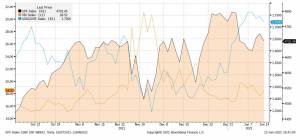

December was, largely, a story of volatility and uncertainty. Markets did nevertheless close positively thanks to the Christmas rush over the last two weeks. In the second half of the month, investors leveraged the two key pillars of equity returns seen in recent months: public companies grinding profits and the rates of return on bonds remaining low, making equities the only viable alternative for a positive return.

As always, the December hikes were not without controversy. the very positive overall performance of equities in 2021 has papered over the cracks in some areas, with many commentators noting the underperformance of smaller companies against the giants that lead the market. Hyper-expansionary monetary policy has been under the microscope, accused of distorting the market to favour large corporations regardless of the direction of the real economy.

We take a slightly different view. We believe that the underperformance of smaller companies is consistent with the situation that’s developed in recent weeks, given that:

- Larger companies have, in our opinion, greater pricing power and can better resist inflation. They often have the ability to operate somewhat independently of the economic environment brought about by lockdowns and other restrictions.

- The rise in interest rates has had little impact on listed companies, for now, as debt levels are lower than in the past and companies have high credit ratings. A more restrictive monetary policy will impact growth companies to a greater degree.

- The fact that Joe Biden’s grand fiscal plan has been slowed has not helped smaller companies, which are more intrinsically linked to the performance of the real economy.

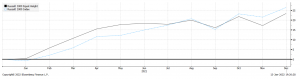

One interesting bit of food for thought is the fact that American Equal Weighted equities (in which all companies in the index are weighted equally regardless of size) performed almost as well as those that are weighted according to market capitalisation.

This indicates a solid and broad equity performance, where not just a few large companies were driving the gains, but rather all funds participated equally in the gains. It is also interesting to note that, on a global level, the standard index has outperformed the equally weighted index, confirming how extraordinary a year it’s been for the US.

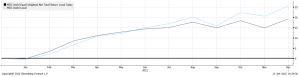

Finally, we’ll reiterate that it’s not the short term interest rate curve that guides investors; it’s the long term. The beginning of January only served to highlight the importance of this point. The upward pull in interest rates in the first week of the new year brought some nervousness back to equities, showing how delicate the balance being struck really is.

Inflation makes headlines

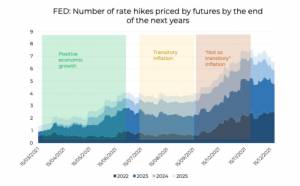

The last month in financial markets has, largely, been defined by inflation. We’ve hit levels not see for some time and it’s something we expect to be talking about well into 2022, as central banks around the world act to address the concerns around rising prices.

Both the ECB and the Fed have significantly scaled back their asset purchase programs. The UK and Noway have raised interest rates. Many central banks in emerging economies, from Chile to Russia, have also raised rates.

Inflation has become a central political issue after remaining under control for much of the Covid-19 pandemic. The tightening of monetary policy by central banks is, therefore, expected to come more swiftly than we perhaps expected. The Federal Reserve is considering selling some of the assets purchased over the last year and a half, while most analysts now think we could see as many as four rates increases this year.

For central banks, it is now time to signal to the market just how important an issue inflation has become. It’s also key that the Fed finds a way to divorce monetary policy from the pandemic in some way. This means that, even if Covid-19 causes further complications, the tightening of monetary policy must and will go ahead. We expect central banks to proceed with caution, however, as they have done throughout the pandemic.

In a sense, we’re already seeingsome of the consequences of high inflation on financial markets. The yield on 10-year Treasury bonds, for example, has risen after remaining stable for some time.

A rise in rates can have a negative impact on equity value. This is particularly true of higher-valued stocks and growth stocks. It is no coincidence that, at the start of 2022, we began to see some turbulence on the Nasdaq.

From a wealth management point of view, the question to answer is where we should direct the stock rotation. We still believe that there are equity sectors and geographies with plenty of room to grow. We’ll take a look at value stocks, and Emerging Markets. These are all areas for us to assess to see if there are opportunities worth exploring and factoring into our portfolios.

Omicron soars but has a relatively mild impact

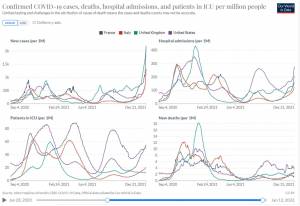

December was the month in which Omicron became the dominant strain of Covid-19. After frightening markets in November and early December, the new variant has lost some of its initial fear factor. Despite soaring case numbers – these are, however, now dropping in the UK – the symptoms appear to be milder than previous variants and this is reflected in hospitalisation and mortality rates.

It seems likely that the (comparably) mild impact of Omicron is thanks to both the variant itself and the vaccination rates in Developed Markets. It will be important to monitor the spread in Emerging Countries in order to quantify the risk of fresh lockdowns and, consequently, new bottlenecks in international supply chains. At present, in line with the markets, we remain cautiously optimistic about Omicron’s limited risk.

Our updated investment strategy is nearly ready

As we do every year, our team is currently working on updating our investment strategy. As usual, we’ll distribute the document to all investors and hold an event in February to discuss it. Broadly speaking, the document is where we estimate the long-term return prospects of the major asset classes.

This year, we’ll focus on “sustainable growth”, not only from an environmental point of view but also from a financial, economic and social perspective. The global economy is changing. Both businesses and governments are having to navigate issues like inflation, supply chain problems and labour shortages.

The good news is that we believe that these issues can be solved. Markets have shown a remarkable degree of adaptability and resilience in recent years. Investing for the long term remains the best solution, especially with the current challenges.

Our job, as usual, is to help you navigate this period with confidence. Therefore, we believe it’s essential to share our perspective with you, and we look forward to doing so in the coming weeks.

Portfolio performance

In December, the performance of the portfolios was positive, with higher volatility than in the rest of 2021. This was, largely, concentrated in the first couple of weeks of the month. The largest contribution comes from equities, while the fixed income sector moved in the opposite direction, in line with its diversifying nature. High yield and emerging market bonds were slightly positive.