After an active last couple of weeks in financial markets, we wanted to take stock of where we are. First, we’ve seen measures of equity market volatility rise. The VIX, an oft-quoted measure of US equity market volatility, is still below the levels seen around “Liberation Day” – the day in April 2025 when the US announced sweeping tariffs on many imported goods – but remains above the average of recent years.

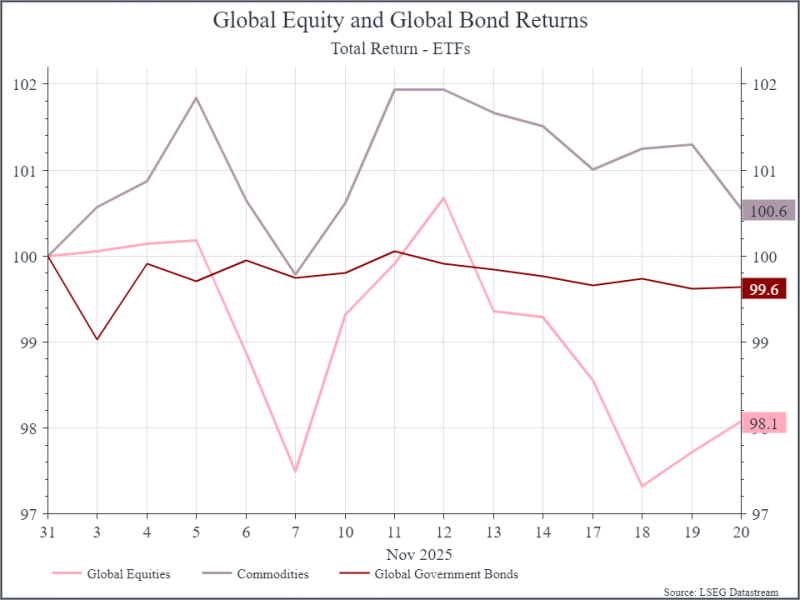

Looking at global market performance from the end of October to 20 November (see chart below), equities have fallen around 2%, commodities have risen slightly, and global government bonds are broadly flat.

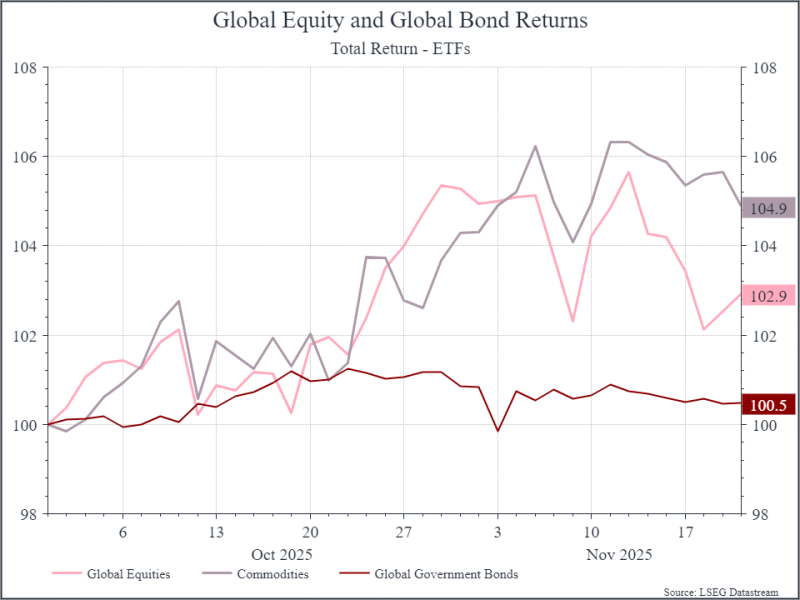

If we look at the same chart from the end of September to 20 November, we can see positive returns from equities and commodities, while government bonds have stayed fairly stable.

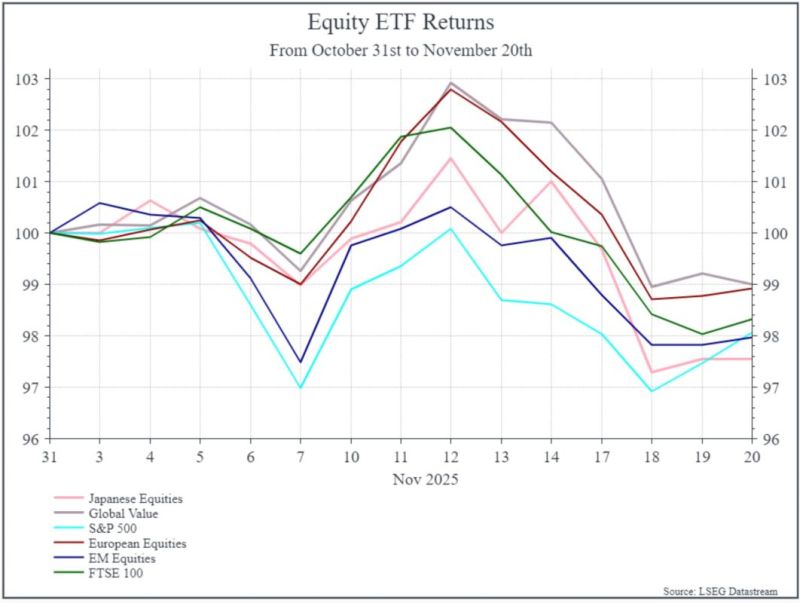

Digging into equity markets a bit further, it’s interesting to see that regional ETFs have generated fairly similar returns (in sterling) since the end of October, despite all the focus on US equities. A global value ETF has fallen around 1% over that period, while Japanese equities are down approximately 2.4%.

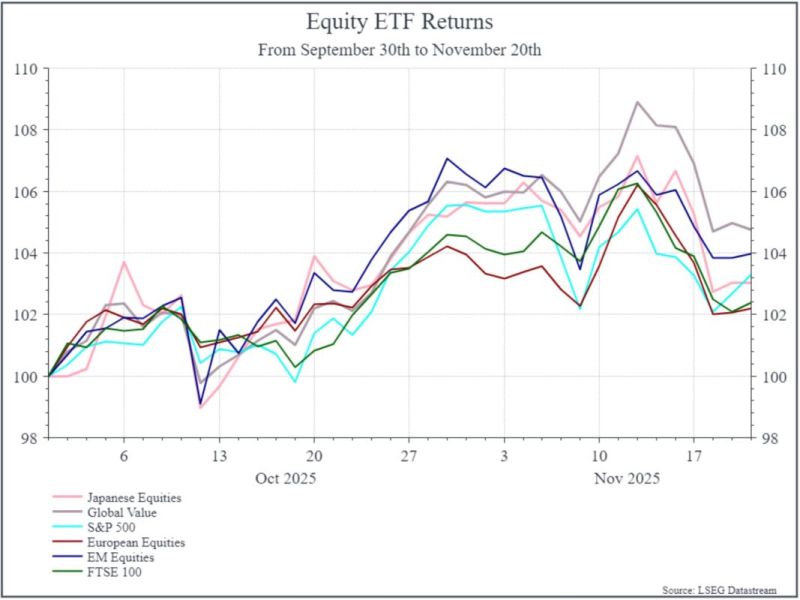

We can see a similar picture if we look back to the end of September.

On the corporate side, we’ve seen the most recent earnings release from Nvidia, which is significant given its weight in US equity indices and its status as a bellwether for sentiment around Artificial Intelligence (AI).

The headline results were very strong, and the company raised its expectations for future growth. At the same time, some commentators noted that receivables from Nvidia’s customers had increased quite sharply during the quarter, even considering strong growth over the period. There have been some questions around the relationship between Nvidia and some of its customers like OpenAI, with Nvidia effectively providing financing for OpenAI to purchase their products. It’s something that analysts are likely to focus on going forward.

In terms of macro data, the US government has reopened and we’re beginning to receive some delayed data releases. The September employment release gave a slightly mixed report, with higher-than-expected job creation and a slightly higher unemployment rate. Average hourly earnings grew at a pretty healthy pace (3.8% year-on-year), a bit ahead of inflation. On balance, this report suggested that the US labour market is still in fairly good shape.

Where does all this get us? After strong equity market performance in September and October, we’ve seen a bit of a pull-back so far in November. Underlying corporate performance looks pretty solid. Nvidia was the focus, and we also saw good results from Walmart, but expectations are clearly high and sentiment has shifted in recent weeks.

Looking beyond equities, we see that fixed income performed largely as expected, acting as a diversifier within multi-asset portfolios.

We continue to monitor closely the overall weight and composition of equities within our portfolios. We’ll look for opportunities that might emerge from the recent pick-up in volatility and focus on managing the overall risk of the portfolios.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.