The months of March and April 2020 will stick in the collective memory for a long time. The outbreak of the pandemic caught the whole world off guard. In the weeks when Covid became a global emergency, no one could confidently predict how the crisis would evolve and what the consequences would be from a health, economic or social perspective.

This uncertainty also affected markets, which recorded one of the most significant collapses in recent history. Volatility hit the market on Monday, February 24, as the Dow Jones Industrial Average and FTSE 100 dropped more than 3% on news that the pandemic was spreading out of China. A few days later, on February 27, various global stock market indices recorded their largest drops since the 2008 financial crisis. The S&P 500 fell 7% in four minutes after trading opened, causing trades to close automatically for 15 minutes.

Overall, equity markets lost more than 30% in March and higher-risk corporate bond spreads widened substantially as investors tapered risks. The crisis also affected the price of oil, which collapsed to a minimum following a price war between producing countries. In short, the weeks of March and April will go down in market history as a period of unprecedented volatility, driven by uncertainty and fear that the pandemic would become uncontrollable.

What happened in the following months is that the global economy proved to be more resilient than perhaps expected. Policies put in place by central banks have allowed the financial system to continue to function, with markets beginning a gradual recovery which then turned into the important growth that we’ve seen this year.

Now, two years after the beginning of the crisis, we feel that the unprecedented situation could offer us some insights into better managing periods of volatility – even the less extreme ones that every investor periodically goes through.

How investors react to uncertainty

When uncertainty hits markets, the average investor is faced with three options: the first is to stay invested, remain faithful to their investment plan and perhaps take advantage of the downturns by investing more. The second is to attempt to time the market, to buy in the slumps and sell at the peaks. The third is to disinvest, in an attempt to capitalise on any profits accrued in the past.

Nobody likes to see the value of their investments go negative and the temptation to divest, entering and exiting the market, is very strong. This was particularly evident during the extreme uncertainty of March and April 2020.

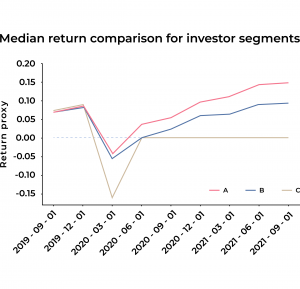

In retrospect, we’re able to compare the average performance of these three different types of investors. We analysed the performance of 11,565 clients with active investments since at least January 2019, the date from which the performance is calculated.

We’ve divided them into three categories:

As of November 2021, forward-looking investors achieved an average return of 14.8%. Investors in the second group achieved an average return of 9.3%, while those who fully disinvested saw an average return on exit of 3.2% – largely thanks to positive performance in 2019.

What does this mean for investors?

It’s not particularly surprising that completely exiting the market was the least successful strategy. After all, these investors were rendered unable to take advantage of the rebound. However, the comparison between those who stayed the course and those who tried to time the market is interesting.

The fact that the latter achieved significantly lower returns on average just serves to highlight how difficult timing the market can be. Being able to identify when to sell and when to buy is an extremely difficult skill and, in many cases, comes down to guesswork as much as intuition.

With investing, it’s never as simple as studying similar situations in the past and predicting what will happen accordingly. Markets don’t work like that. The past data should simply serve as a reminder that acting on emotion or speculation in times of extreme volatility can prove risky at best.

On the contrary, taking a long-term, forward-looking stance and using professional advice to make informed decisions is the best antidote to volatility. So long as you stick to your risk profile and have a portfolio diversified enough to absorb the downturns.

A note on the methodology

Returns were analysed by aggregating at the user level and comparing invested capital with net inflows. The returns proposed in this analysis are a proxy and are not the actual returns of clients’ portfolios, nor what our clients see on the platform.

However, they are a solid indicator of investment performance. The distribution of assets between portfolios of different risk levels is similar in the 3 segments. We can therefore discard the hypothesis that the higher returns achieved by forward-looking investors are due to more aggressive portfolios.