In Europe, 2022 has gotten off to a turbulent start in the markets. The after-effects of the pandemic were still being felt when the outbreak of war in Ukraine rocked performance in a number of key areas.

Currently, we are facing a serious geopolitical crisis, one which affects Europe closely given the connections that exist between it, Russia and Ukraine. However, events of similar magnitude have impacted the world of finance in the past.

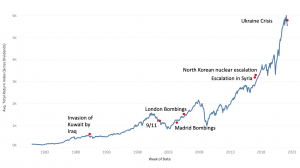

Over the years, we’ve seen how markets have reacted to the invasion of Kuwait, the London Underground bombings and the nuclear escalation in North Korea, to name a few. You can see their impact in the graph below.

All of these geopolitical events could have led to – or, in some cases, did lead to – an escalation. If you look at the impact on markets, they share two important characteristics:

1) They do not have a lasting impact on the performance of global assets;

2) Historically, the declines have always been followed by swift recoveries. We think back to the Covid-19 crisis, when the recovery was rapid and came sooner than most investors expected.

So, the long-term perspective on geopolitical events and the more recent experience of COVID both argue for a swift recovery in equity markets, even ahead of improving fundamentals.

The less optimistic view

Inevitably, there are some differing views on the subject:

Firstly, you might reasonably argue that equity markets don’t reflect the situation on the ground. The conflict continues at great human cost, and the possibility of a protracted struggle seems fairly high, even if the two sides continue to negotiate. That has been reflected, as we’ve noted before, in reduced expectations for growth and higher expectations for inflation in the Eurozone.

The longer the conflict continues, goes this argument, the greater the impact on the European economy. And, even if we do see a swift end to military conflict, the on-going sanctions against Russia have potential consequences that will only emerge over time.

Secondly, when we look back at the Covid-19 experience, we see an unprecedented level of policy support delivered with unprecedented speed. That’s probably not going to be the case this time around. As we saw last week, Central bankers are feeling the pressure to tighten policy and Fed Chair Powell, in particular, was keen to say that the US economy is strong enough to tolerate higher interest rates.

The Bank of England sent a slightly more reserved message but it’s difficult to see how monetary authorities can provide too much support when inflation is the highest in a generation. The fixed income market expects another six (or more) rate hikes in the US over the next twelve months – if that proves to be correct, we’d guess that US growth expectations will come down.

Bonds vs shares

When equity markets become unstable, many investors gravitate towards assets they perceive as safe, like fixed income securities. In the short term, these assets tend to show less volatility than equities. It’s an attractive feature of bonds but it’s important to avoid thinking that bonds are guaranteed to be safe and that equities are intrinsically risky.

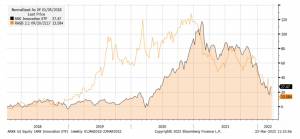

The next chart compares the price (indexed from the start of 2018) of an asset generally regarded as high-risk and high return, in this case the Ark Innovation ETF, and something ostensibly low-risk, in this case the Austrian sovereign 100-year. bond. The comparison is fairly close, particularly recently.

The 100-year bond might not have that much credit risk but, by definition, it carries a lot of duration risk. When yields fall, it does well, and vice versa. But it’s still an important reminder that the fixed income part of a multi-asset portfolio can have significant implications for the returns. What’s the point of fixed income with yields so low? It’s an important question. The charts above remind us that there are still a lot of ways to impact a portfolio with decisions related to fixed income.

So, what can we do?

The turnaround in European equities has been swift. Looking to the past can be instructive but we should be cautious about using the Covid-19 experience as a guide. For one, the political environment now is very different from that of the beginning of the pandemic. There could also be greater volatility compared to what we’ve seen over the past year or so.

This all leads us to a slightly more conservative positioning when compared to the past 18 months. There are a number of risk factors to consider going forward but, as we’ve seen over the past week, exiting the markets completely can prove to be a much riskier proposition.

A focus on Europe: the potential scenarios

The key to European equities in the medium term will be Europe’s ability to latch onto the recovery. According to the latest report published by the ECB, real GDP growth in the eurozone has been revised down by 0.2 percentage points due to the further energy price shock and uncertainty caused by the Russian invasion of Ukraine.

The outlook for European activity is uncertain and is critically dependent on events in Ukraine. The war is weakening short-term growth, and the surge in energy prices combined with the negative effects on consumer confidence has led to weak domestic demand.

The ECB expects economic growth to improve from the second quarter of 2022. Ultimately, though, the outlook will always be weakened by the conflict in Ukraine. The expected improvement is based on a number of supporting factors:

- A further drop in the economic impact of the pandemic,

- A gradual easing of supply bottlenecks,

- An improvement in the competitiveness of export prices with respect to the main trading partners.

Private consumption

Private consumption should recover over the course of the year, despite the increased uncertainty due to the conflict and the rise in energy prices (it shouldn’t be forgotten that Covid has been lurking in the background). The increase in energy prices, however, has repercussions on the purchasing power of families. This could lead to a contraction in private consumption in the first part of the year. A slight increase is then expected.

Saving rates

The household saving rate has also been revised downwards and is expected to fall for the whole of 2022. Although the conflict in Ukraine creates uncertainty, which should lead to an increase in precautionary savings, this is not the case as households use the money to cushion, at least in part, the negative effects of the energy shock and rising commodity prices. The ECB expects the savings rate to stabilise well below the historical average, starting in mid-2023.

Business investments

Business investments are likely to increase and represent a growing share of real GDP. In the short term, despite the greater uncertainty and volatility in financial markets due to the conflict, business confidence is still high. As supply disruptions ease, investments are expected to grow, although commodity prices are likely to rise. Higher expenses related to the decarbonisation of the European economy will also provide a further boost to business investments in the medium term.

So, as we head into the second quarter of 2022, there are still a number of uncertainties to contend with. Markets have rallied over the last week or so, but there are still enough unresolved variables to necessitate caution going forward.

As ever, our portfolio management specialists will be monitoring markets daily and making any changes if and when any opportunities arise. If you want to talk to one of our investment consultants, please don’t hesitate to get in touch.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.