It’s an unfortunate truth that the state pension has become progressively less impactful relative to average full-time earnings. It currently stands at £9,339.20¹ per year, up against average earnings of £38,600², some way off the golden ‘two-thirds of your previous income’ mark that most people aim to hit for a comfortable retirement.

With this in mind, it’s never been more important for people to consider a personal, defined contribution pension (a private pension, essentially). The additional savings can be the difference between a serviceable retirement and a fulfilling one.

However, unlike your state pension, which gradually accrues over your working life through National Insurance contributions, it’s up to you when and how much you contribute to a private pension.

Often, people delay these contributions until much later in their working lives, to allow plenty of time for personal milestones in the meantime. From waiting for a raise to saving for a new car, there are myriad reasons people delay and our natural tendency is to seek instant gratification rather than save. This can often make it difficult to build a coherent plan.

We all occasionally find ourselves guilty of procrastination. However, the longer you wait to get started when saving for the long term, the greater the catch up required. In some cases, the amount you need to save per month to reach your goals can become unaffordable for all but those on a high income.

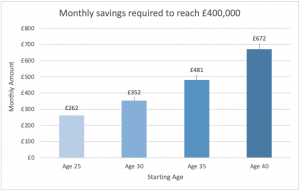

This chart displays an investor looking to achieve £400,000 by 65. It has assumed a growth rate of 5% with a fixed contribution at the end of each month. For simplicity, these illustrative figures have assumed no product charge or inflation has been taken into account, which would increase the monthly requirement. Pension tax relief can act to reduce this value.

To avoid stretching ourselves thin by saving too heavily today, we can choose to defer our retirement to a later age, giving our investments more time to grow. Be that as it may, making a start now – even small – could be the difference between enjoying a few more years of hard-earned free time or working for a few more years. This is, naturally, something we’d all like to avoid.

The graph above represents an individual who hasn’t begun saving for their retirement and has opted out of their employer’s pension scheme. As you can see, the impact of each five year delay is vast, raising the contributions required in future to achieve the same goal. This all serves to make retirement goals feel less achievable and potentially result in settling for a lower income in retirement.

While returns on investments are not guaranteed and there’s always a chance that you could get back less than you started with, the earlier you start the longer you get to benefit from one of the greatest tools in finance, compound interest. This means that your earliest contributions become your most important, as these investments have the longest time to compound.

For investors who want to plan for the long term without the hassle of daily financial management, a Moneyfarm self-invested personal pension (SIPP) is an ideal solution. You decide how much you want to invest and how regularly, and we handle everything else. To get an idea of how much you could grow your savings over time, check out our new widget . Just input some simple information and we can map how much you need to save to meet your goals.

¹ State pension 2020/21.

² https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2020

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/datasets/agegroupbyindustry2digitsicashetable21