The world economy ended the decade in a much stronger position than when it started. Last year topped an incredible ten years for financial markets, as they recovered from the market turmoil that ended 2018. Moving into 2020, there is scope for continued economic growth with falling rates and progress with US-China trade negotiations, although it’s difficult to envisage financial markets matching the incredible returns of 2019. We do however believe financial markets will continue to provide long-term investors the best opportunity to grow their wealth.

Build a personalised investment portfolio for 20202019 was a great year for financial investments. Check out a selection of December quarterly reports, to discover how Moneyfarm portfolios performed:

The past decade in review

The past decade has certainly been interesting, particularly when looking at financial markets and the political and economic factors influencing them.

The UK alone had five governments, four general elections and of course two referenda. Political discourse shifted drastically, testing the political establishment to its limits. This pattern was repeated across the globe, with the traditional political status quo shifting decisively.

On the face of it, the world economy had a much calmer ride. Many developed economies saw their first recession-free decade in modern history. However, an economic miracle it was not – growth was sluggish and unequal, with growing income inequality feeding the turbulent politics of the decade.

Despite ten consecutive years of growth, the impact of the global financial crisis can still be felt throughout the global economy. During this period Central Banks resorted to extraordinary measures, as monetary policy filled the gap left by fiscal policy’s receding role. Quantitative easing saw mass purchases of government, and even company bonds, in addition to a drop in interest rates. This monetary stimulus left interest rates at record lows and failed to stimulate sustained inflation across developed economies. The knock-on impact of these measures was a fall in interest rates on cash products, directly hitting UK savers.

Amidst this uncertainty, sitting out of financial markets may have seemed a good option at the time. However, over the decade equity markets more than doubled in value, transforming many an investment portfolio. Stocks climbed in 7 of the 10 years, aided by low starting valuations and supportive monetary policy. Those who remained invested were the ones to benefit from the decade’s growth.

Narrowing our focus to the events of the past 12 months, we can’t help but note that financial markets are in a very different position compared to this time last year. Markets entered 2019 on a wave of uncertainty.

A sharp equities sell-off in December 2018 and concerns over the course of US monetary policy had left investors nervous. However, the US Federal Reserve changed track in February 2019 and began to lower interest rates, underpinning a sharp rally in both equities and government bonds. Twelve months on, the turmoil that ended 2018 now seems a distant memory.

Outlook on 2020 (and beyond)

Looking towards 2020 and beyond, we again face unpredictability, and with it, the choice of how to invest. We expect uncertainty to continue this decade, with the current political and economic landscape looking set to carry on into the new decade. That said, as with the past ten years, we believe that patience will again provide a pay-off for those able to invest for the long term. In line with these beliefs, Moneyfarm’s investment strategy will continue to focus on the long-term.

The outlook for this year remains upbeat. Sentiment has clearly improved and monetary policy is more supportive. This should translate to better economic growth over the coming year.

Market expectations, the other side of the coin, tell a slightly different story – with current valuations suggesting another year of 2019-like returns to be less likely.

The Fed U-turn

The biggest shift over the past year has been in monetary policy, where the US Federal Reserve moved from raising rates to lowering them – with the ECB following suit. Global growth has been quite muted – particularly in the manufacturing sector – but the impact of lower rates should prove supportive going forward. Services have held up better, but have also seen a slowdown in activity.

Nonetheless, concerns over a recession in developed markets haven’t come to fruition and labour markets in the US and much of Europe remain relatively robust. We could look back and say that policy-makers have (so far) successfully negotiated a mini-slowdown in the global economy, avoiding the long-waited and long-feared recession.

Higher valuations

The second notable shift has been around expectations. The chart below shows the historical forward PE for the S&P 500 over the past 10 years. At the end of 2019, we see that the ratio has recovered back to the levels of late 2018. The equity market appears to be pricing in a period of decent, if not accelerating, profit growth – underpinned, we assume, by lower interest rates and improving economic conditions. Higher valuations hint at lower long-term expected returns of an asset class; this requires a careful composition of the risk exposure in our portfolios, when we look for returns over a long time-frame.

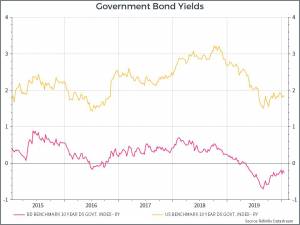

Turning to fixed income, we see a slightly different set of expectations. The chart below looks at 10 year government bond yields in the US and Germany. For much of 2019 we’ve seen a steady decline in bond yields as concerns about economic growth prompted central banks to shift to an easing stance.

Inflation, or the absence of inflation, plays an important role in all of this. As unemployment has fallen around the world, and as wage growth has gradually picked up, lots of analysts (including some of us!) have expected inflation to accelerate. 2019 was another year when it didn’t really happen – quite the reverse. The chart below shows the flash estimate for Eurozone inflation and UK inflation (CPI). Each is well below the 2% target of their respective Central Banks. Similarly, the chart below shows the US Personal Consumption Deflator (The US central banks preferred measure of inflation). Again, it’s sitting some way below the 2% target.

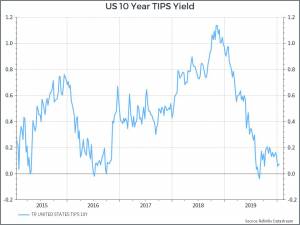

From the markets’ perspective, here’s the yield on US 10-year TIPS (inflation-linked bonds).

Betting on the re-emergence of inflation has been a losing game for the past several years and there’s no sign of this changing. We’d also argue that a lot of asset prices around the world depend on inflation not re-accelerating in 2020.

Looking into 2020, it’s tough to imagine we’ll see as good a year for financial markets as in 2019. Starting valuations are higher than they were. But with lower rates, notably in the US, and a truce in the US-China trade war, we could see a pick-up in economic growth that would help to support risky assets.

The world economy ended the decade in a much stronger position than when it started. Last year topped an incredible ten years for financial markets, as they recovered from the market turmoil that ended 2018. Moving into 2020, there is scope for continued economic growth with falling rates and progress with US-China trade negotiations, although it’s difficult to envisage financial markets matching the incredible returns of 2019. We do however believe financial markets will continue to provide long-term investors the best opportunity to grow their wealth.

The past decade in review

The past decade has certainly been interesting, particularly when looking at financial markets and the political and economic factors influencing them.

The UK alone had five governments, four general elections and of course two referenda. Political discourse shifted drastically, testing the political establishment to its limits. This pattern was repeated across the globe, with the traditional political status quo shifting decisively.

On the face of it, the world economy had a much calmer ride. Many developed economies saw their first recession-free decade in modern history. However, an economic miracle it was not – growth was sluggish and unequal, with growing income inequality feeding the turbulent politics of the decade.

Despite ten consecutive years of growth, the impact of the global financial crisis can still be felt throughout the global economy. During this period Central Banks resorted to extraordinary measures, as monetary policy filled the gap left by fiscal policy’s receding role. Quantitative easing saw mass purchases of government, and even company bonds, in addition to a drop in interest rates. This monetary stimulus left interest rates at record lows and failed to stimulate sustained inflation across developed economies. The knock-on impact of these measures was a fall in interest rates on cash products, directly hitting UK savers.

Amidst this uncertainty, sitting out of financial markets may have seemed a good option at the time. However, over the decade equity markets more than doubled in value, transforming many an investment portfolio. Stocks climbed in 7 of the 10 years, aided by low starting valuations and supportive monetary policy. Those who remained invested were the ones to benefit from the decade’s growth.

Narrowing our focus to the events of the past 12 months, we can’t help but note that financial markets are in a very different position compared to this time last year. Markets entered 2019 on a wave of uncertainty.

A sharp equities sell-off in December 2018 and concerns over the course of US monetary policy had left investors nervous. However, the US Federal Reserve changed track in February 2019 and began to lower interest rates, underpinning a sharp rally in both equities and government bonds. Twelve months on, the turmoil that ended 2018 now seems a distant memory.

Outlook on 2020 (and beyond)

Looking towards 2020 and beyond, we again face unpredictability, and with it, the choice of how to invest. We expect uncertainty to continue this decade, with the current political and economic landscape looking set to carry on into the new decade. That said, as with the past ten years, we believe that patience will again provide a pay-off for those able to invest for the long term. In line with these beliefs, Moneyfarm’s investment strategy will continue to focus on the long-term.

The outlook for this year remains upbeat. Sentiment has clearly improved and monetary policy is more supportive. This should translate to better economic growth over the coming year.

Market expectations, the other side of the coin, tell a slightly different story – with current valuations suggesting another year of 2019-like returns to be less likely.

The Fed U-turn

The biggest shift over the past year has been in monetary policy, where the US Federal Reserve moved from raising rates to lowering them – with the ECB following suit. Global growth has been quite muted – particularly in the manufacturing sector – but the impact of lower rates should prove supportive going forward. Services have held up better, but have also seen a slowdown in activity.

Nonetheless, concerns over a recession in developed markets haven’t come to fruition and labour markets in the US and much of Europe remain relatively robust. We could look back and say that policy-makers have (so far) successfully negotiated a mini-slowdown in the global economy, avoiding the long-waited and long-feared recession.

Higher valuations

The second notable shift has been around expectations. The chart below shows the historical forward PE for the S&P 500 over the past 10 years. At the end of 2019, we see that the ratio has recovered back to the levels of late 2018. The equity market appears to be pricing in a period of decent, if not accelerating, profit growth – underpinned, we assume, by lower interest rates and improving economic conditions. Higher valuations hint at lower long-term expected returns of an asset class; this requires a careful composition of the risk exposure in our portfolios, when we look for returns over a long time-frame.

Turning to fixed income, we see a slightly different set of expectations. The chart below looks at 10 year government bond yields in the US and Germany. For much of 2019 we’ve seen a steady decline in bond yields as concerns about economic growth prompted central banks to shift to an easing stance.

Inflation, or the absence of inflation, plays an important role in all of this. As unemployment has fallen around the world, and as wage growth has gradually picked up, lots of analysts (including some of us!) have expected inflation to accelerate. 2019 was another year when it didn’t really happen – quite the reverse. The chart below shows the flash estimate for Eurozone inflation and UK inflation (CPI). Each is well below the 2% target of their respective Central Banks.

Similarly, the chart below shows the US Personal Consumption Deflator (The US central banks preferred measure of inflation). Again, it’s sitting some way below the 2% target.

From the markets’ perspective, here’s the yield on US 10-year TIPS (inflation-linked bonds).

Betting on the re-emergence of inflation has been a losing game for the past several years and there’s no sign of this changing. We’d also argue that a lot of asset prices around the world depend on inflation not re-accelerating in 2020.

Looking into 2020, I think is reasonable to manage expectations after a terrific 2019. Starting valuations are higher than they were. But with lower rates, notably in the US, and a truce in the US-China trade war, we could see a pick-up in economic growth that would help to support risky assets.