With the news coming out of Russia and Ukraine developing at pace and markets reacting, investor reactions have been mixed. While some are panicking and considering disinvesting, others are taking a long term view and putting more of their money in to take advantage of any market weakness.

Disinvesting during Uncertainty: Summary Table

| ⚠️ Investors that disinvest during uncertainty miss out on? | Rallying periods |

| ☝️ Remaining invested through market downturns favours? | Medium to long-term investments |

| 🛑️ Selling down during times of uncertainty avoids? | Short-term losses |

| 📉 Withdrawing investments during market volatility can result in? | Up to 60% of the portfolio’s growth |

If the news has got you concerned, it is important to understand the potential impact of pushing the panic button on your long term finances.

Why are markets reacting?

Fears that Russia may lead an invasion of Ukraine may be coming to fruition. It’s a rapidly developing situation and, so far, the West has responded by issuing sanctions and we will likely see more retaliations in the coming days. Markets have responded badly, although not on anything like the scale seen during the Covid-19 crisis.

That said, the long-term impact of similar potential market turbulence on markets has, in the past, been small. So, what is the potential cost of running for the hills?

The potential cost of getting it wrong

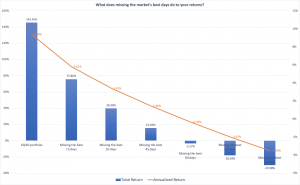

To assess the impact of withdrawing from the markets, we examined the growth of two identical hypothetical portfolios (see the chart above). One portfolio (from a particularly poorly timed investor) was pulled out of the markets during the four major dips over the last 10 years and only reinvested once markets had recovered, while the other stayed the course and waited for the seas to calm.

As shown in the chart, missing out on recoveries can be very costly for long term investors. In the example, missing the bounce that followed the falls during the period led to a portfolio that was around 35% lower at the end, when compared to leaving it invested. Withdrawing investments meant, ultimately, missing out on around 60% of the portfolio’s growth.

The graph demonstrates the cost incurred when that rallying period passes an investor by. Selling down can avoid losses in the short-term, but unless you know exactly when to reinvest back into markets, remaining invested through downturns has been shown to reward faith for investors with medium and long-term horizons.

In terms of the reaction to periods of significant market volatility, the situation tends to be one of ‘less is more’.

Looking more deeply at the same period, an investor that spent exactly zero days out of the market would have seen an annualised return of 9.39%, based on a portfolio of 60% world equities (GBP-hedged) and 40% world bonds (again, GBP-hedged). By contrast, an investor that missed the 30 best days during that 10-year timeframe would have seen an annualised return of just 3.41%. If you extend the exercise to missing the 90 best days during the 10 years, the annualised return drops to a negative return of -3.5%. Often the best days in markets follow periods of weakness, and missing out on these can make a meaningful difference to your long term performance and ability to reach your financial goals.

Try not to panic

An instinctive reaction to a downturn in the markets can be full liquidation. As the markets slump, moving your capital as far away as possible can seem a sensible precaution, but as demonstrated above can come at a cost.

If your investment timeframe is longer than that of the crisis, withdrawing all investments can be a very expensive measure. Pulling out entirely once the damage (or part of the damage) has been done serves, simply, to cement your losses. On a fundamental level, selling at a time when valuations are low and buying back in once they have recovered is a recipe for losing money. For the long-term investor, any knee-jerk decision to sell during a slump will hit their pockets once they decide to reestablish their portfolios.

If you are considering changing your risk profile, we have trained investment consultants on hand for you to talk to, who will guide you through the process and help you analyse your circumstances to make the right decision for your financial future. Book a call today to speak to a member of our team.

FAQ

What can cause market volatility?

There are a variety of factors that can cause uncertainty in the stock market which then causes volatility. They include inflation rates, interest rates, tax changes, monetary policies, market events such as the 2000 dot.com bubble, and national and global events such as Russia and Ukraine conflict and COVID-19.

Is it better to buy during market uncertainty?

There are good investment opportunities during market volatility, stocks drop in value and investors can get their hands on stocks at attractive prices. However, it is not a good idea to sell in times of market uncertainty, as you can lose money and timing the market might not work.

Should I stay invested when the market is down?

You should stay invested but diversifying your investments during market uncertainty is crucial. Your investment portfolio should consist of different asset classes to withstand market instability. Diversify using financial instruments like government and corporate bonds, dividend stocks, and alternative investments like gold.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.