If you have any questions you want to put to Moneyfarm’s Investment Consultant team, please email your question to hello@moneyfarm.com and we’ll be in touch.

Question: My current income is £75,000 a year. What could the income tax cut proposed by Boris Johnson in the Leadership contest mean for my pension contributions?

Answer: Stephen Jones:

Boris Johnson’s headline-grabbing proposal to cut income tax for higher earners may be a welcome tax break for individuals. That said, it comes with a hidden cost for pension savers.

What could change

In the run-up to the Conservative Party leadership vote, Boris Johnson proposed raising the higher rate tax threshold for income tax. The new proposal would see the starting threshold for the higher rate tax band moved to £80,000 from £50,000. More people paying less income tax might seem like a win-win on your personal finances, but sadly, in this case, it is not all good news.

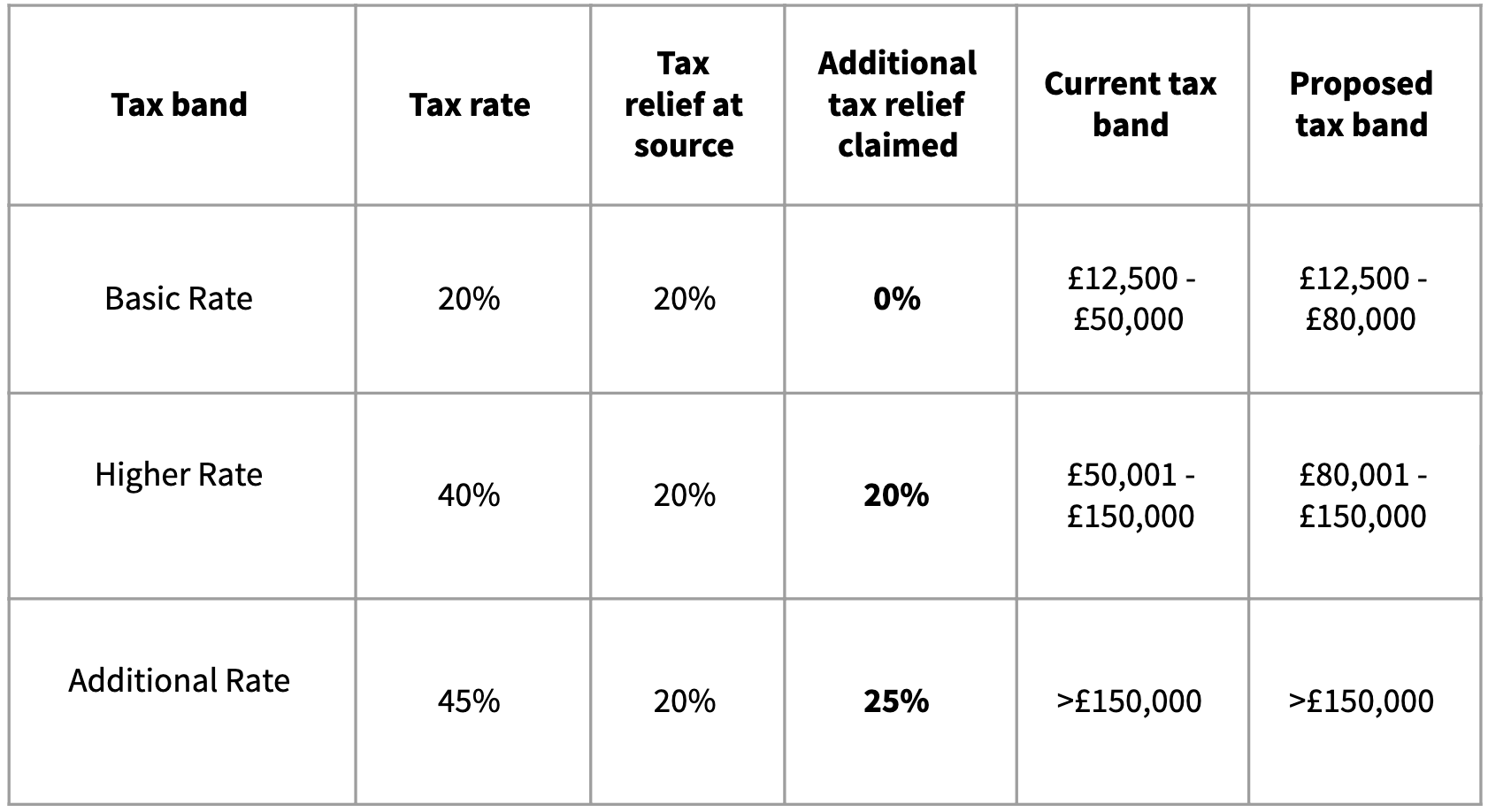

Currently, the tax bands in England and Wales are split in three: basic, higher and additional. You are not charged tax on the first £12,500 of your £75,000 annual income as this is covered by your Personal Allowance. The remaining £62,500 counts as your taxable income. For your current situation, the income between £12,500 to £50,000 will be charged at 20%, with the remaining income between £50,000 to £150,000 charged at 40%.

When could this happen?

When or if this policy ever gets implemented, is yet to be decided. There are already doubts over his premiership following his six failed parliament votes in six days, and the loss of his working majority.

With Government suspended until the 14 October, and the Brexit deadline fast approaching on the 31 October, it’s easy to see this getting lost in the short-term noise. If there’s a commitment to this proposal by Boris Johnson, expect to hear more in the next general election – which is unlikely to be before November, at the earliest.

Additionally, it’s not uncommon for Prime Ministers to backtrack on proposals flaunted in leadership bids once they’re in office. This is not to say the idea is dead or that it couldn’t be picked up by another MP – in fact, it’s probably quite attractive as the basic annual salary of an MP currently stands at £70,468.

If this tax cut is implemented, it will probably be introduced slowly over a number of years – just as the government is doing with new changes to inheritance tax rules. The residential nil rate band is essentially increasing the inheritance tax threshold level when an individual leaves a residence or the sale proceeds of a residence, to his direct descendants.

How this impacts you

For individuals like yourself who earn between £50,000 and the new proposed £80,000 threshold, this tax cut could help you save up to £6,000 in income tax. Whilst you will save on your income tax, the tax relief you’re eligible for on your pension contributions will fall from higher (40%) to basic (20%).

I’ve outlined the current tax relief system in England and Wales, below. As you can see, you’re eligible for tax relief relative to your income tax band. As you currently pay the higher rate of income tax, you’re eligible for 40% tax relief on your pension contributions, 20% each time you put money in your pension, and 20% through your Self Assessment tax return.

The overall impact of this tax cut will naturally depend on the person in question. To help visualise this, we’ll use the example of a £5,000 contribution.

How this could impact the size of your retirement pot?

As a higher rate taxpayer looking to place £5,000 in your pension, this currently costs you just £3,000. Broken down, you will personally contribute £4,000 to your pension and receive a ‘free’ £1,000 boost from the 25% government top-up – at Moneyfarm this is automatically added but this doesn’t happen everywhere. You can then claim back £1,000 for your higher rate tax relief in your Self Assessment tax returns.

Increasing the higher rate threshold to £80,000 will mean a £5,000 contribution costs you £4,000, rather than the £3,000 currently. As no higher rate tax has been paid, there is nothing to claim back in your SelfAssessment tax returns.

If you want to maintain your overall cost (after your basic and higher rate relief) at £3,000, you’ll be cutting the amount that goes into your pension pot by 25%. Instead of £5,000, you’ll get just £3,750 in your pension.

What if you live in Scotland?

Any change applied to the Income Tax band will impact England and Wales only. This would not apply to Scotland as the Scottish Parliament has devolved powers, allowing them to decide the income tax rates and bands.

Whilst there currently doesn’t seem to be any plans for Scotland to increase their own income tax threshold, Scottish savers will have to help fund the new policy. Increasing the income tax threshold will be offset by an increase in employee national insurance contributions to balance the books. The power of National Insurance still sits with Westminster.

What can you do?

No one ever knows for certain whether the income tax thresholds will be moved, but it’s best to remember that the pension rules are always vulnerable to changing.

We know pension rules can change, and that these changes – whether it’s to the state pension age, the limit to how much you can save, or how you access your pension – can have far-reaching consequences.

Saving more today, whether you increase your monthly contributions or invest a lump sum to maximise your annual allowance, will help you make the most of the generous pension tax relief currently available.

It’s important you look at your financial situation to ensure that any changes you make to your pension contributions are sustainable and don’t significantly reduce your standard of living. The more you can contribute today, the less likely you will need to make big sacrifices in the future to meet your retirement goals.

Not only will you be investing earlier and benefiting from a higher boost to your pensions contributions, but your pension pot will benefit from compounding – this is where the return on your investment is reinvested and generates its own return. Einstein is said to have called this the Eighth Wonder of the World – and for good reason, it can have a powerful impact on your overall returns.

Give yourself the best chance today to build the pension pot for your future, because one day, we all have to retire. If you need any help, talk to an independent financial adviser and be sure to read our pension guide.

Our free Pension Drawdown Service helps you make confident, stress free decisions to stay in control of your retirement income.

If you’d like to discuss the impact of recent UK events on your investments or your Moneyfarm portfolio, please reach out to me directly. My email address is stephen.jones@moneyfarm.com.