Lately, markets have been in a rough patch. A coalition of uncertainty caused by the tightening of monetary policy and the war in Ukraine has taken its toll after an extended period of relative calm.

The US economy, for example, was expected to grow in the last quarter; instead, it shrunk. This can largely be attributed to declines in net exports and private consumption, along with the continuing rise in inflation. Naturally, this leads us to look to the fundamentals, to assess the potential effects of the current climate on our portfolios in the coming months.

Our analysis has reinforced our approach – we will maintain a conservative positioning, staying alert to the potential opportunities the market can offer going forward. This is the fundamental approach we take throughout uncertainty. For investors, it’s important to take a step back and look at the bigger picture. We take every period of volatility in context and it can be helpful to take a broader view.

How serious is the current volatility?

This is, unfortunately, not the first time we’ve experienced difficult markets over the last couple of years. The biggest market downturn came during the first outbreak of Covid-19, as countries went into lockdown and economies over the world ground to a halt.

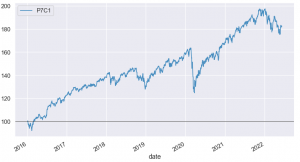

There have been other downturns over the last half a decade or so but, as you can see from the graph below, recoveries have often been swift. Now, we can’t and shouldn’t take past performance as a guarantee that markets will quickly right themselves, but it’s useful to see the current period of volatility within its full context.

The chart above follows Moneyfarm’s highest-risk portfolio since inception. The key areas to look at are October 2018 to January 2019 and January 2020 to April 2020. The pandemic caused a far bigger correction than we’ve seen so far this year, with late 2018 and early 2019 seeing a comparable dip.

The important thing to note is that, despite these significant downturns, both Moneyfarm’s portfolios are up over the six-year period. You can find all the information about how we calculate performance vs our peers here.

The bigger picture

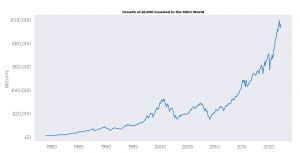

If we zoom out even further, we can take a look at the growth of the MSCI World index from 1980 until now. The chart below shows that downturns do occur and always have done. They don’t occur on a set schedule and there’s no uniformity to their duration but they have always been a feature of investing.

However, even with all these downturns, we know that the stock market has been up three out of every four years on average. Another way to look at this is that, when dividends are factored in, the MSCI World Index has finished positively in a vast majority of the years in this period. Even when hefty losses have rocked markets, they still have a pretty good chance of finishing the year above where they started.

What should I do?

This current market correction feels particularly troubling for some investors because we have such high inflation – most corrections will have a feature that makes them concerning for one reason or another.

The important thing to remember is that this is nothing out of the ordinary. If we take the S&P 500 as another example, in the period between 1928 and 2021, 63% of years saw at least one correction of 10% or more. In fact, only one in every 20 years avoided corrections of 5% or more. And, even with this being the case, three of every four years markets finished positively.

For investors, our message is always to stay calm and avoid any knee-jerk reactions to periods of volatility. We’ve written a few times about the danger of missing out on any potential recovery that occurs after a correction and we believe that disinvesting during uncertainty is little more than a surefire way to crystallise any losses.

This period of uncertainty and market volatility could get worse before it gets better and, if history is anything to go by, it just might. This is the nature of risk and is an inherent part of investing over the long term. What these periods do serve to highlight is the importance of having a fully diversified portfolio and a financial plan that looks years into the future rather than months.