What are we talking about? This week the US Federal Reserve and the Bank of England both raised rates by 75 bps in an effort to curb high inflation. But the messaging was rather different. Fed Chair Powell delivered a hawkish message, saying that the Fed expected the peak policy rate (whenever that occurs) to be higher than previously expected. In contrast, the Bank of England indicated that it expected its peak policy rate to be lower than financial markets were currently pricing.

What’s going on? There are a few points to make. First, the Bank of England is still dealing with the financial fallout from the mini-budget fiasco. Market expectations for UK interest rates have fallen from the highest peaks “achieved” during the Truss premiership, but the Bank evidently believes there’s still some risk premium priced in. The chart below illustrates the point. It shows market expectations for the policy rate for the US, UK and Eurozone in one years time. We can see the mini-budget spike at the top of the chart and the gradual drift down.

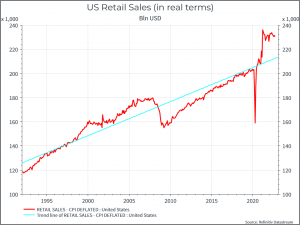

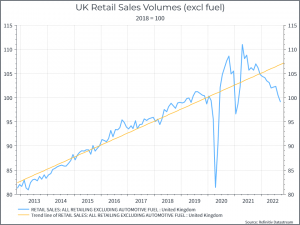

Second, the US economy still looks more robust than the UK – a point made by the Governor of the Bank of England this week. The two charts below illustrate the point. The first chart shows US retail sales (in real terms) compared to the long-term trend. The second chart shows UK retail sales volumes. They’re not precisely the same, but the message is pretty clear. US sales are still above the long-term trend. even after inflation. UK sales volumes are already below where they were in 2019.

The final point is around the mortgage market in the UK. It’s a point we’ve made before, but it was highlighted by the Bank of England (and, among others, by John Authers at Bloomberg) this week. Most UK mortgages are fixed only over 2 and 5 years, and given the sharp increase in mortgage rates, there’s a consistent stream of borrowers each month who are seeing their monthly mortgage payments rise significantly. If you’re spending twice what you used to on your mortgage, you’re probably spending less somewhere else. All this left Andrew Bailey, governor of the Bank of England, in a sombre mood – predicting a recession next year.

Where does this get us? Central Bank policy is as critical as ever. But even when Central Banks act the same, they’re coming from different places. The US economy still looks pretty robust, while challenges in the UK look to be growing. Does that mean the Bank of England will stop hiking before the US? That probably depends on how quickly inflation comes down. Financial markets today seem to suggest that US policy rates will peak before the UK, but Fed governors have been sceptical about the markets timeline. And today it seems that what Central Banks will do (“the Central Bank reaction function” – if you’re feeling fancy) is the most important driver for markets.

What does it mean from a portfolio perspective? There are a few points to make. First, it looks like the UK domestic economy is in for a difficult time over the next year or two – maybe tougher than elsewhere – and that argues for having a well-diversified portfolio. Second, UK large cap equities aren’t necessarily representative of the UK domestic economy, so a weaker economy doesn’t mean that UK large caps hold up ok, and we think UK large cap stocks still look attractively valued, in aggregate. We have a tilt towards the US in some portfolios, and that partly reflects our view that the US economy enters this period in better shape than others. But the key question remains around inflation and how quickly will it fall. We do expect to see inflation slow over the coming months, but it’s clearly proven more sticky than analysts had expected.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.