There is no one size fits all approach to investing. The best strategy for any given investor is affected by their goals, their financial situation, their attitude and, crucially, their age.

Across this three-part series, we are looking at the pivotal stages in an investor’s journey. People in their early career, those in their middle age and those nearing retirement have very different needs, so a different approach to investing is needed.

In this first instalment, we’ll be focusing on those who are starting out in their careers – people in their 20s and 30s who want to get into investing. Whether you’re saving for retirement, your first home or a child’s education, it pays to think about the future as early as possible.

So, here are our top tips for any young people looking to build a strong investment portfolio.

Set your goals

Though it may seem too early to be planning for major life events down the line, setting clear goals is important. Saving for a rainy day is great, but developing a more detailed long term plan can help you devise an investment strategy that works for you in the long run.

Knowing roughly if you want to withdraw your pension before 55 and how much you’re going to need gives you something to base your portfolio on. Different risk levels suit different goals, while someone saving for retirement may find a SIPP more suitable than an ISA or a GIA.

Clearly defined goals will give your wealth manager something to go on, too. The more information you can give an asset allocation specialist or an investment advisor, the better they’ll be able to build and manage a portfolio that’s right for you.

To get an idea of how different goals affect the amount you need to be saving, for example, take a look at the Moneyfarm Pension Calculator. All you need to do is input a few details about your current situation and goals and you’ll see how your contributions match up.

It pays to start early

The best way to get started with investing is to, well, get started. When putting money away for the long term, a few years in the markets can be the difference between good returns and great ones.

The compound interest generated over the course of, say, five years is reflected exponentially as the decades roll on. This is why, even if you can only put away a modest amount every month, any start you can make on your investment journey puts you in good stead to be rewarded down the line.

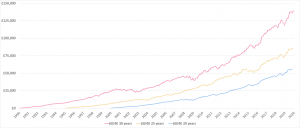

We simulated three different pension accounts, one beginning in 1990, one in 1995, and one in 2000. Each account is grown on the basis of investment of £100 a month. As shown, the exponential growth seen when investments are made early means that, by the time the account has been open 30, 25, and 20 years respectively, the difference in the final figures is staggering. It pays to get started early, with manageable investments made over an extended period for full reward come retirement.

Don’t be afraid of risk

In the context of long term investing, risk is not necessarily something to be afraid of. Risk is the reason that valuations fluctuate and the cause of both losses and gains in portfolios – it’s a fundamental part of investing. Without risk, investors wouldn’t make a penny.

A general rule is that, the longer the time horizon for your investments, the more risk you can absorb along the way. So, for a pension plan that won’t be accessed for decades, a higher risk portfolio might be suitable. Conversely, those saving to buy their first home might favour a lower risk portfolio to avoid losing out if volatility strikes.

We’ve written extensively about the benefits of staying the course when the markets become volatile. Generally, we believe that the ideal approach to reactive trading can be best categorised as ‘less is more’. Periods of heightened volatility can see valuations drop but recoveries are often swift, meaning in the long run it pays to hold fast instead of disinvesting at the first sign of movement.

Take advantage of professional help

As technology has developed, so too have alternatives to traditional wealth managers. Companies like Moneyfarm offer professional wealth management, full support, easy access and strong returns, all while removing the barriers to entry for younger investors.

At Moneyfarm, we have a team of experienced asset allocation specialists who monitor developments in the markets and highlight opportunities for investment accordingly. Alongside them, we have a team of highly qualified investment advisors whose job it is to ensure our clients are fully informed and fully supported as they grow their wealth.

Managing a globally diversified investment portfolio is a full time job. It is, arguably, a job for an entire team and is certainly not something many people can effectively do on the side. In days gone by, this kind of service might have been prohibitively expensive for most people. Today, it comes as standard with a Moneyfarm account.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.