For anyone looking to invest their money in an ISA, the decision between whether to allocate their funds in a cash ISA or a stocks and shares ISA is a vital one. These are just two of the several different types of ISAs available, and depending on the circumstances, both have their merits as the ISA deadline approaches. It pays, then, to be as informed as possible when planning for your own secure financial future and to choose the best one for your needs.

| Top 3 reasons to choose a CASH ISA | Tax-free status Good for short term goals Help cultivate a good saving habit |

| Is the allowance the same? | Yes, in both cases, there is a £20.000 allowance |

| Who’s the winner? | Both of them! You can choose both for a more diversified portfolio |

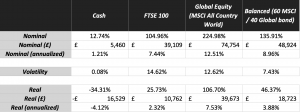

There is also a decision to be made regarding the type of stocks to invest in. Moneyfarm’s research team simulated the performance of four different hypothetical investment portfolios over the decade from 2010 to 2020. Namely, cash ISAs, FTSE 100 portfolios, global equity investments, and a balanced portfolio between equity investments and global bonds.

Of course, the financial context of the decade is important to bear in mind when analysing the results. There is a disparity between the returns and the relative volatility of the different asset classes studied. For investors, it is a case of weighing up the level of risk you are comfortable exposing yourself to and projecting accordingly. It is also a matter of detailing just how long-term your strategy is – those with broader time horizons can take on greater risk and give themselves a far better chance of reaping the benefits.

Want to invest in an ISA? Moneyfarm’s investment advisors are on hand to help you choose the right portfolio for your risk level and financial goals. Get in touch today.

Before we dive into our simulation, it is essential to note that it is just that. Also, note that past performance is not necessarily a reliable indicator of future returns. However, we expect the underlying characteristics of the last 10 years – low interest rates, expansionary monetary policy, and controlled inflation in the US – to continue for the foreseeable future.

Based on data from Bloomberg and the Bank of England

Cash ISAs

Cash ISAs are, ultimately, predictable. According to our study, very low volatility rates – in the extremely stable region of 0.08%, mean that returns are relatively easy to calculate. As a result, these ISAs have, traditionally, been viewed (rightfully) as a safe deposit box in which to grow savings moderately over time and, at the very least, protect them from inflation.

In terms of our simulation, we used the Bank of England figures to calculate the returns for cash ISAs.

The problem comes when real returns are considered in moderate inflation and low-interest periods. This environment means that the real value of savings decreases over time, so investments need to be working well and seeing returns to ensure the pot grows in the long term.

Reasons for choosing cash ISAs

There are several reasons why you might want to keep your money in a cash ISA. They include:

- Tax-free Status: Cash ISAs are tax-free savings accounts, and the £20,000 annual ISA allowance is tax-free. Also, depending on your tax bracket, interest over £1,000 a year is tax-free.

- Short-Term Savings: A cash ISA account is used to save for short-term goals (within five years).

- Saving Habit: Some cash ISAs require regular payments, which can help cultivate a good saving habit.

- Withdrawals: You can withdraw from a cash ISA depending on the type of account, e.g. an easy-access cash ISA account and a flexible cash ISA account.

- Multiple Accounts: You can have multiple cash ISA accounts for different financial goals, and you can transfer funds from old accounts to a new account.

- Easy Transfer: Since the funds held in a cash ISA is cash, it is easy to transfer the money to another type of ISA account.

- Safety: A cash ISA account opened at any financial institution regulated by the Financial Conduct Authority (FCA) is protected by the Financial Services Compensation Scheme (FSCS). It covers up to £85,000 per individual.

- Risk-Free: Cash ISAs are one of the safest forms of investment because the cash is not invested in the stock market. Hence, it is free of stock market volatility.

- Inheritance: A spouse can inherit a cash ISA without it affecting their annual ISA allowance.

Stocks and shares ISAs

By contrast, let’s examine the performance of various forms of stocks and shares portfolios over the same period. For the purposes of the research, we looked at the FTSE 100-only profile, a global equities profile, and a balanced profile split 60/40 between equities and bonds.

The first thing to note is that all performed well. On average, the hypothetical stocks and shares ISAs we simulated saw nominal annual gross revenues of 9.64%. Up against the nominal annual return of the cash ISA – 1.21% – the benefits of opening an investment up to greater risk over an extended period of time come into sharper focus.

The difference between the different spreads becomes apparent when we examine their relative returns. Over the 10 years, the FTSE 100 portfolio saw the lowest nominal returns – a serviceable 104.96%. At the other end of the scale, the global equities portfolio saw impressive nominal returns of 224.94%. In this context, cash’s 12.74% pales into insignificance.

Reasons for choosing stocks and shares ISAs

There are several reasons why you should invest your money in a stocks and shares ISA. They include:

- Tax-Free status: Investments held in stocks and shares ISA are free of income tax, capital gains tax and dividend tax.

- Better returns: Stocks and shares ISA accounts have better returns than a cash ISA because the investments are held for a longer duration, and the funds are invested in the stock market.

- Long-term financial goals: A stocks and shares ISA is used for long-term goals, and it can also be used as a retirement plan.

- Withdrawals: You can withdraw money from a stocks and shares ISA account. However, if you don’t have a flexible account and withdraw money from a stocks and shares ISA account, a reinvestment will count towards your annual ISA allowance.

- Diversification: The funds are spread across a wide range of asset classes and investment vehicles. Diversification helps to minimise the overall stock market risk of an asset or portfolio.

- Safety: Like the cash ISA, stocks and shares ISA is also protected by the Financial Services Compensation Scheme (FSCS) if the financial institution is regulated by the Financial Conduct Authority (FCA). If your financial institution goes under, £85,000 of your investment is safe.

- Inheritance: A spouse can inherit a stocks and shares ISA without the inheritance affecting their annual ISA allowance.

Cash ISA vs Stocks & Shares ISA: What is the difference?

There are a few differences when it comes to cash ISA and stocks and shares ISA. A cash ISA is similar to a savings account but without any tax benefits. On the other hand, a stocks and shares ISA is an investment account with equity investments and some tax benefits. Cash ISAs are mostly for short-term savings with less than 5 years timeline, while a stocks and share ISA is recommended for long-term investments with over 5 years duration.

When comparing the risk involved between cash ISA vs stocks and shares ISA, there is no risk involved with cash ISAs as a cash ISA has a fixed interest rate with guaranteed returns. However, since a stocks and share ISA is invested in the stock market, it is prone to various levels of risk depending on the ISA type and asset allocation.

When it comes to cash ISA vs stocks and shares ISA, there is only one similarity which is the personal allowance limit. They both have an allowance of £20,000 per tax year.

Here is a table showcasing the pros and cons of cash ISA vs stocks and shares ISA.

| Cash ISA | S&S ISA | |

|---|---|---|

| Which ISA is suitable for short-term investments? | Yes | No |

| Which ISA is suitable for long-term investments? | No | Yes |

| Which ISA have substantial risk? | No | Yes |

| Which ISA investment can fall in value? | No | Yes |

| Which ISA has better returns? | No | Yes |

| Which ISA has the most significant tax benefits? | No | Yes |

| Can this ISA be inherited? | Yes | Yes |

| What is the ISA allowance? | £20,000 | £20,000 |

| How much is protected by FSCS? | £85,000 | £85,000 |

Long term vs Short term: The last 10 years

Remember, cash ISAs are used for short-term investing; they provide lower interest rates and are highly liquid investments. On the other hand, a stocks and shares ISA is a long-term investment with higher interest rates and higher levels of risk.

You can use both long-term and short-term investments to build wealth and increase returns. It doesn’t matter which one you choose. Combining both strategies will be your most effective approach, whether you’re looking to build wealth or create a passive income stream.

For example, you can use a cash ISA to achieve short-term financial goals, such as saving for a vacation or a car, while in the long term, stocks and shares ISA can be used to save for retirement or save for a child’s education. However, if you hold a stocks and shares ISA for the short term, it might not earn better returns and have had enough time to ride out the stock market’s volatility.

The global economy closed the decade in a much healthier position than it did entering it. 2019 was a positive ending to a decade in which global equity markets more than doubled in value. Unfortunately, the decade was marred by political upheaval across the globe, events that the world economy managed to escape relatively unscathed from.

This is not to say that economies everywhere have seen plain sailing across the 10-year period. For the UK, in particular, it was a decade defined by uncertainty. Britain’s withdrawal process from the European Union injected instability into the markets after years of continued recovery from the 2008 financial crisis.

In terms of what this all means for cash, the last decade has been defined by loose monetary policy from central banks and high rates of inflation. Global interest rates are also currently notably low – the Bank of England, for example, lowered it in an effort to combat the impact of Covid-19. This has resulted in the traditionally safe, predictable investment of a cash ISA performing relatively poorly over the course of the decade.

If the maximum amount of investment was made each year from 2010 up to and including 2019, in a portfolio made up of cash ISAs, a total of £110,920 would have been saved tax-free in the decade. As you can see from the table detailing our study, this means a real return of -34.41%, or -4.12% each year. With the maximum amount invested each year, cash would have generated a loss of over £16,000 across the decade.

Should I choose a cash ISA or a stocks and shares ISA?

There are several factors to consider if you have to choose between a cash ISA or a stocks and shares ISA. You should think about your financial goals, personal circumstances, investment timeframe, and risk tolerance. These factors will help you choose the right choice.

You also have to decide between cash ISA vs stocks and shares ISA benefits. Remember, Investing is not just for short-term gains. If you intend to use the money from an ISA within the next few years, then a Cash ISA might be the best choice for you.

Can I have a Cash ISA and a Stocks and Shares ISA at the same time?

You can have a cash ISA and a stocks and shares ISA account simultaneously. You could always invest in both if you’ve got some money lying around. However, you’re only allowed to open one of each type of ISA account in the same tax year.

You can pay into a cash ISA and a stocks and shares ISA each tax year. However, make sure you don’t exceed your combined ISA allowance of £20,000. You can hold cash in a Stocks & Shares ISA until you are ready to invest it. While you can invest in both, always remember that you will earn less with a cash ISA.

Choose both: Why diversification is important

Ultimately, it is a balanced approach that we believe offers the best risk-return profile. For example, investing in global equities between 2010 and 2020 would have provided the greatest real return – £39,673 – but this asset class comes with relatively high volatility. 12.62% over the course of a decade is manageable, but there is no guarantee that returns will be so positive over the same period going forward.

The FTSE 100 portfolio saw the greatest volatility of the three – at 14.62% – which makes its relatively modest return all the more disappointing. However, our view is not necessarily that the FTSE 100 will continue underperforming. Instead, a diversified portfolio has a better chance of lower volatility and is less affected by local risks like Brexit.

By spreading investments across a balanced portfolio, the volatility drops to a far more palatable 7.43%. A nominal return of £48,924 translates to a real return of £18,723 – clear protection against inflation and an effective way to make your investments work for you without taking on an off-putting degree of risk.

Read our full guide if you want to see how an ISA compares to a SIPP and why you might want to choose one over the other.

Our strategy at Moneyfarm is to combine the right mix of assets with the appropriate level of risk for each individual customer. So, we update our portfolios regularly to ensure that our customers are always getting the most out of their investments. This is all backed by low fees and personal, dedicated investment advice.

FAQ

How well do Stocks and Shares ISAs perform?

Historically speaking, Stocks and Shares ISAs perform very well. For example, in the past 10 years, the average annual rate of return for Stocks and Shares ISA has been 9.64%.

What is the typical return on a Stocks and Shares ISA?

The typical average Stocks and Shares ISA return is 9.64%, but 2021/22 saw an average return of 6.92%.

Is it worth getting a Stocks and Shares ISA?

Yes, if you have mid to long-term financial goals, then stocks and shares ISAs are worth it, especially if you want tax benefits and a higher rate of return.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.