Setting goals is important, whether it’s in your everyday life or your investments. In order to be able to achieve your goals, though, you first need to determine what they are. This can be as simple as wanting to build wealth over the long term, or as specific as having a pension pot of £300,000 at retirement.

This guide to goal setting is simple – it will allow you to take the time to determine what is important for you to achieve in your lifetime. Whether it be buying a house, saving for retirement, or building wealth for a comfortable life, we’ve got you covered. To help you reach your goals, here are a few steps you can follow. If you get stuck, one of our investment consultants will gladly help you determine what those goals could be.

- Pick a saving goal. People tend to have more than one, so pick your top three. For example, you might be saving for a car, a wedding, your children’s education, or a house. Less specific goals include building wealth, saving for retirement or saving for a rainy day. Take the time to think about this. Having more specific goals will give you more satisfaction in the long run.

- Determine how much you will need. Do some research and determine how much your goal would cost now, then add inflation. So, if a car costs £20,000 now and you want to buy it in five years time, an average inflation of 2% will mean it’ll cost £22,081 when you come to buy it. It’s always better to overestimate than underestimate.

- Sit down and review your income and outgoings. How much are you really able to save each month? Be realistic with this figure. Usually, you can determine this by taking your monthly payslip, subtracting your fixed monthly outgoings, and subtracting an estimate for your variable monthly outgoings.

Bear in mind that, at specific times of the year, you may end up spending more. Around winter people tend to spend more for Christmas. During the summer months, you might spend more by going on holiday. Usually, at the beginning of the year – January, February, March – people tend to spend less to compensate for the spending in the months before. These are all factors to take into account, so be realistic.

Now you know what you’re saving for, how much you need to save and how much you can afford to save each month, the next is to determine where to place said savings. This is where the importance of asset class comes in.

Asset classes explained

With Moneyfarm, you receive a diversified portfolio across a range of asset classes. The most relevant of these are bonds, equities, and cash. Where you choose to invest your savings is an important factor in achieving your goals.

Cash is an important part of any portfolio – it allows you to have liquidity and to diversify away risk. This liquidity should also be found outside of your investments in the form of an emergency cash fund. As a general rule, at least three to six months’ living expenses should be held in cash to cover any unforeseen expenditure. This will help to determine how much you should hold.

However, if you overcompensate and have an emergency cash fund that is too large, this can really have an adverse effect on your wealth. Cash is often seen as risk-free, but this is not the case. Cash holdings are exposed to inflation risk which, over longer periods of time, can dramatically reduce the spending power of your cash.

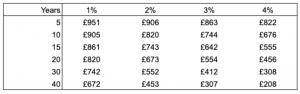

Below is an example of the effects of inflation on £1,000 up to 40 years, at different levels of inflation rates.

Given that interest rates are no longer attractive, people who tend to be savers are looking to investing as an alternative. Equities play a key part in the returns that you can expect to achieve. Among the many functions of bonds, they are held to reduce risk through diversification, but are not the main drivers of performance. They are seen as a safer investment with low risk. Over a longer time period, equities historically outperform most asset classes.

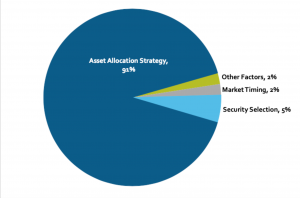

When it comes to investing, it’s not your market timing or fund selection that plays the deciding role. It’s your asset allocation strategy that makes the difference.

Source: Roger G. Ibbotson. Does Asset Allocation Policy Explain 10, 90 or 100 Percent of Performance? Financial Analyst Journal, January/February 2000; Brinson, Singer and Beebower. Determination of Performance II: An Update, Financial Analyst Journal, May/June 1991. Based on US pension-fund data from 1977 to 1987. The asset allocation strategy includes broad market exposure.

Asset allocation can be daunting to think about. How can you be sure what is appropriate? At Moneyfarm, we take that worry away. Our asset allocation team put together effective risk-controlled strategies and we match you to the right portfolio based upon your risk appetite. We perform the analysis, so you don’t have to.

Establish your time horizon

So, you’ve set your goals and you know that you want to invest in the market. Next, you have to establish how long you’re investing for. This is a major factor in determining how much risk you should be exposing your money to. Firstly, you have to analyse your own investor profile – are you a cautious, exploring, or pioneering investor? You can find your investor profile in your advice centre on our platform.

If you have a longer time horizon (more than seven years, say), this allows you to increase the equity exposure in your portfolio as you have more time to ride out short-term volatility. If you have a shorter time horizon of two or three years, then you don’t have the luxury of time, so a lower equity exposure or risk level may be appropriate.

Are your goals achievable?

By this point, you’ve set your goals, you know where you want to invest and you know how long for. Next, you need to be sure those goals are achievable. When investing, you have to be realistic. You can’t assume that saving £100 a month is going to turn into £20,000 in five years. For that to happen, you’d have to have an annual performance return of around 53%.

To help determine how much to save each month, you need to look at the potential returns you can achieve. As you are investing in the market, there are no guarantees. The rates that you base your calculations on can be estimated. Think about best-case and worst-case scenarios, to come to an average. To help you determine a feel for what you can achieve, look to our portfolios past performance. However, past performance is no indication of future performance.

Based upon your estimated rates, you could use the handy calculator from the Money Advice Service to see how much you need to save monthly to achieve the desired result. This calculator gives you a rough estimate of how much you need to save in order to achieve your goals.

For example, if you were to invest in a portfolio that has a targeted annual return of 5%. To achieve £20,000 in five years, you would need to save £295 a month. If you began with a £2000 lump sum, that figure drops to £258 per month*.

*These figures are an estimation and no indication of future performance.

The key to long-term investing is to be realistic. Take the time to set your goals, establish your attitude to risk, build an appropriate portfolio and decide how much you can save. All of this will save you time in the long run and allow you to achieve your goals that much sooner.

If you need any help with anything we’ve discussed in this article, do not hesitate to book an appointment with one of our qualified investment consultants to help guide you through.