What are we talking about? We thought it was worth looking over some of the key issues in markets at the moment.

Details: There are a few contrasts that are worth considering.

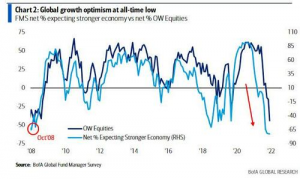

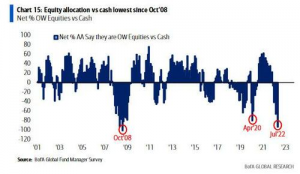

First, investor sentiment looks poor. The chart below comes from the most recent Bank of America survey of fund managers (via Zero Hedge). It shows very few, if any, fund managers admitting to being overweight equities (whatever that “overweight” might mean”).

Usually, you’d argue that such a strong consensus might well be wrong. It’s a nice line – “the consensus is always wrong” – but the chart below doesn’t really give you that much comfort. It shows that peak pessimism, at least on this measure, during the Global Financial Crisis came in October 2008, but the US equity market only finally bottomed in March 2009.

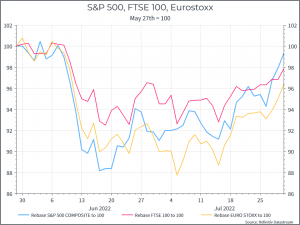

All that said, the chart below does show a nice contrast between poor investor sentiment and equity market performance. The chart shows equity performance in the US, Europe and the UK since the end of May. After a sharp sell-off in mid-June, equities, particularly in the US, have regained most of what they lost. It’s another reminder of the challenges of short-term trading.

But is the apparent optimism of recent weeks justified or misplaced? History suggests that a difficult market environment can still be punctuated by quite sharp rallies. At the same time, there are reasons to be more constructive over the long term.

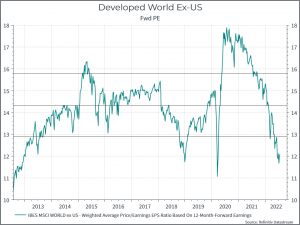

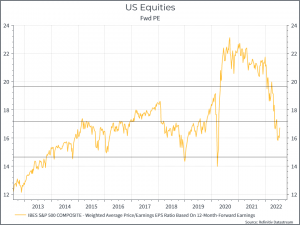

On the constructive side, we can point to equity valuations. The two charts below show forward Price/Earnings for the Developed World Ex-US and for US equities. In both cases, we can see a sharp de-rating over the past few months. All else equal, that should represent a better entry point for investors.

In terms of earnings, we have seen some downgrades to earnings estimates, but so far they’ve been fairly muted. That might just be a question of time – and corporate profitability is still at risk – or maybe corporates are proving able to manage their way through slowing growth and high inflation.

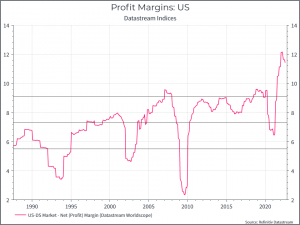

To illustrate the point, let’s look at the chart for US profit margins. As we’ve noted before, corporate profitability is well above the long-term average, and it has begun to drift a bit lower recently – which is what you’d expect. How far it still has to fall is one of the key questions facing investors, we think.

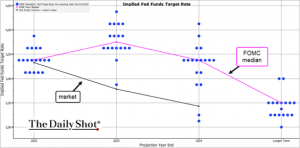

What about policy? Part of the recent rally, we’d argue, has been driven by optimism that the Fed will not need to raise rates as much as had been feared. The chart below (from Bloomberg, via the Daily Shot) illustrates the point. It shows the market-implied trajectory for the US policy rate, compared to the forecasts of US Central Bankers (from June). The market today (or last week) expects a lower Fed Funds rate than Fed members.

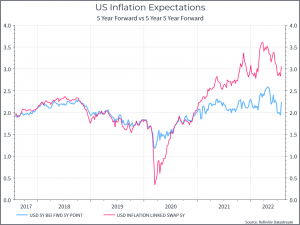

That assessment partly reflects expectations about interest rates. While inflation is currently high, financial markets believe that it will come down. The chart below shows longer-term inflation forecasts – 5 years from now and (roughly speaking) 10 years from now. We can see that those expectations have drifted down from earlier in the year, but that they’re also quite volatile.

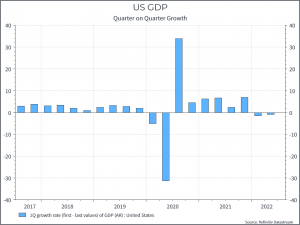

The other part is around growth in the US. The chart below shows two consecutive declining quarters – traditionally an indicator that the economy is in recession. Maybe it’s too early to call a recession – with a strong labour market and decent consumption. But the signals for slower growth are giving some cause for hope that the Fed will need to do less than previously expected.

Where does this get us? Investor sentiment is poor, valuations are below their long-term average, earnings have weakened but generally held up ok. That sounds like a decent combination – at least from a long-term perspective. Inevitably it’s not so straight-forward in the shorter-term. First, we still need to see inflation begin to normalise. There are some signs of improvement – for instance lower commodity prices and some improvements in the global supply chain – but the most recent inflation data, for instance in Germany, have come in ahead of expectations. Second, we still need to be comfortable that corporate earnings will hold up – that the resilience we’re seeing isn’t just a question of timing. And those questions remain unanswered for now.