In the first issue of Moneyfarm Green we cover the latest from COP27 and highlight many other eco-friendly initiatives and investments. This year, COP27 ended with a historic decision to create a loss and damage fund for the most vulnerable nations that have been affected by climate change. One of the concerns that the finer points of this fund still need to be hammered out. We’re really hoping an agreement on the way forward can be reached soon.

Some of the other key highlights/lowlights identified by the UN Environment Programme, include:

- A failure to move away from fossil fuels. Unfortunately, coal is still being “phased down” and some critics suggest that talk of “low emission” energy refers to the use of natural gas which contributes to GHG emissions.

- The lack of commitment to the Paris Agreement’s ambition to limit global warming to 1.5 degrees celsius above pre-industrial levels.

- It was acknowledged that there was a need for “climate finance”, so in the final agreement it showed that between $4-$6 trillion a year needs to be invested in renewable energy until 2030 to help the world reach net-zero by 2050.

- There was also talk of an “Adaptation Fund” where regional governments and developed agencies would donate $230 million to help vulnerable communities to fight climate change.

COP27 has some failures and some ambitious goals to achieve. As ever, we’ll be keeping a watchful eye on whether the pledges made will be kept.

Delegates at COP27 weren’t the only ones making pledges and promising change. Here’s some other green news we found interesting:

The rise of zero-carbon lithium

The world is on the cusp of a mining revolution. An EV battery requires 52kg of graphite, 29kg of nickel, 20kg of copper, 8kg of cobalt and 6kg of lithium. Mining industries are keen to mine more sustainably by developing zero-carbon lithium using geothermal energy for extraction.

There are two schools of thought when it comes to the European Union (EU) sustainable finance taxonomy. The one says “It’s the world’s most ambitious green investment rulebook and could direct huge sums of money into fighting climate change” while the other claims “It’s a greenwashing exercise that puts the European Union’s climate change targets at risk”.

The EU taxonomy is a complex system used to classify which part of the economy can be marketed as sustainable investments. It doesn’t’ restrict investment into non-green activities but it does limit what companies and investors can deem to be eco-friendly. Earlier this year the EU Commission proposed that gas and nuclear power plants should be added if they meet certain criteria. Not all have agreed to this proposal but it looks like their addition will go ahead from 1 January 2023.

A generous donation to fight climate change

Yvon Chouinard, founder of sustainable outdoor clothing brand Patagonia, has decided to give the majority of the company’s profits (98%) to a non-profit group to aid in the fight for climate change. The other 2% and all the decision making has gone to a different trust. This is all in aid to fighting climate change. Imagine how close to ending climate change we’d be if all companies had the same philosophy!

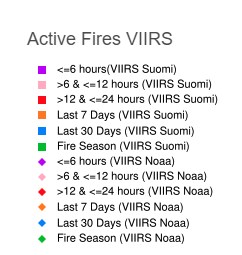

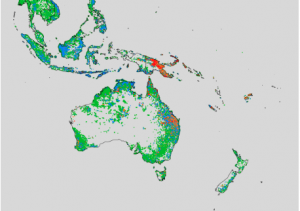

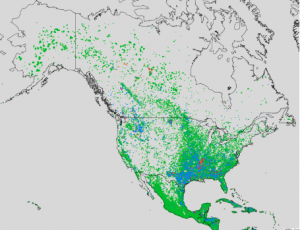

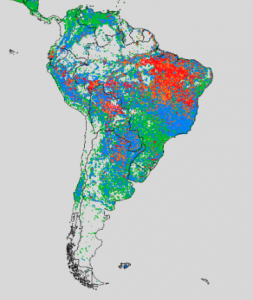

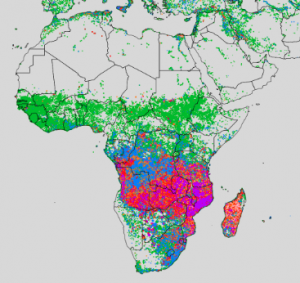

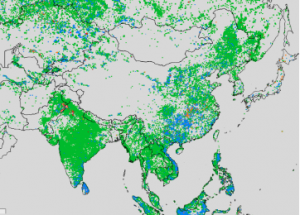

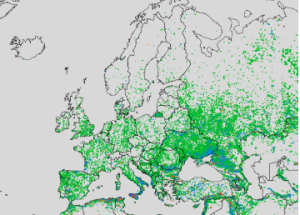

Chart of the month: worldwide wildfires last six months

The following screenshot shows the wildfires registered across specific geographical areas in the world between (1st May 2022 – 6th October 2022. As you can see all major continents have been impacted by the spread of wildfires. As of today, wildfires are still present in the southern east part of Africa, and central South America (purple colour).

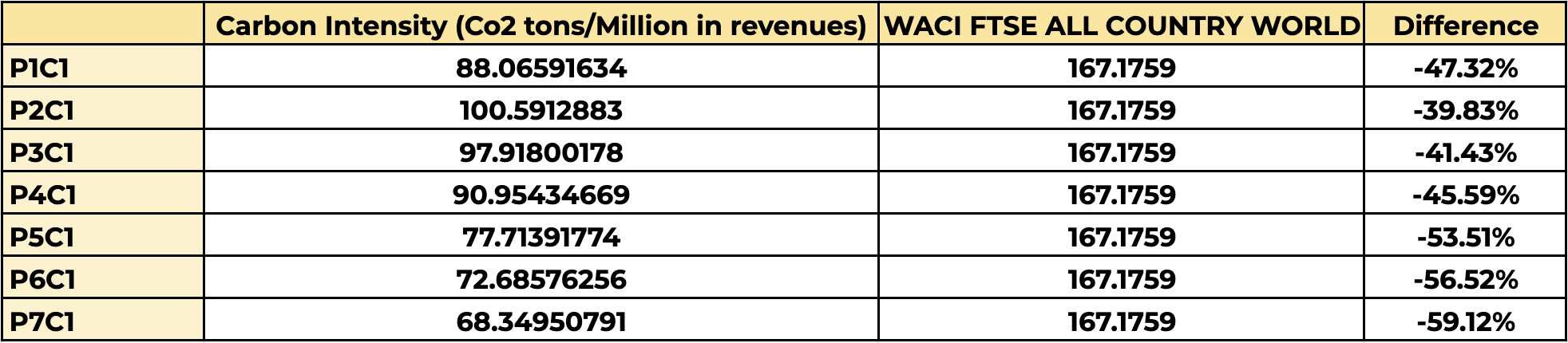

Moneyfarm portfolios under the lens: Carbon intensity

Carbon intensity metrics measure the carbon efficiency of companies in relation to the products they sell and can determine a portfolio’s exposure to carbon-intensive companies or sectors. This efficiency can be calculated in economic terms (using revenues as a common economic denominator) or in physical terms (using industry-specific physical units of production).

Source: MSCI

Weighted Average Carbon Intensity (WACI) is a measure of emissions normalised by revenue. It is expressed by tons of CO2 emitted/millions of revenues.

Since revenue is a point of comparison across all issuers, the metric can be used to estimate the impact in terms of emissions across sectors and investment portfolios.

Since high-emitting, low-revenue companies are likely to be more vulnerable to carbon pricing mechanisms, the metric is also useful from a risk analysis perspective to indicate an issuer’s potential exposure to carbon transition.

Advantages and limitations of applying Carbon Intensity (WACI):

+ Easy to apply to portfolio analysis (decomposition and attribution).

+ Reflects the size and efficiency of individual companies in terms of emissions.

– Revenue normalisation can make this parameter sensitive to short-term fluctuations in product prices.

– Sensitive to outliers, as the presence of extreme values for large portfolio weights can distort the outcome.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.