The US earnings season is in full swing, and an interesting picture is emerging. The biggest movements have been in the tech sectors so far, as some of the giants try to reset market expectations. Although the phenomenal pace of growth investors have got used to can’t last forever, this doesn’t spell the end by any means.

Disappointing second quarter results from Twitter and Facebook triggered three consecutive days of losses for tech stocks last week, with a three-day decline of -8.95% the largest seen from the sector in three years.

Better-than-expected results from Apple helped the sector rebound, however, as it became the first US listed company to be worth one trillion dollars.

Takeaways from earnings season

Tech stocks have had a phenomenal few years of growth. Facebook, Amazon, Apple, Netflix and Google – together dubbed FAANG – have eaten into an increasing share of the S&P 500. Add in Microsoft, and their market capitalisation counts for a big chunk of the S&P 500 today.

It might sound cliche, but it’s tough growing quickly forever – eventually the law of large numbers kicks in and things start to slow.

The Apple of your eye

Yet it’s important to remember slower growth doesn’t mean the end for a stock or a business. Apple has been there, done that and got the t-shirt.

The volume of iPhone shipments has slowed from a sprint in its early days to a walking pace today.

Apple’s most recent results reported growth of just 1% year-on-year, but this facilitated a 6% jump in the share price.

Look back at Facebook and it’s still generating earnings growth of 30% year-on-year from revenues of $12 billion per quarter – it’s not even at Apple’s stage of the business cycle yet.

Why forecasts matter

This brings us to what really caused investors to panic over the last couple of weeks; expectations – they matter.

If a company grows at 30% when investors expect it to grow by 40%, you can only expect a painful response. Especially if the stock is highly rated by traditional valuation measures.

On a very simple level, you can value a stock based on how profitable the business will be and how quickly it can grow these profits.

The problem is that both of these forecasts are uncertain as nobody can say with absolute certainty what profitability will look like in the future.

There’s evidence to suggest that growth mean reverts faster than profitability, which essentially means a good business can stay profitable for longer than it can grow quickly. However, it can be very painful when expectations for a business change, especially when there are signs of slower growth.

Valuing tech stocks

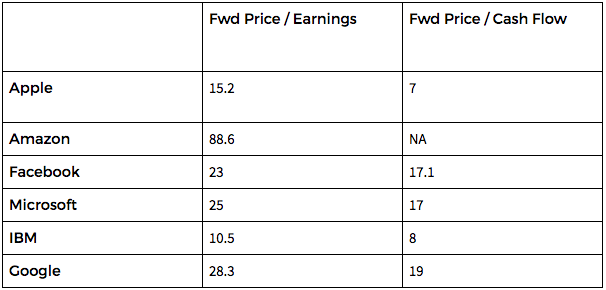

Tech valuations are interesting to look at, as they allow for all sorts of interpretations about what ‘the market’ thinks about business prospects. The table below shows Price/Earnings (P/E) and Price/Cashflow (P/C) ratios for a few big tech giants, sourced from Bloomberg.

It’s worth bearing in mind that this is just a snapshot, but you can make some preliminary conclusions from the data.

Firstly, the market doesn’t think much of Apple’s growth prospects. Only IBM has a lower P/E. We’d argue, very crudely, that a higher P/E implies higher future expected growth.

Amazon, clearly, has some very strong growth assumptions baked into the stock – which is impressive for a business with an $870 billion valuation. In fairness, part of that is probably an assumption that Amazon will be a more profitable business in the future, as it continues to invest aggressively today. But, it’s still a punchy headline number.

The other stand-out is Microsoft – for a business that was “Oh-So-90s”, it commands a healthy valuation premium versus Apple and a small one, now, versus Facebook. Forward P/Es aren’t the final arbiter of valuation, but it still stands out.

And then there’s Facebook, which maybe looks a bit cheap for a business still growing earnings at 30% yoy but certainly doesn’t suggest a business whose growth is coming to an end. Part of that reflects the recent disappointment and concerns over increased regulation.

Management resetting expectations

Management also like to beat expectations and do everything they can to manage external forecasts to do so. It’s why many new CEOs who are flown in to save failing companies use the “kitchen-sinking” strategy.

Facebook’s earnings were disappointing, but the market reaction was influenced by its outlook and the potential for slower growth. Now, although management are certainly closer to real time information from the business than outsiders, in most cases the impact this has on the visibility of business performance is often overstated.

By getting all the bad news out in one go in the first earnings release, the manager can start on a clean foot, reset expectations and hopefully beat forecasts from then on.

That’s not to say that Facebook is anywhere close to failing or wanted to engineer a 20% drop in its share price – far from it! But you wouldn’t be surprised to hear that the business has done a bit better than the expectations that were set this quarter.

What does this mean for Moneyfarm portfolios?

The Moneyfarm portfolios own all these equities through our various ETFs, but the weights are relatively small.

In our All-World Equity ETF, for instance – Apple is the largest single weight at 2%, followed by Microsoft at 1.6% and Amazon at 1.5%.

With perfect foresight, you’d have wanted to own far more of these over the years. But perfect foresight is in short supply and the 20% drop at Facebook reminds us the risks in doing so.

The benefits of a diversified investment strategy are clearer to see in these situations, especially when you see a good earnings season coming from the wider market. The momentum behind sales and earnings should help underpin valuations going forward.