Headlines in March were dominated by the bankruptcy of Silicon Valley Bank and the purchase of Credit Suisse by UBS, but the overall picture is more optimistic, with portfolios performing positively. The collapse in rates obviously benefitted the bond sector, but equities also recovered well after the initial crash. Investors have not been overly spooked by tremors in the banking sector, recognising the overall resilience of the economy.

A sharp contrast remains between money and equity markets, with the former pricing in a steep slowdown, while the latter not particularly shaken by the banking crisis, as demonstrated by the S&P 500 sitting above its 50-day moving average. The global bond aggregate finished flat, and the US government bond index up +1.7%. European and Americanequities finished respectively at -0.5% and +1.4%, and the NASDAQ at +.7.2%.

A drama but not a crisis

March will (not!) be be remembered as a month in which a serious financial crisis failed tomaterialise. It began when Silicon Valley Bank (SVB) sought extra capital to strengthen its capital structure after the 2022 rate hike, which had hit the institution particularly hard because of its significant investment in mortgage-backed securities. The markets reacted swiftly – recognising what this said about the company’s risk management – and started betting against the bank. The rest is history: SVB’s collapse then put pressure on other American regional banks and precipitated the Credit Suisse crisis.

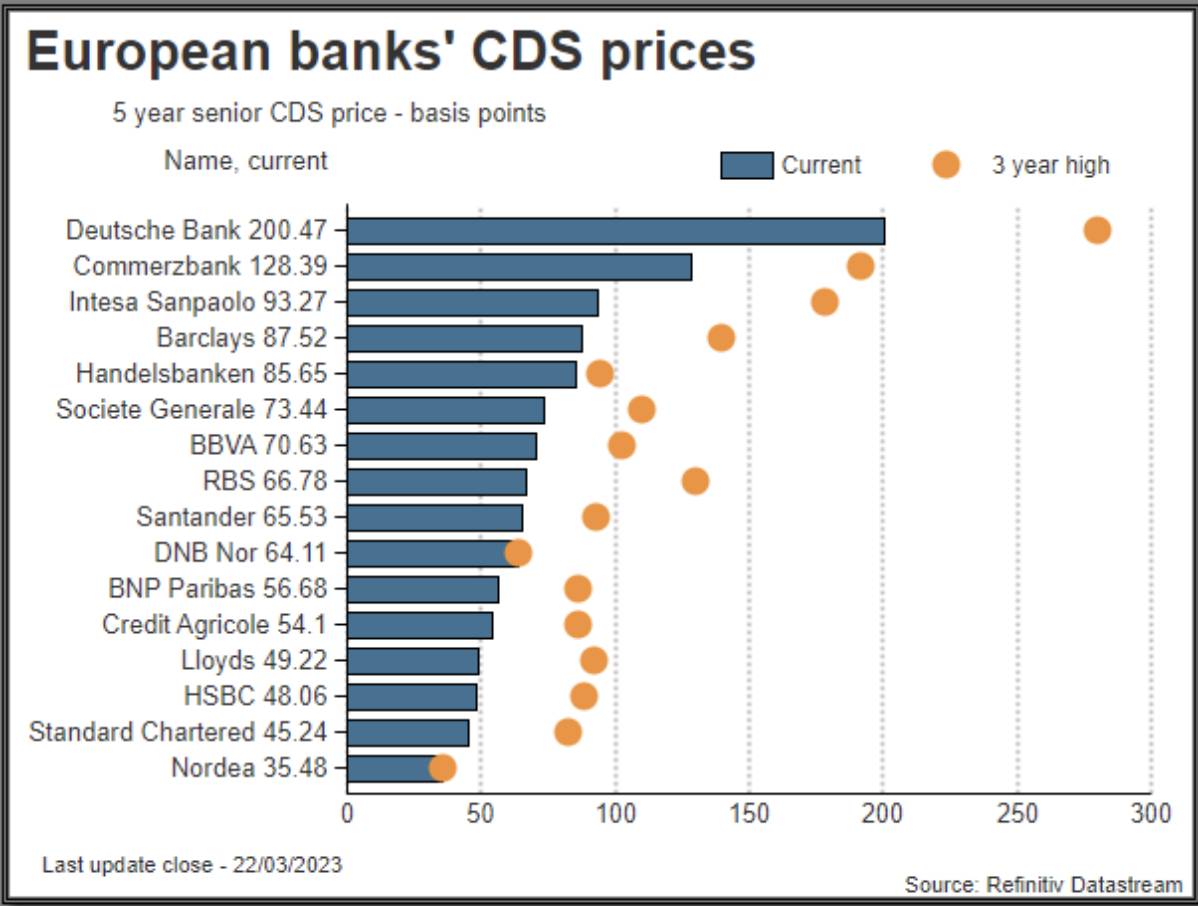

As is well known, the Swiss bank has had a troubled recent history, with numerous scandals and poor risk management. While there had been signs of improvement, panic broke out when the bank’s main investors indicated they would not provide further capital, leading the government to step in and broker the deal with UBS. Then Deutsche Bank briefly caused tremors in the market by buying back a large amount of subordinated debt before maturity. In reality, however, there was little to worry about. Fears of a systemic banking crisis proved unfounded.

The key point to understand is that SVB faced specific problems that do not apply to other banks. Moreover, the central banks acted decisively when needed, with US regulators providing ample liquidity and credit lines to prevent SVB’s problems spreading, and the Swiss National Bank supporting the historic acquisition of Credit Suisse by UBS with a large credit line. The system worked.

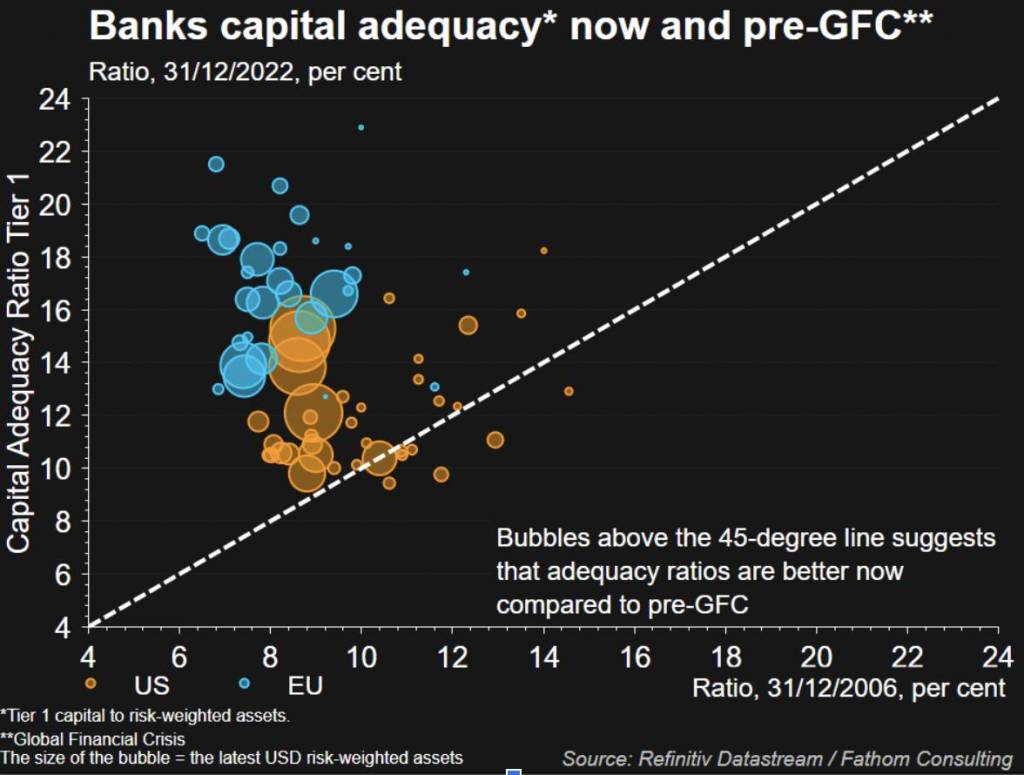

The big picture is that banks in the US and Europe are in better shape than they were at the time of the financial crisis. While there’s no guarantee that the weakest will survive, the data are encouraging.

The Tier 1 ratio shows the degree of banks’ capitalization in relation to assets held (weighted by risk). Better regulation has improved these numbers and we expect them to be strengthened further following the events of March.

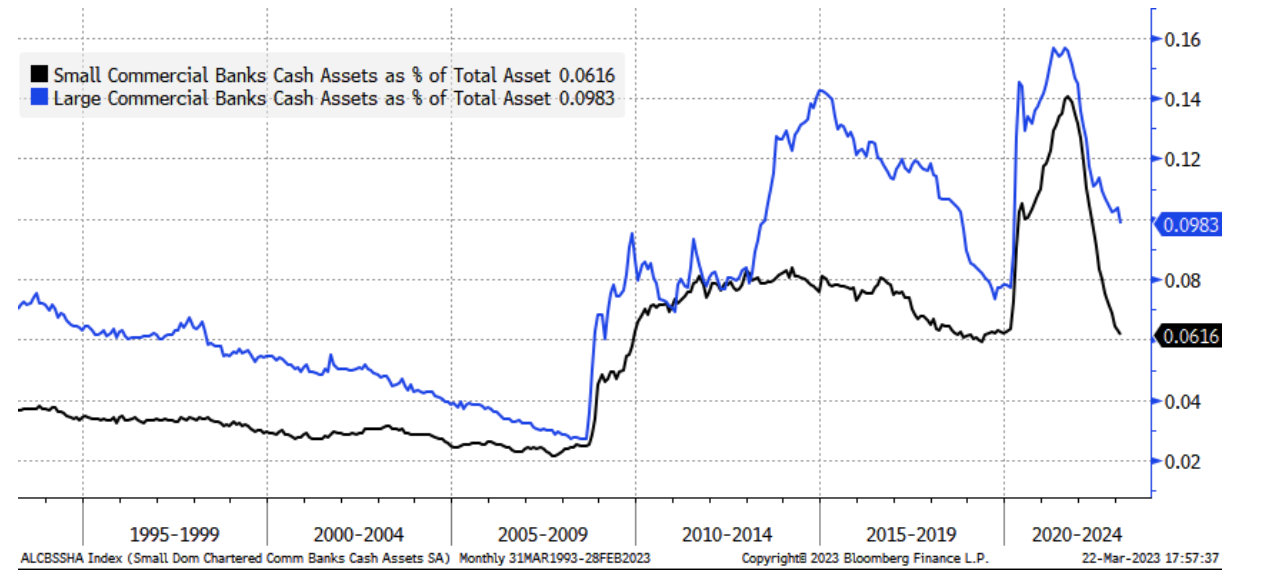

Meanwhile, credit risk in the euro area has increased, but not as much as in previous crises. The reserves of American banks are well above pre-2008 levels, especially in the case of large credit institutions.

Source: Lyn Alden Investment Research.

Finally, the gap between the interbank rate and the Fed deposit rate remains very low, indicating fundamental trust in the system, in contrast to 2008, when this indicator skyrocketed.

Betting on lower inflation

More interesting than the textbook market response to the events of March is the state of the markets after crisis was averted. Investors are betting that the Fed will not raise rates as much as previously expected, largely because banks are likely respond to recent events by strengthening their balance sheets, slowing down inflation and undermining the rationale for rate hikes.

Indeed, equity prices not only held up after their initial collapse, but even reached new peaks compared to the beginning of March. The most sensible interpretation is that the markets expect inflation to pose less and less of a threat. In our opinion, however, unless this optimism is backed up soon by data on jobs and inflation, we could see at least a partial reversal of the latest movements.

Where is all this taking us?

Overall, volatility remains high. Adding to the ongoing risks of higher inflation, a slowdown in the economy and an increasingly difficult geopolitical context, there is also the possibility that something else will ‘break’ in the financial system, though we consider it unlikely.

Only after the Central Banks remove temporary support to the economy – effectively re- starting ‘Quantitative Tightening’ – will the real extent of the fall in bank credit be clear. Then we can judge whether economies will be strong enough to hold up, and how ‘sticky’ inflation will remain. For now, it seems like a time to be cautious and conservative.

How Moneyfarm is reacting

Given the highly uncertain environment, we continue to favour conservative exposure, even though the crisis appears to have passed for the time being. Given both attractive rate levels and the possibility of inflationary surprises, our preference is for inflation-linked stocks and high-quality credit.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.