Every April, the tax year comes to a close. For savers, it is an important time, as people assess their contributions for the year and make sure they aren’t missing out on any tax allowances. As 2021 approaches, it might be time to start assessing your investments ahead of time – whether you have existing investments or are planning to open accounts before the next tax year begins, now is the time to maximise your tax-efficient savings.

The yearly limit for pension contributions is set at £40,000, or 100% of your yearly income (whichever is lower). Any contributions made over this limit will not receive any tax relief. This is double the limit for ISA contributions and there are other mechanisms that allow people to grow their pension pot as effectively as possible.

Make the most of your pension allowance for the tax year – contribute into a Moneyfarm pension and utilise your carried forward allowance before it’s too late.

Carried forward pension allowance

For pension accounts, tax allowances are slightly more complicated than they are for ISAs. To help savers put away as much as possible for the future, any unused allowance from the previous three tax years is carried forward and can be applied to the current tax year.

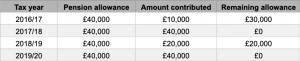

To explain the allowance, we took a look at a series of hypothetical contributions across the last four tax years, up to and including the current one. From the amount contributed, we can tally the remaining allowance, which the saver has access to in the run up to the end of the current tax year.

In this example, across the previous three tax years, £50,000 of unused pension allowance has been carried forward. This means that in the remaining days of the 2019/20 tax year, including the requisite £40,000 already saved, a total of £90,000 can be put away for the future while receiving the tax relief available.

It’s important to remember that, in order to access the remaining allowance from previous tax years, you need to have already contributed £40,000 into this year’s allowance. Also, you cannot contribute more than you earn in a year. In the above example, therefore, someone with a yearly salary of £86,000 would only be able to contribute this amount as a maximum, whereas someone who earns £110,000 would be able to utilise the full £90,000 allowance.

It is also worth noting that, once this tax year ends, the remaining allowance from the 2016/17 tax year will no longer be accessible. Only the previous three tax years are taken into consideration, so any unused allowance from before that period is wiped permanently.

Tapered pension allowance

In the recent UK government budget, incumbent chancellor Rishi Sunak announced changes to the tapered annual allowance, which reduces the tax-free pension contribution limit for high earners.

Previously, anyone earning over £150,000 would see their annual allowance reduce by £1 for every £2 earned over that threshold. The maximum reduction, then, was £30,000 from the standard £40,000 allowance. Under this system, anyone earning over £210,000 each year would only be able to contribute £10,000 into their pension tax-free, which forced many to look for alternative tax subsidised investments.

In his announcement, Sunak pledged to increase the threshold from £150,000 to £240,000, allowing anyone earning within that bracket to utilise the full pension allowance with no taper. The budget announcement did include a change to the maximum effect of the taper, though, with the highest earners only able to contribute £4,000 tax-free, down from the previous £10,000 lower limit. So, though those earning £300,000 might feel hard done by, the majority of higher earners will see their tax-free pension contributions increase.

The pension allowance taper is important to bear in mind when calculating how much you can carry forward from previous tax years. Though it only affects an individual’s pension allowance in any given tax year, it will affect how much you can carry forward to the current one.

If you want to discuss your pension or the changes announced in the budget, please do not hesitate to get in touch with the Moneyfarm team.