Most investors will have noticed that the beginning of 2022 has been relatively rough from a markets point of view. The near-constant growth of the last 18 months has come to a halt, with the main indices recording significant drops (S&P 500 -7.5%, Nasdaq -12.2%, EuroStoxx -3.35%).

This correction shouldn’t be a major cause for concern. After nearly two years of largely uncontested growth following the initial Covid-19 dip, it’s only natural that markets would see corrections sooner or later. One reassuring factor is that the reasons for the slowdown can all be attributed to internal market dynamics, which have been part of our valuations for some time. There are no external elements causing us to rethink our strategic assessments.

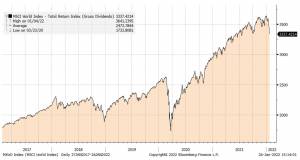

In short, it’s important to view this decline within the context of long-term market dynamics. The graph below illustrates this well enough, though we must also analyse the reasons for this step and understand what the possible opportunities might be for investors.

Source: Bloomberg

Here, we’ll explain our point of view and explain some of the steps we are about to take to prepare portfolios for the rest of 2022.

What are the causes behind the market correction?

As we’ve already said, the selloff is attributable to market dynamics. The usual suspects are inflation and monetary policy.

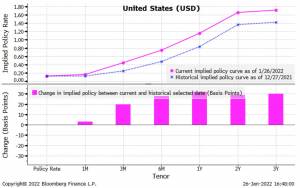

As we’ve highlighted in recent weeks, inflation has led to a readjustment of expectations on Fed monetary policy actions. Following the latest Fed statements and minutes, market expectations have shifted towards four rate hikes by the end of 2022 and on higher tapering expectations. During the month of January, these expectations moved further towards an interest rate of 1.2%.

Source: Bloomberg

A quicker than expected monetary tightening has been on the radar for some time, and expectations are now being adapted. This does, sooner or later, have an impact on the prices of financial assets.

Not only does an increase in rates make equity valuations less attractive, but it also brings with it the fear of a ‘policy misstep’ – the fear that an excessively sudden rate hike could undermine economic growth.

Another notable feature of the latest selloff is that it particularly targeted tech companies. You might remember that, when the market reached its peak, these companies were seeing a price-to-expected earnings ratio of 26 – substantially higher than the historical average.

With this ratio so high it’s unsurprising that delicate moments, like the publication of earnings, would lead to increased market volatility. For example, the publication of worse-than-expected data from Netflix and Peloton has led to losses of 47% and 75% respectively in recent months. This is a loss that’s only been amplified by high starting valuations.

This somewhat disappointing data came from companies that had previously enjoyed very high valuations in line with the rest of the index. This then helped to engender some more cautious sentiment over the past week, in anticipation of quarterly results from large companies.

The good news here is that the first part of the current earnings season results looks strong, a positive indicator of strong momentum for the economy. To date of the 101 S&P 500 companies that have declared their results, 80% have outperformed analysts’ expectations. If we isolate the technology sector, this figure rises to 90%. In short, the positive economic environment, beyond the short-term corrections, should be a source of comfort for investors worried about the performance of equities in the coming months.

Stock valuations are also likely to benefit. As for the Nasdaq, the price-to-expected earnings ratio fell from 26 to around 20. This is due to not just the correction of prices but also the growth of the denominator (corporate profits). A price-to-earnings ratio that is more in line with fundamentals may help create a more sustainable path for equities for the rest of the year.

What are the next steps?

Naturally, the key issue we’ll be focusing (and acting) on soon is that of share rotation. We believe that there are equity segments with less stressed valuations, which are more likely to take advantage of the positive economic recovery in 2022. We will tinker with the equity component of the portfolio over the coming weeks to take advantage of this trend.

However, the long-term outlook remains positive for equities. We’ll discuss this in detail with all investors during our annual conference on February 22nd. If you’d like to register for the event, you can do so here.

How should investors respond?

For most investors, when faced with corrections in the market, the safest option is always sticking with your guns and staying faithful to your investment plan. Also, if there are opportunities to be found as markets recover, you’ll be well-positioned to take advantage of them provided you have enough time to invest.

We recently carried out a study on the behaviour of a sample of 12,000 investors during the economic crash brought about by the first wave of Covid-19. This showed that, in most cases, staying invested yielded better performance than trying to time the market or avoid the dip completely.

If you want to discuss the situation in the market or your own financial position, feel free to get in touch with a member of our investment consultancy team.