Over the last month, we’ve seen more turbulence in the markets than we did in the previous few. Concerns around rising inflation were a focal point, while the significant cryptocurrency sell-off also sparked conversation around its viability as an investment.

In this video, Senior Investment Consultant & Pension Specialist, Stephen Jones, discusses the key points from May, beginning with these inflation concerns. The Fed has displayed some confident rhetoric and appears determined to avoid tightening monetary policy, which is a boon for investors. In short, the line that we took at the beginning of May seems to have held up; that inflation will be manageable in the medium term.

In terms of what that medium term will look like for Moneyfarm’s portfolios, we explore how they are positioned to handle any inflation risk. Gradually increasing inflation and the slow tightening of monetary policy, for example, may well provide a favourable environment for equities.

We then go on to look at the Bitcoin crash. The Bloomberg Galaxy Crypto Index lost 40% in a matter of days, after a series of news stories fundamentally affected the sentiment around cryptocurrency more broadly. The drop in price then led to a panic sell-off which saw Bitcoin fall from $63,000 to $35,000 in just a few weeks. We look at the reasons behind the sell-off and what it means, exactly, for the future of an industry still very much in its infancy.

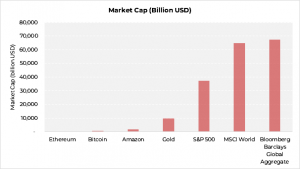

Ultimately, though, as the chart above demonstrates, cryptocurrency still represents a tiny fraction of the markets. It simply does not trade on a scale anywhere close to that of the more established assets.

How Moneyfarm performed

Despite the turbulence, Moneyfarm’s portfolios held strong in May and achieved positive returns. The biggest contributors this month were European assets and ‘value equities’ – i.e. those hit hardest by the move to a digital economy and subsequently those enjoying the end of lockdown the most. Bonds benefited from the stabilisation of interest rates, while there was something of a mixed bag to be found in exposure to emerging markets – largely due to the depreciation of some local currencies.

Our last two rebalances have included the increase of our exposure to ‘value’ equities, a decision that has certainly paid off in the first few months of the year, with this asset class outperforming. As the recovery accelerates in the Western world, however, assumptions around underlying trade could change – this is something our Investment Committee will be keeping a close eye on going forward.