What are we talking about? Financial markets have decided – at least for now – that inflation probably won’t be as transitory as we might have once hoped. In that context, we’ve been discussing a couple of important questions (we think) – first, what does higher inflation mean for various asset classes and second, why are real interest rates so low.

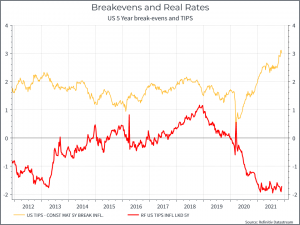

On inflation and real interest rates: The chart below illustrates the point. The top line is the 5-year breakeven in the US, a measure of inflation expectations. It stands at the highest level in more than a decade. The bottom line is the 5-year TIPS yield, an inflation adjusted interest rate. It sits at the lowest level in a decade. That’s surprising (see a piece from John Authers at Bloomberg for a more eloquent perspective) and possibly reflects some assumptions about how keen Central Banks really are to bring down inflation – given how effectively inflation can be at reducing government debt ratios.

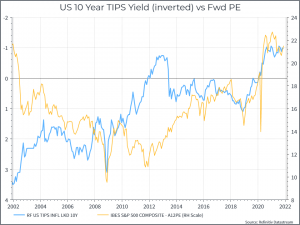

In any event, negative real interest rates might have some important implications for a range of asset classes. The chart below illustrates one example. It shows the 10-year US TIPS (inflation-linked) yield – inverted – compared to the forward PE on the S&P 500. It’s hardly a perfect relationship, but in recent years you could say that the re-rating we’ve seen in US equities has some correlation with declining TIPS yields. And that raises the question – if real rates become even a bit less negative, will that prompt a de-rating in US equities towards longer-term averages? It’s a familiar debate – does the absolute level matter (still negative) or is it the direction of travel that’s more important for financial markets. Usually, you’d argue it’s the direction of travel that matters more

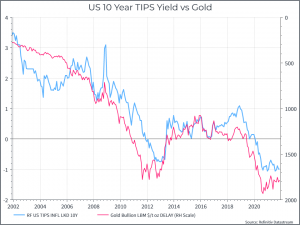

We can show a similar relationship between real rates and gold (see chart below). We have small gold positions in some of our portfolios and it’s been disappointing. As we think about the path of US rates, we continue to debate whether we should keep our exposure to gold

Where does this get us? It’s fair to say that 10-year TIPS yields (real rates) have stayed lower than we might have expected, and maybe it reflects market expectations of dovish Central Banks. Nonetheless, as we see Central Banks getting ready to taper / increase rates, we could see real rates move higher – or become a little less negative. So far, we haven’t felt the need to adjust portfolios to reflect that, but it’s something we continue to debate.