities are shifting and rebalancing to reflect that.

Moneyfarm tops Boring Money performance study: Summary Table

| 🤔️ Which investment platform performed best in Boring Money’s 3-year Report? | Moneyfarm was the best-performing investment platform from a list of 15 |

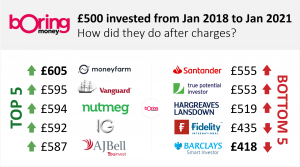

| 💰 £500 invested in Moneyfarm from 2018 to 2021 yielded? | £605. Moneyfarm was the only provider over to break £600 |

| 🤷♀️Which investment platform had the best result from Boring Money’s £50,000 investment report from 2018 to 2021? | Moneyfarm was the clear winner and the only provider to reach over £60,000 in portfolio value |

| 💥 How does Moneyfarm achieve stellar investment results? | Through technology and a team of portfolio management experts combination |

There is, however, one all-important feature that isn’t going anywhere any time soon: performance. For most of us, investing is about protecting and growing wealth for the future – ultimately, it’s about the bottom line. Other areas like advice are arguably now just as important in an investor’s journey, but the figure in the account at the end of the tax year is paramount.

It’s with this in mind that we’re pleased to share a report from investment gurus Boring Money. The independent research found Moneyfarm to be the best performing investment platform from a list of 15.

The study

In 2018, Boring Money invested £500 into test accounts across 15 investment providers and robo advisors to track performance. The portfolios were ‘medium-risk’ and had as close to 60% in equities as possible at the time of investment.

As the graphic below lays out, Moneyfarm was the only provider over the three-year period to break £600, outperforming the likes of Vanguard, Nutmeg and Hargreaves Lansdown, along with a number of high street banks.

Source: Boring Money

The analysis leaves out complex spreadsheets and asset breakdowns to focus on the number investors really care about the most: the bottom line. So, even without taking into consideration Moneyfarm’s active management, hands-on advice and accessibility, we’re doing something right.

You need to keep in mind that with investing, your capital is at risk and the value of your portfolio with Moneyfarm can go down as well as up. This means that you may get back less than what you invested. Past performance is not a reliable indicator of future performance.

Boring Money research was conducted over a 3 years period. The standard market practice is to show portfolio performance over a period of 5 years. You can take a look at Moneyfarm’s 5 years performance across our seven different risk levels here for additional information.

Boring Money CEO, Holly Mackay, said: “As robo advisers experience continued growth, longer track records are shifting the focus from who has the snappiest app to a more fundamental performance decision.

“Over the past three years, my £500 investment has made me £86 more with one provider than another. This sort of difference is material – and currently largely impossible to see if you are a retail customer shopping around for a ready-made solution.”

The impact of fees

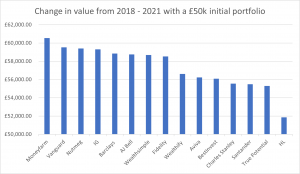

One of the limitations of Boring Money’s study was that, with such a small amount invested, any fixed fees had a disproportionate impact on the performance of the portfolio. This means that any provider with a fixed fee or a minimum monthly fee struggled.

When performance net of fees is looked at for larger £50,000 accounts, Santander, True Potential Investor and Hargreaves Lansdown performed the worst over a three-year period.

In addition to charges and equity allocations, the proportionate weighting to the US has been a key factor. The top three performers all had more than 40% of their overall share allocations in the US markets.

So, to extrapolate the performance out to a significant investment account and level the playing ground in terms of fee structures, Boring Money simulated a £50,000 investment over the same time period. The results are below and again show Moneyfarm as the clear leaders.

Source: Boring Money

How Moneyfarm works

Moneyfarm’s investment approach is powered by technology and backed by expertise. What this means is that we have sophisticated tech that helps us make investment decisions, but control is never fully passed over to the machine – this is a common misconception that can make people less likely to take advantage of a ‘robo-advisor’.

At Moneyfarm, it is the combination of that tech and our team of portfolio management experts that drives such strong performance. All our investors need to do is tell us a bit about themselves so that we can build a portfolio that suits their goals and their attitudes – we take care of the rest.

You can take a look at the five-year performance across our seven different risk levels here. Alternatively, if you want to discuss your options with one of our qualified investment advisors, please don’t hesitate to get in touch.

As with all investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest.

FAQ

Boring Money’s performance survey research sampled?

Online investment platforms and robo advisors with the same portfolios

How did investments perform from Boring Moneys data

A Boring Money study from 2018 to 2021 showed that Moneyfarm had the best performance after charges. A £500 investment in Moneyfarm over 3 years yielded £605.

The takeaway from Boring Money’s performance survey

Always be informed of charges issued by platforms and diversify your investments.