The past two weeks have been particularly eventful for financial markets. A stream of news has added further turmoil to an already uncertain environment.

The first thing to hit investors was the release of US inflation figures for May. The Bureau of Labor Statistics published a figure that exceeded expectations, an 8.6% rise against the Bloomberg consensus of 8.3%. Spikes in the price of energy and food have contributed to the sharp increase (exacerbated by international developments), but core inflation was also high.

This sustained growth in prices is beginning to be represented in medium-term inflation expectations, reflecting a growing (though not yet alarming) market distrust in the ability of Central Banks to manage the situation.

Faced with this situation, the reaction from Central Banks was fairly heavy-handed, coming in the form of a series of hikes that helped determine the short-term retracement of financial markets.

The Fed conference resulted in decisive action, with the Central Bank essentially contradicting its previous comments and raising rates by 75bps, the biggest hike since 1994. Powell had essentially ruled out a rise of this scale back in May, but the latest inflation data and the market expectations forced his hand. The hike was accompanied by reassuring comments about the exceptional nature of the measure, but it’s a fairly drastic action however you slice it.

A hike in interest rates is generally bad news for both equity and bonds, at least in the short term. It reflects a squeeze in the liquidity in circulation in the economy and has a direct negative impact on bond valuations.

The European Central Bank has also affected markets by announcing a rate hike beginning in July. The decision created tension in government bond markets and weakened the Euro, causing spreads to widen. Under pressure from governments, the ECB was made to hastily announce a plan to ensure the financial stability of the Eurozone, first through the reinvestment of the yields obtained from the bonds purchased during the PEPP pandemic plan. The Bank of England followed a similar path.

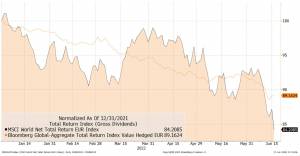

As if all this were not enough, the threat of further anti-Covid measures is still very real in China, which has led to further discomfort in the markets. In short, we’re experiencing something of a perfect storm in both the equity and bond sides of our portfolios. The inflation prospects, the slowdown of the economy and the rate hikes have created an environment that’s difficult for investors to navigate.

In this situation, we believe it’s important to highlight the positives where possible, which can help us build a vision for the next few months.

- The job market remains very strong in the US and generally robust in Europe. In the US, we’re seeing near full employment, with only 3.6% unemployment. Signs of economic slowdown shouldn’t be dismissed, but it may prove to be significant that we’re starting from a position of relative strength.This means that a scenario in which the rate hikes have few dramatic consequences for the economy shouldn’t be ruled out. It’s also possible to imagine a recovery in financial markets if this is the case.

- Medium-term inflation expectations are relatively stable, although they have been rising recently. This raises the possibility that markets have already priced in the worst-case scenarios. If this trend continues, it’s possible we won’t see more surprises from Central Banks, particularly if the economy is showing signs of slowing. With the latest rate hikes, Central Banks have given themselves a little bit of wiggle room in the coming months.It’s important to remember that, at least in Europe, markets are pricing in more rises than Central Banks have declared in their forward guidance. This lowers the risk of negative surprises over the next few months.

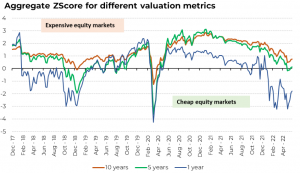

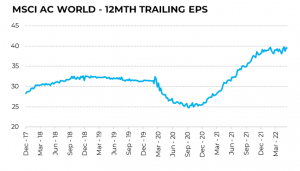

- With equity valuations falling substantially since the start of the year, they are now more in line with companies’ actual performance (as measured by earnings). If we look at the data, we see that normalised valuations are below or extremely close to the levels of five years ago. This means that, in simple terms, prices today are in line with the economic levels of five years ago, despite corporate earnings being well above the level in that period. This means that markets are somewhat prepped for economic slowdown and, in the event of positive economic signals, there is a lot of scope for growth.This will be of particular interest to long-term investors, who see the recovery period as within their investment time horizon. As of today, we can’t say for sure when the economic cycle will start growing again, but what we do know is that markets are likely to move before it does.

These factors give the situation some perspective but we’re not suggesting that the difficult period is nearing an end. In the short term, the global economy will face numerous challenges and market volatility may continue for some time.

As experienced investors know, financial markets work in cycles. We’ve been through 17 bear markets since the postwar period and the one we’re experiencing now certainly won’t be the last. Despite this, they have always rewarded investors with positive performance and growth in the aftermath. This will perhaps be of little comfort to investors with losses in their portfolios, but it is the nature of the game.

However, this is not to say that we don’t have the tools to navigate periods like this. Our rebalances, which have reduced risk gradually since last July, have served to limit the losses relative to the performance of the indices.

From our side, we’ll continue to monitor the situation and remain ready to act, whether it’s with new defensive measures or steps to seize the recovery if and when it does eventually come.

As far as investors are concerned, the advice is always the same. Avoid any knee-jerk reactions and remember that missing even a few days of a sharp rebound can negatively affect a long-term investment plan. For example, looking back at history, if you’d invested $10,000 on 1 January 1997 and left it tracking the S&P 500 until 30 December 2016, your portfolio would be worth $43,933. If you missed the 10 best days (10 days in a 9-year period) the value would be nearly half, at $21,925. Given that the best days often come around the worst days, it shows the benefits of staying invested during these periods.

We suggest that investors contact us if they feel that the risk level of their portfolio is no longer right for them, or if they want to structure their plan to enter the markets over the next few months to take advantage of the reduced prices. Alternatively, if you simply want to discuss your portfolio, our consultants will be happy to help in what is a delicate moment for everyone.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.