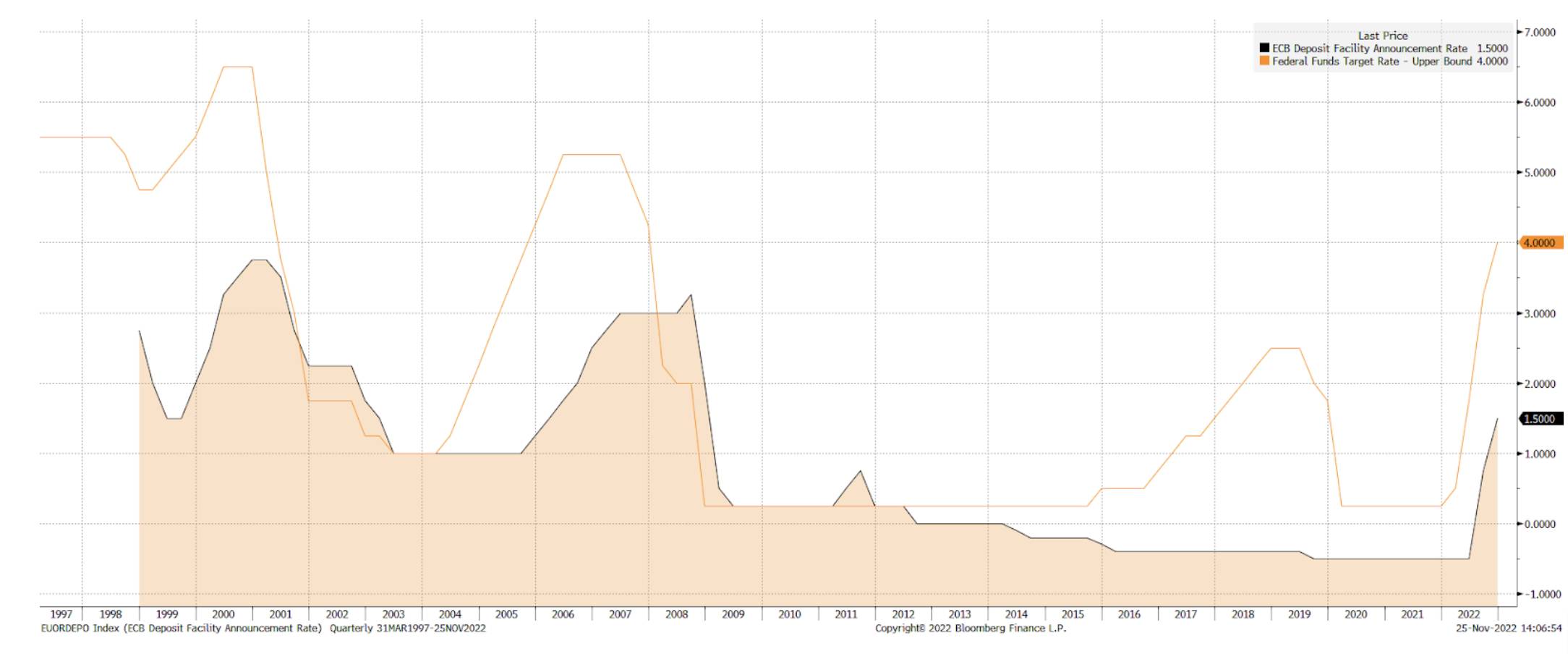

There is no doubt that 2022 will go down in history as a unique year from the point of view of monetary and investment policy. In the wake of rising inflation, which few had predicted, Central Banks around the world ran for cover, introducing restrictive policies and raising rates. The movement in interest rates was sudden and upset the geography of financial assets. This is not surprising, especially since we came from over 10 years of low or negative inflation and very expansive monetary policies to help the economy after the Financial Crisis and Covid.

To bring context to the recent rate hikes this year – we have witnessed the fastest rate hike by the US central bank since the early 1980s. Rates climbed from 0.25% to 4% year-to-date. Naturally, this rise had a particularly negative impact on government bonds, generating high volatility and the worst performance of this investment sector since 1949.

In light of the levels that bond coupons have reached it’s important to clarify how the role of bonds has changed and how investors should, in our opinion, approach this asset class in 2023. In a world where inflation could remain high at least in the medium term and where the fiscal space to maintain super-expansive monetary policies seems to be closing, it is reasonable to expect that the bond component of portfolios could play a different role in the near future than what it has in recent years.

Back to offering attractive returns

Bonds, especially government bonds of developed countries, have returned to offering attractive returns, after years in which the only advantage offered was diversification. If we look at 10-year expected returns, a long-term metric that we use to estimate the profitability of the asset classes, government bonds and corporate bonds, expected returns are among the highest in the last 10 years.

In this context, it is reasonable to expect that the normalization of the interest rate and inflation cycle, when it comes, could finally lead this asset class to rebound.

For now, the situation seems better in the United States, where price growth dynamics are responding better to monetary policy, while in Europe and the United Kingdom rate hikes are still lagging.

How should you approach bond investing?

Investors need to be careful not to look at the attractiveness of bonds with rose-tinted glasses. The attractive coupons found on the market today could invite investors to put more of their assets into bonds than would be optimal. Another risk, which we see in the behaviour of many investors, is that of concentrating the investment on a few bond issues.

In our view, there are several reasons to continue to favour a diversified bond index investing through ETFs (exchange traded funds), and most importantly, we still believe that bonds offer more benefits in a multi-asset environment.

The advantages of investing in ETFs rather than individual issues

Investing in a single issue has drawbacks that investors tend to underestimate. For example, although it is true that buying a treasury’s GILTs from today would yield around 3% a year, this assumes that the investor blocks their savings for the next 10 years. In fact, if they wanted to sell earlier, they would suffer a gain or a loss depending on the trend in interest rates.

In fact, if these were to rise, this bond would clearly be worth less to the markets, which could now buy a new issue at a higher rate, and this would lead to a capital loss. The concept of “duration” captures this effect. If a bond has duration 7, this means that a 1% increase in the reference rate would result in a capital loss of 7%.

By investing in diversified bond ETFs, both the capital gain and the coupon yield are expressed directly by the value of the instrument itself. The ETF then tracks the total return, also called ‘yield to maturity’, giving immediate exposure to the actual market return.

Furthermore, ETF bond issuers, tracking market indices, automatically replace maturing securities with new issues, capturing trends in rising rates with their performance. In addition to this, by purchasing an index product, investors would enjoy the diversification inherent in investing in different geographies, maturities, and levels of credit risk.

The considerations made so far can also be applied to the corporate bond world. Diversification, interest rate sensitivity and issuer risk remain important risks when investing in individual securities in general. Savers must also check for possible placement commissions, the type of bond and the liquidity of the instrument in case they need to sell. Products which are therefore normally offered to the market, such as structured bonds or subordinated securities, require careful assessment both in terms of possible risks and possible expected returns.

Invest in bonds in a multi-asset portfolio

The discussion becomes more interesting when you add the multi-asset management component, where industry experts can optimize the amount of funds allocated to bonds to try maximising the expected return per unit of risk.

It is important to keep in mind that the performance of the markets since the beginning of the year has surpassed the expectations of returns not only for the bond segment, but also for other investment segments, such as equities in particular.

As shown in the graph, by purchasing individual stocks or even government bond indices, investors risk sub-optimal performance over the long term compared to investing in a multi-asset portfolio.

Safe investments?

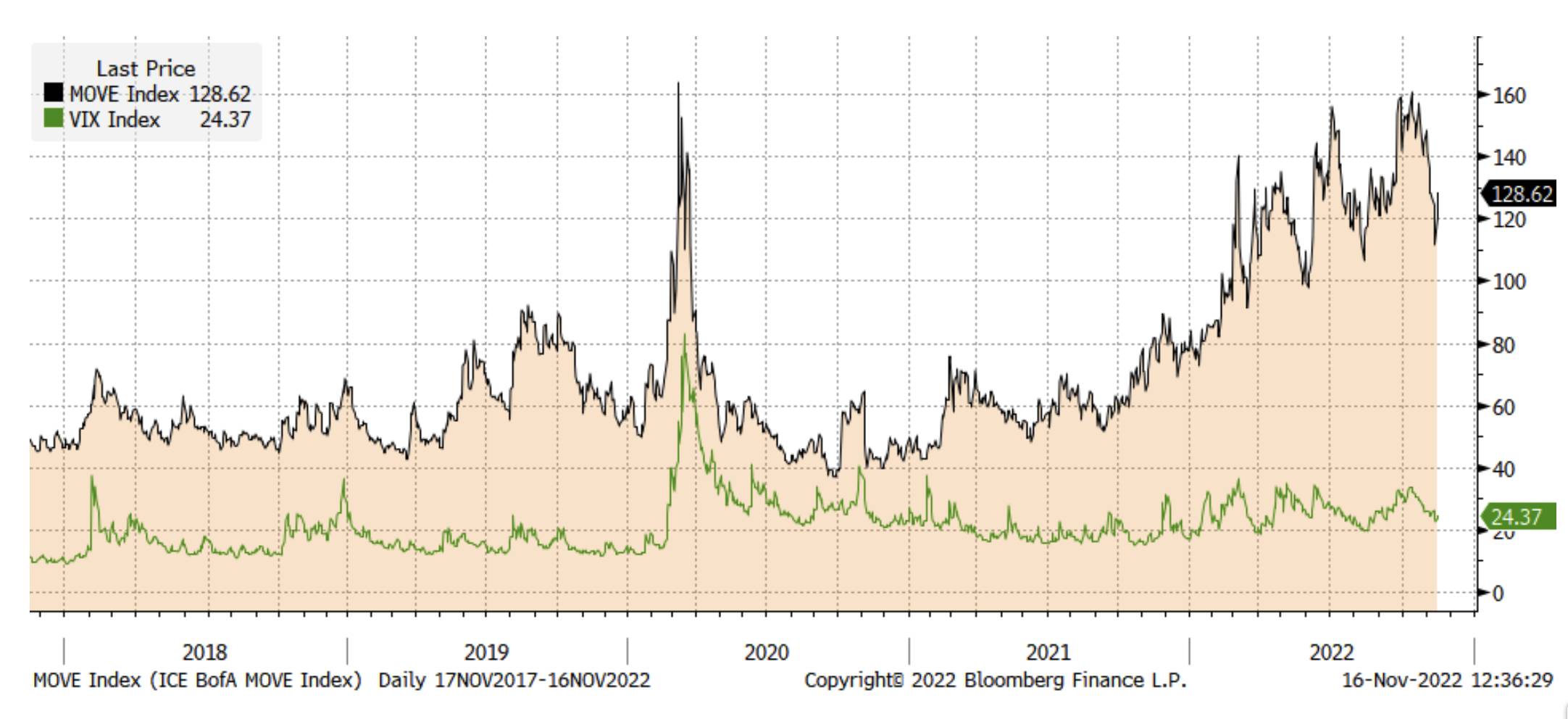

This conclusion is even more valid if we consider the volatility of government bonds since the beginning of the year and the prospects in the short and medium term.

Indeed, first of all, it is essential to highlight when rates (and therefore the return on bonds) have been incredibly volatile since the beginning of the year. Evidence that reminds us that in the current scenario, overexposure to the bond component wouldn’t decrease the overall portfolio’s volatility.

Furthermore, in the macroeconomic context, inflation could still push rates up, generating capital losses for bondholders. Although data on price increases in the United States for October was below expectations, it remains above 7% and US bankers have reiterated that the battle against inflation is not over yet.

In conclusion…

Overall, while investors may be tempted to invest in individual government issues given the level of the coupons, it is important to keep in mind the risks associated with this strategy.

Certainly, for most investors it remains essential to adopt a diversified approach to avoid specific risks and exploit opportunities for outperformance in specific geographies and sectors of the bond market.

Furthermore, it is important not to forget that the expected performance of multi-asset portfolios remains higher, especially considering that central banks maintain a very conservative tone and given the level of interest rate volatility in 2022.

At Moneyfarm, we maintain a profile on the conservative bond side, with a relatively low duration (and therefore exposure to interest rate volatility) for the moment and by continuing to seek market opportunities such those we feel are presented in Chinese Government Bonds, or targeting specific sub- segments, such as inflation-linked bonds.

Furthermore, we maintain a robust portfolio construction methodology that is constantly optimised in the light of market movements, aimed at maximising the expected return per unit of risk and adapted to each client’s specific conditions.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.