We are proud to introduce our range of thematic portfolios where we actively manage your risk and target growth in a smart way by identifying the megatrends that will shape our future.

But what, exactly, is thematic investing? Here we unpack Moneyfarm’s new offering and portfolio structure.

What is thematic investment?

Thematic investment means investing in companies with revenues that are tied to social-economic megatrends that are shaping our economy and the future of our world.

Moneyfarm believes we can find value in companies that are aligning themselves with megatrends because they tend to have a good chance of outperforming in the long term. We believe exposing portfolios to megatrends is better than picking economic themes in isolation.

So why do we refer to megatrends instead of ‘themes’? To drill down into this concept even further – a megatrend represents wide economic shifts whereas a theme could, for example, be part of a new idea/process of technology that is supporting or driving a megatrend. We believe that megatrends will enable us to remain relevant, while themes can change more quickly over time.

What are the options for investors?

Our team will select themes and exchange traded funds (ETFs) to offer investors four investment solutions covering three crucial megatrends: Technology and Innovation, Demographic and Social Shifts and Sustainability. Our team screens the market to identify suitable ETFs for each theme in order to compose unique allocations. Overall, our options for investors include:

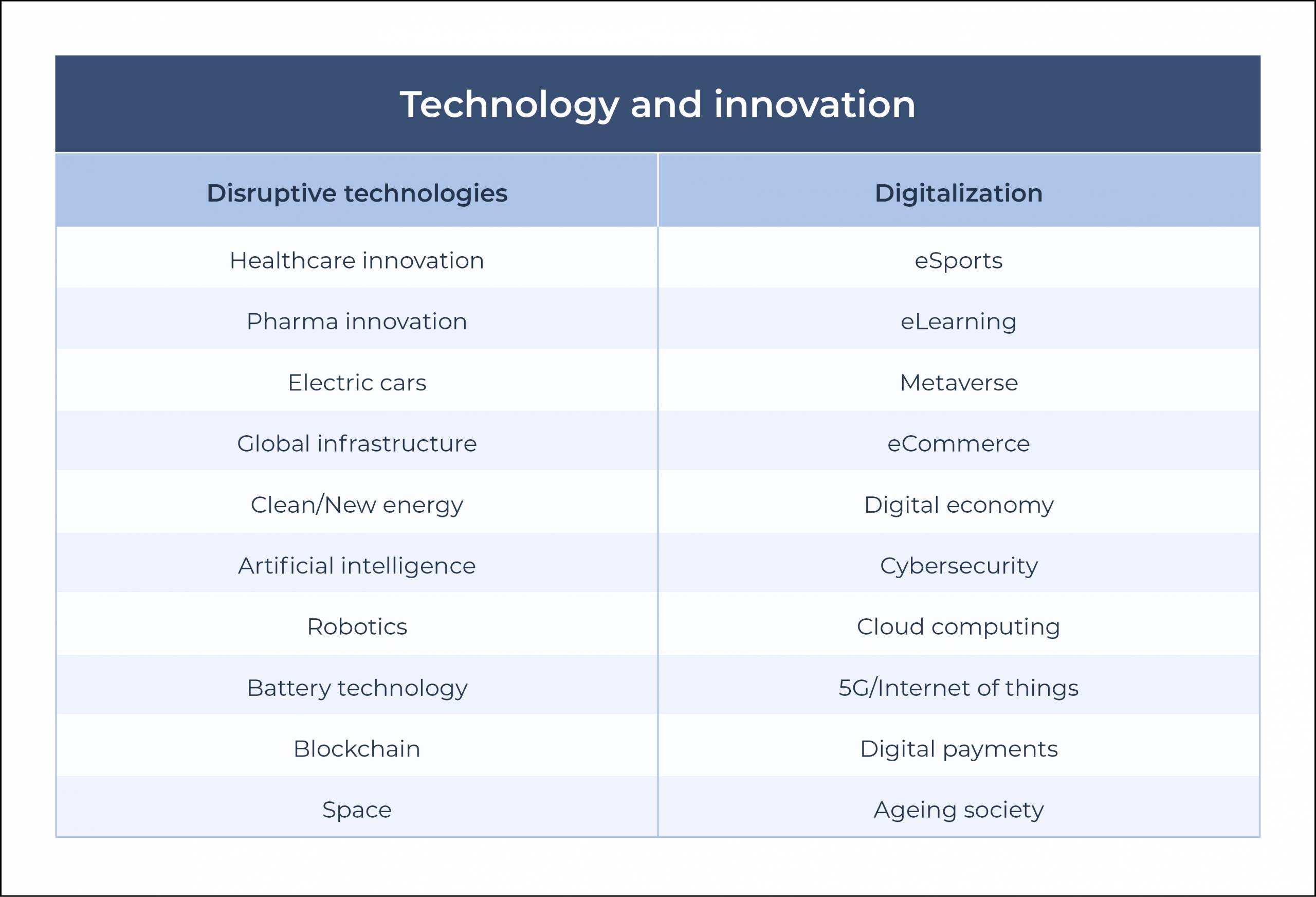

Technology innovation: Portfolios are invested in 10 ETFs that invest in companies that specialise in breakthrough technology. For example, space exploration and battery technology may be at its infancy now, but these have caught the attention of our asset allocation team and they’re now on our radar. They believe that it’s these technologies that will become more relevant in the future. Here is a breakdown of other technological themes we’re considering:

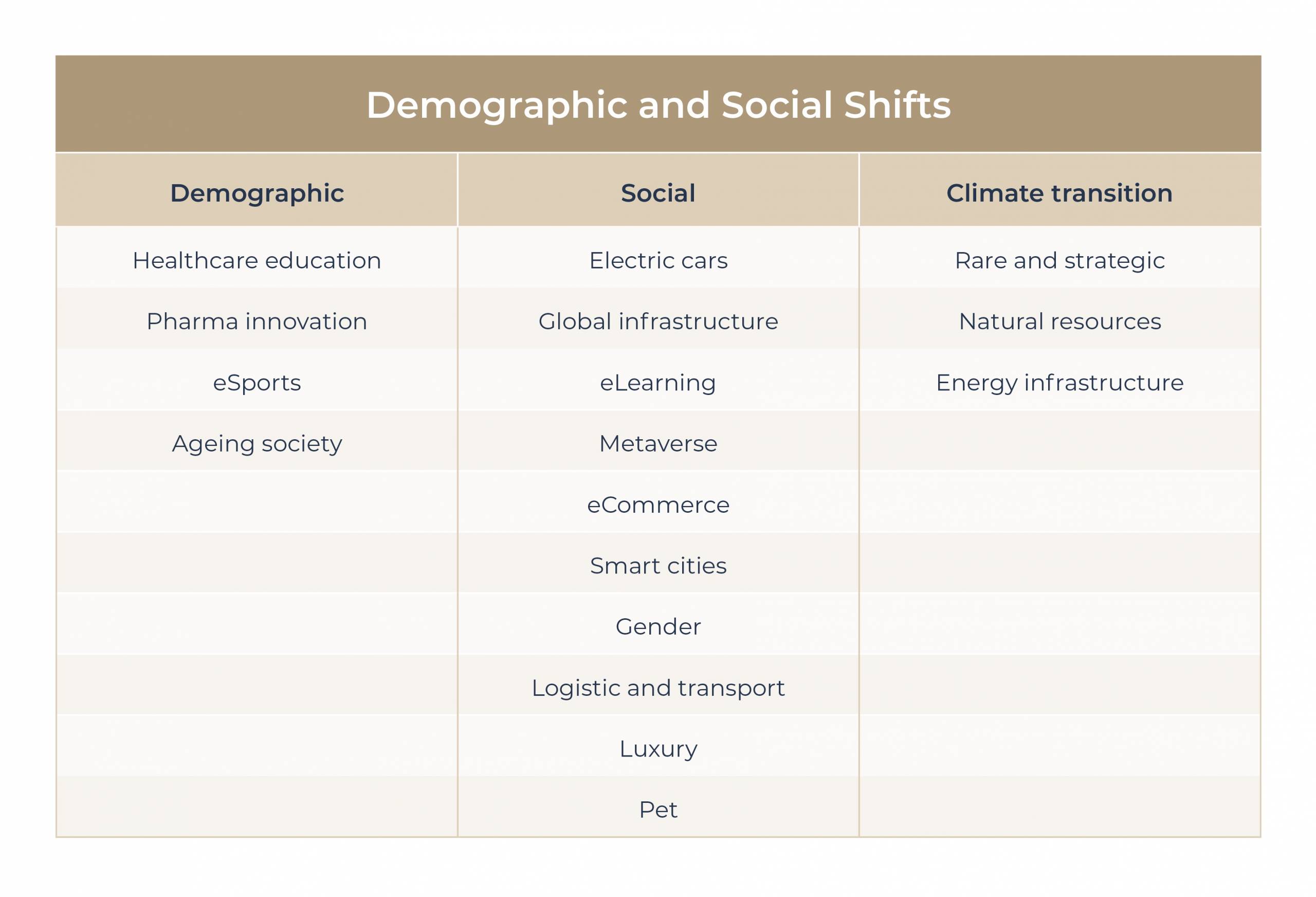

Demographic and social shifts: This looks at investment opportunities on the back of the fact that most countries in the world have an ageing population and other trends such as the rise of smart cities, and that e-sport and e-learning are gaining in popularity. Other social and demographic shifts include the move towards more gender equality, electric cars and the expansion of luxury goods and services for pets. Here’s a further breakdown of what this portfolio looks like:

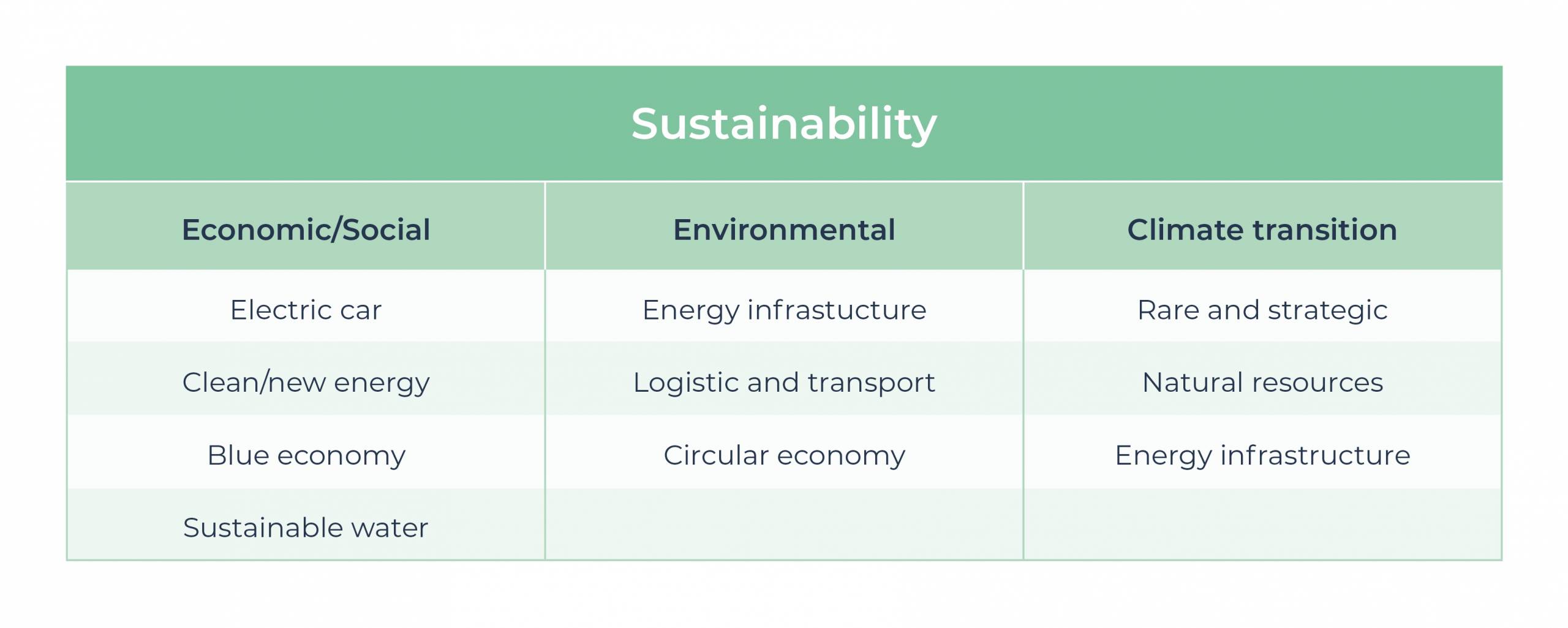

Sustainability: Investments that focus on creating a more sustainable economy are at the core of this portfolio. This is why Moneyfarm exposes investors’ portfolios to companies and funds that are aligned with the United Nations’ 17 Sustainable Development Goals (SDGs). The UN’s 17 SDGs are important because they are designed to help end poverty, hunger, sickness, discrimination against women and girls and bring peace and prosperity globally. We’ve narrowed down these SDGs and created our own:

Multi-trend: The multi-trend portfolio is aimed at undecided investors who want to take advantage of a selection of the megatrends we’re focusing on. For them, Moneyfarm creates a portfolio based on the risk and returns profile of the ETFs in each of the main megatrends: technology innovation, demographic and social shifts and sustainability.

Who is Moneyfarm’s thematic investing for?

Thematic investing is exclusively for our clients that want to push the envelope a bit and expose their portfolio to more unusual risks with the aim of increasing their expected return over the long term.

Moneyfarm’s thematic portfolios enable you to add a percentage of your overall investment portfolio to forward-thinking, innovative sectors that have the potential for improved growth in the future, such as Clean Energy, Smart Cities and the Blue Economy (it goes without saying that, when it comes to investing, returns are never guaranteed).

Investments in megatrends have a higher expected volatility than traditional investments. As such the thematic portfolio will not be accessible to all of our clients as we need to make sure that investors maintain a well-balanced portfolio that is able to withstand the risk.

A minimum investment of £10,000 applies. Investors qualify if they already have this minimum amount invested in their current Moneyfarm portfolios or investors can top their portfolios up to £10,000 to qualify for our thematic fund offering. A minimum of £10,000 is needed to ensure that investors’ portfolios have enough funds to invest in their core and chosen satellite portfolios.

How are the portfolios structured?

The portfolios are 100% invested in equities with underlying ETFs dedicated to the main macro themes that Moneyfarm has identified. Moneyfarm has adopted a ‘core-satellite’ investment approach.

Our thematic offering gives the investor the ability to invest in our core investment strategies and select one or more (up to three) thematic portfolios. To ensure a balanced level of risk, each investor will be assigned by Moneyfarm a quota from 5% to 20% of their portfolio that will be eligible to invest in one or more megatrends.

What fees will I be charged?

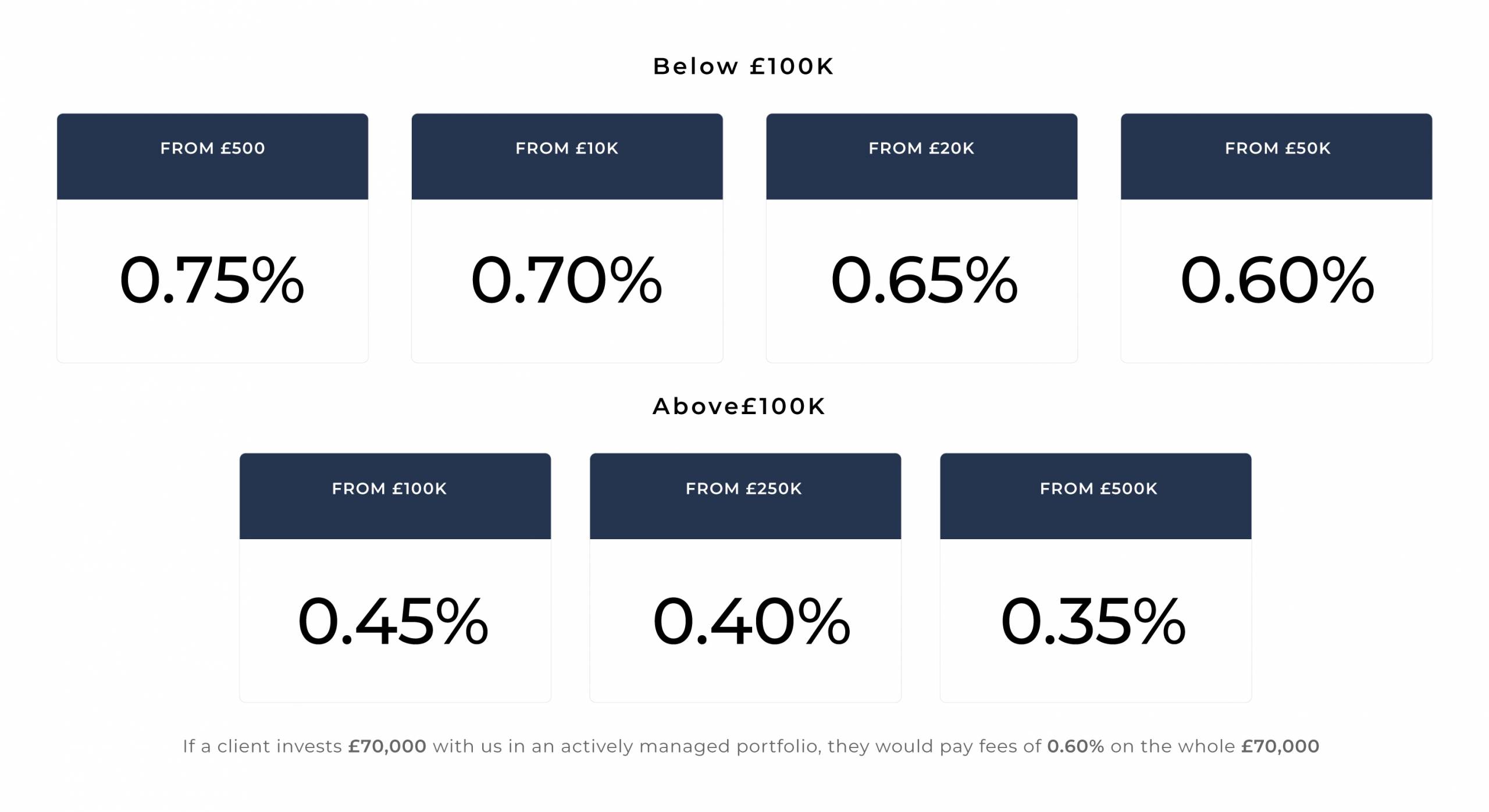

Moneyfarm’s platform fee, which ranges between 0.35-0.75% will remain the same but the underlying ETF fund costs will range between 0.40-0.45%.

The Moneyfarm process: the added value of investing in megatrends

It is challenging to keep track of the ever-increasing number of investment solutions in the thematics space, particularly when there is no recognised classification. Our rigorous selection process will ensure that investors are offered the best ETFs aligned with the themes they have chosen from our core megatrend offerings.

ETF selection: Thematic ETFs usually invest in fewer companies than traditional ETFs and typically expose investors to small-cap businesses. This, in itself, is not a bad thing but requires a rigorous selection process.

Moneyfarm ranks ETFs according to cost, liquidity and quality. But we have also included some new metrics to formulate our decision, including (a) concentration of risk, favouring more diversified and less concentrated ETF, (b) past performance, both in terms of volatility and risk, favouring ETFs with a stronger track record.

Risk management: If you choose to invest in our thematic portfolios you are taking on an element of risk (medium/high). This is because thematic portfolios are usually more volatile than classic allocation funds.

But we do have strategies to reduce this risk. The first one is in the portfolio construction stage, where we select funds to create a well diversified allocation that reduces specific risk as much as possible. To ensure the risk is spread we expose only a percentage of your portfolio to thematic funds (from 5 to 20%). We increase or decrease this exposure based on your risk appetite and specific financial circumstances. This ensures that you don’t exceed the optimal level of volatility for your mandate.

Should you invest?

If you have a medium to high-risk investment appetite and are seeking more alpha (excess return) and investments that align with your own values and interests then our thematic portfolios should be just what you’re looking for.

To get the best return on your investment you must be prepared to invest for the medium to long term. Your dedicated Moneyfarm advisor will assist you in choosing the right themes that match your values as well as return objectives and offer the best value over time. If you want to broaden your investment horizon with a personalised portfolio that will invest in themes that are set to improve our society, contact us for more information.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.