As summer holidays come to an end and the routine of school and work resumes, the high cost of childcare in the UK once again becomes a significant concern for working parents. Childcare expenses in the UK are among the highest in the world, with the average annual cost of a full-time nursery place for a child under two now reaching a staggering £14,836, according to a report by the charity Coram. However, new rules set to take effect this September could help parents save on these costs if they plan wisely.

Understanding the new childcare rules

Currently, under the tax-free childcare scheme, parents can receive up to £500 every three months (up to £2,000 annually) per child to help with childcare costs, with the amount increasing to £1,000 every three months for a disabled child. To qualify, your child must be 11 years old or younger, and both you and your partner (if applicable) must work at least 16 hours per week, earning at least the National Minimum Wage. However, if either parent’s adjusted net income exceeds £100,000, they are no longer eligible for tax-free childcare.

In addition, all three- and four-year-olds currently receive 15 hours of free childcare per week during term time, increasing to 30 hours for eligible working parents. Similar to tax-free childcare, the additional hours are forfeited if either parent has an adjusted net income over £100,000.

Starting in April 2024, the 15 free hours were extended to eligible working parents with children aged two to three years. From September 2024, this will further extend to include children as young as nine months. By September 2025, the 30 hours of free childcare will be available to all working parents of children aged nine months to four years. However, these benefits will still be forfeited if either parent’s adjusted net income exceeds £100,000. As free childcare is extended to younger children, this financial support becomes increasingly valuable to families, potentially providing substantial savings before children start school.

Potential savings on childcare costs

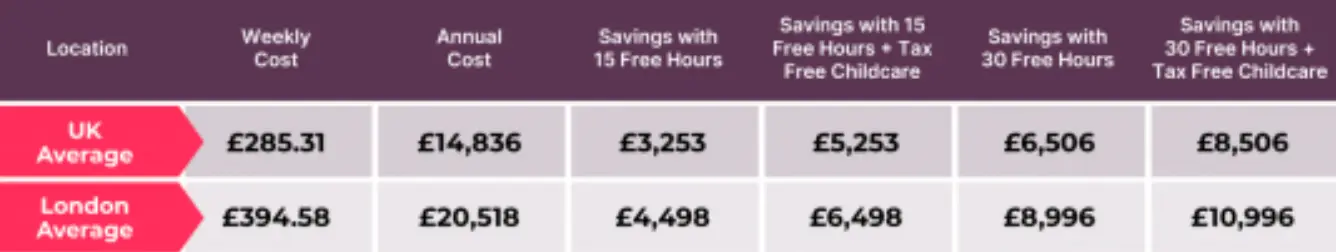

Here’s a breakdown of the potential savings based on the new rules:

Navigating eligibility and maximising benefits

Eligibility for free childcare is based on individual earnings between £8,670 and £100,000, meaning that in a two-income household where both parents earn £99,000, they qualify. However, a single parent earning £101,000 does not qualify and must pay full price for childcare. It’s also important to note that your personal tax allowance of £12,570 decreases by £1 for every £2 earned over £100,000, effectively increasing the tax on earnings above this threshold.

Therefore, it’s essential to evaluate whether the net difference in your take-home pay if earning over £100,000 outweighs the potential savings in childcare costs, particularly during the early years before your child starts school.

How pension contributions can help

One effective strategy to benefit from government assistance with childcare costs is through pension contributions via salary sacrifice. By reducing your adjusted net income through pension contributions, you could bring your earnings below the £100,000 threshold, making you eligible for tax-free childcare and free childcare hours. This approach not only allows you to receive government support but also boosts your retirement savings. For example, you could explore whether your employer can make additional pension contributions instead of offering a salary increase. Alternatively, making personal pension contributions to lower your adjusted net income below £100,000 can help you retain your entire personal allowance and qualify for additional childcare support.

This strategy requires careful planning, but it could lead to significant savings on childcare costs while also securing a better financial future for your retirement.

Plan your retirement with Moneyfarm

When you’re planning for life after work, it’s vital to choose an investment partner that you can trust, so you can have peace of mind when you retire. At Moneyfarm, we’re dedicated to helping you try to grow your savings so you can enjoy the retirement you deserve.

How we can help you save for the life after work you deserve

No matter what stage of your retirement planning journey you’re on, you can enjoy a range of benefits to help you make the most of your money, including:

- Tax efficiency – Get a 25% boost to your pension, without making a claim to HMRC. You may be entitled to more or less than this amount, subject to your tax status. Please note the tax treatment depends on your individual circumstances and may be subject to change in the future.

- Drawdown options – With a flexi-access drawdown pension, you can take any level of income you choose, or you can choose not to take any income at all after having taken your pension commencement lump sum [PCLS – the 25% tax-free lump sum]. You can increase or reduce the amount of income being drawn or ask for an extra one-off flexi-access drawdown pension payment. You can choose for it to be paid on a monthly, quarterly, semi-annual or annual basis. If you wish to change the amount of flexi-access drawdown pension being drawn from your plan you should instruct us in writing. You can also choose to drawdown through UFPLS (Uncrystallised Funds Pension Lump Sum) which is a flexible pension withdrawal option that allows individuals aged 55 or older to take lump sums from their defined contribution pensions. With each withdrawal, 25% is tax-free, while the remaining 75% is subject to income tax.

- Targeted savings to suit your retirement plans – We manage your portfolio around your target retirement date and will update your pension portfolio risk recommendations as the date approaches. However, we don’t automatically change your risk tolerance as the target date approaches, and this is at your discretion.

- Expert guidance – Our team of pension and savings experts are always on hand to help you make the best financial decisions possible. And best of all, all our consultancy services are completely free and only a phone call away.

If you’d like more information on your Moneyfarm pension or would like to open a pension with us, why not book an appointment with one of our team of consultants? You can do so via this link or call us on 0800 433 4574. You can also email hello@moneyfarm.com or start an online chat session and we’ll be happy to help.

As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. This information is for educational purposes only and should not be considered as personalised investment advice. It is important to consider your risk tolerance and investment objectives before proceeding with any investments. A pension may not be right for everyone. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you are unsure investing is the right choice for you, please seek financial advice.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.