In our latest edition of the Asset Allocation team observatory, Moneyfarm’s Chief Investment Officer, Richard Flax, analyses sluggish UK growth in Q3 and a rallying bond market.

UK Q3 GDP – UK plc at a standstill?

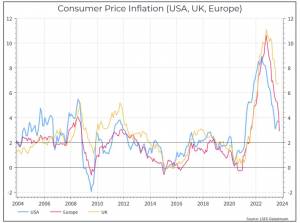

UK GDP for the 3rd quarter came in flat relative to the second quarter and up 0.6% versus the same quarter last year. While that’s marginally better than economists had expected, it does show an economy that’s basically dead in the water. That doesn’t sound great, but given the sharp rise in interest rates, we probably shouldn’t be that surprised. If anything, we might have expected the economy to be even weaker. And that highlights the challenge that the Bank of England faces. As the chart below shows, UK inflation remains more stubborn than in the US or the Eurozone, and that makes the case for policy rates “higher-for-longer” even stronger in the UK than elsewhere. The Bank of England kept rates unchanged at its latest meeting, but three out of the nine members of the committee voted to hike rates again. A stagnant but resilient economy, with stubborn inflation, might be the worst of all worlds.

Bonds rally on prospect of rate hike pause

We’ve seen a sharp rally in bond markets over the past couple of weeks, helped by the prospect of an end to rate hikes, and that has helped drive portfolio performance. But the market environment remains finely balanced. On Thursday, we got a brief reminder of some of the challenges. First, Fed Chair Powell highlighted again that the US Central Bank would hike rates if required. That might not seem like new news, but it evidently gave fixed-income traders pause for thought. Second, traders believed that Thursday’s auction of US government bonds had gone badly, raising the question of whether yields had fallen too far.

Finally, a large Chinese bank suffered a cyber-attack that impacted its ability to trade in US treasuries. Some commentators argue that that, rather than weak demand, was behind the relatively poor US government bond auction.

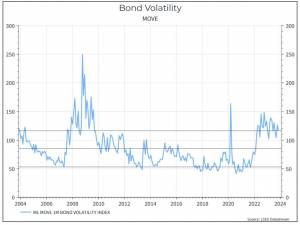

At a higher level, we can see the impact of these types of events in market volatility. Usually, commentators talk about equity market volatility, but volatility in the bond market has possibly been more interesting. The chart below shows a measure of volatility for the US bond market. After 2008, we saw generally a period of very low volatility in the government bond market – with a brief spike during COVID. That was the result, we think, of low inflation and Central Banks intervening in the market. As inflation has risen and central banks aren’t so active, we’ve seen bond prices fall and volatility in the bond market rise.

Higher volatility in bonds raises some interesting questions about the best way to construct portfolios. In theory, government bonds should be relatively ‘safe’ but, as we’ve seen over the past eighteen months, their prices can move around a lot! It has made short-dated bonds look more attractive as a way to manage overall portfolio risk. One key question going forward is whether, with policy rates close to a peak, short-dated bonds will still be our preferred choice or whether we’ll begin to see bond market volatility begin to drift lower.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.