For a lot of young people, the health of their pension pot is understandably something of an afterthought. With decades to pass before seriously considering retirement, planning the financial logistics of life after work can be daunting.

Thankfully, it has been compulsory for employers to automatically enroll their workers onto a pension scheme since 2012. This ruling also means that employers have to pay money into the scheme as part of the pay packet. This means that, if you’ve ever been paid through PAYE, you’ll already have a pension pot somewhere.

Want to get started right away? It takes minutes to set up a Self Invested Personal Pension with Moneyfarm. Just fill out a quick online questionnaire and you’ll be assigned a long-term investment portfolio that’s built around your retirement goals.

Get started with a SIPPHow to find your pension

The first thing you need to do when assessing your pension progress is to establish exactly where your accrued savings are being held. One problem a lot of people have is that we now average 11 jobs over the course of a working life. This means that keeping track of pensions as you move around can be tricky. Luckily, it’s been made a lot more straightforward than you might think.

Launched in 2016, the UK government has an online service that will locate your various pension services automatically – all you need to do is provide some basic details about your employment history. Using this service, you can calculate how much your existing pot is worth and where the money is held.

Do I have a choice when it comes to my pension?

Once you know where your accrued pension is, then it’s time to evaluate it. A lot of people, particularly younger people, will have done limited or no research into how their given pension provider(s) are actually performing.

Different providers will have differing fee structures, different performance levels and will be investing in different things. Transferring or combining your existing pensions can be a way to not only improve the performance of your pension pot but also to get everything organised.

Do your research – there can be more lucrative options out there. Even if you are relatively early on in your career, it can be worth taking time to review your pension savings versus your retirement income goal to see how well they match up. Use our Pension Calculator, which can tell you how much you need to be saving to meet your goals.

It pays to put in early

When it comes to saving for your pension, you have more flexibility than you might think. Part of the compulsory employer contribution to pensions is that the beneficiary is entitled to decrease or increase the amount they put in on a monthly basis. All you have to do is speak to your employer about changing the amount, which is usually a percentage of your monthly wage.

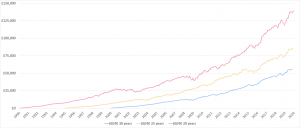

This is something a lot of younger people do – reduce their voluntary pension percentage in favour of short-term gain. Taking home more money every month can make a big difference in the early stages of your career. These early pension contributions can be vital in the long run as they grow, though, and it is unwise to put in less than the recommended default. Pension pots grow exponentially if invested well – it pays to be putting in as much as possible, as early as possible.

We simulated three different pension accounts, one beginning in 1990, one in 1995 and one in 2000. Each account is grown on the basis of an investment of £100 a month. As shown, the exponential growth seen when investments are made early means that, by the time the account has been open 30, 25 and 20 years respectively, the difference in the final figures is staggering. It pays to get started early, with manageable investments made over an extended period for full reward come retirement.

How much will I need for retirement?

You might be decades away from seriously thinking about your retirement, but getting a picture of how much you want to have saved by the time you do leave work can be useful. Getting a broad picture of how much you need to be putting away to get the retirement you deserve is valuable even at a young age.

The Moneyfarm Retirement Calculator takes basic information like your current financial situation, your age and your desired pension income to lay out how much you need to be saving every month to get yourself on track. The general rule is that you’ll need between half and two-thirds of your final salary to enjoy a comfortable standard of living during retirement – you can work on this basis to calculate roughly how much you’ll want saved.