What are we talking about? Recently we’ve been discussing the case for adding to equities – and the first “decent” inflation print out of the US has sharpened that discussion. With hindsight, of course, the correct answer was “June 16th”, but hindsight is a wonderful thing. Nonetheless, it’s worth revisiting where we are in our thinking.

What do we think? Our portfolio positioning says what we think – or at least it should. On that basis, versus our internal benchmarks, we are broadly underweight equities – but less so than, for instance, in March 2020. According to Bank of Americas July fund manager survey, that puts us squarely in line with everyone else.

Our thinking runs something like this:

1. Uncertainty remains high: Geopolitics has had a significant impact on the global economy and that doesn’t look likely to dissipate in the near term.

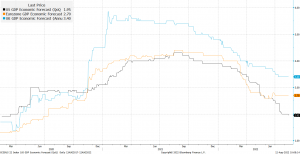

2. Inflation is high, central banks are behind the curve and are trying to catch up. That means higher rates and a slower economy going forward. The chart below shows how the forecasts for economic growth in the US, EU and UK have changed over the course of the past year or so. We can see steady downgrades since the end of last year.

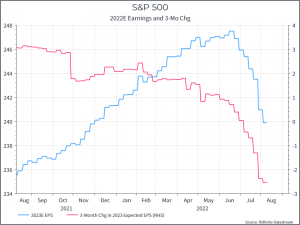

3. Equity valuations have come down, but earnings expectations have held up fairly well so far. The risk is that earnings forecasts need to come down from here to reflect weak growth / recession in the global economy.Those downgrades aren’t fully reflected in equity prices currently. The chart below shows that earnings expectations for next year, in this case for the S&P 500, are beginning to come down. And, as Factset has noted, if you exclude energy, S&P 500 earnings in 2Q declined year-on-year.

Key considerations? We usually think there are three key things to try to identify. First, what are the variables that matter. Second, how will those variables behave. Three, how will the market react. Or, in other words – what’s the right question, what’s the right answer and how will the market react. Usually, it’s worth analysing data – but it’s still going to require some judgement.

So, one part of our thesis for being underweight equities has basically been that equities don’t fully reflect the drop in earnings that we’re likely to see in a slowing macro environment.

There are a couple of ways that we can be wrong.

First, we under-estimate the resilience of corporate profitability. Earnings basically hold up better than we thought – either because the global economy holds up well or because listed businesses are able to manage their costs and their revenues well enough to keep profits high.

The chart below illustrates the point – it shows global profit margins over time. A few points to highlight. First, margins have been drifting higher over time. Second, they are usually cyclical – they fall when the economy slows. Third, during the pandemic, margins held up far better than we might have expected given the experience of the Global Financial Crisis and the post-dot com recession. Finally, we can see that margins have begun to deteriorate a bit, but not very much and from a very high starting level.

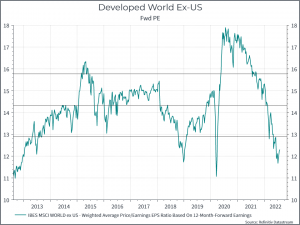

Second, even if we’re right about margins, maybe it’s all already priced in. After all, everyone expects growth to slow and equity valuations have already de-rated (in some cases quite sharply).

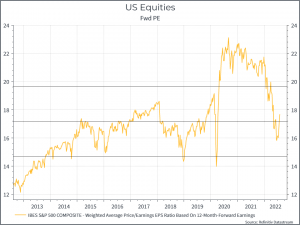

The charts below provide some context. We see the forward P/E for Developed Equities Ex-US looking cheap versus their 10-year history. On the same metric, US equities are around their 10-year average.

It’s worth reminding ourselves that no one can actually know exactly what is priced into equity markets – so this ends up as a (hopefully) informed judgement. Surveys have indicated that investor sentiment on equities is very poor – with most survey participants claiming to be underweight (at least a few weeks ago). The chart below (from Bank of America, via Zero Hedge) shows the percentage of survey participants overweight equities relative to cash. In July that metric hit the October 2008 level. Curmudgeons might remind us, however, that the US equity market only bottomed in March 2009. We might be able to say that, in our judgement, equities don’t reflect profit levels we saw in 2008 – but we’re not expecting that outcome either (or we’d be far more underweight equities than we are).

Where does this get us? We think that there are two key considerations at play. The first is the outlook for earnings – where we do see downgrades, even if the second quarter in the US was decent. The second is valuation – what’s priced in? The easy answer is “some” – we’ve seen a de-rating, albeit compared to a dramatic pandemic rise in equity valuations. But that doesn’t give a clear answer to the question – buy more equities today or not. Non-US equities look cheap, but maybe the uncertainty there is greater. US equity valuations look “ok” – but perhaps you’d want a more compelling signal before buying into slowing growth and maybe optimistic expectations. We think that’s a fair indication of where we are today- we might not be quite ready to buy more equities today, but we’re comfortable not being more underweight, and the important questions we need to consider before adjusting that view.