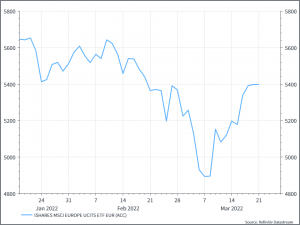

What are we talking about? The European Equity ETF we own (SMEA MI) is back above the level of February 23rd – the day before Russia invaded Ukraine. It’s worth thinking about that in a bit more detail.

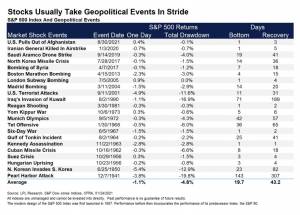

Does that make sense? As usual, there are a few arguments to work through. First, as has been well-documented, history usually argues for buying geopolitical crises. The table below comes from a piece by Barry Ritholtz (from February 2022) and looks at the performance of the S&P500 during various crises.

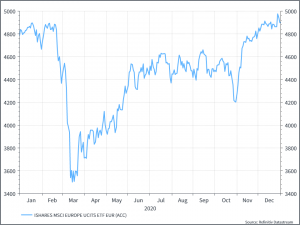

Second, the recent experience with COVID is also notable. The US equity market recovered far faster than during previous drops (according to the chart below, that came via the Daily Shot).

The story is similar, albeit perhaps less pronounced, with the European equity ETF. How should we think about this? You could argue that by June 2020, equity markets appeared to believe a) governments would provide dramatic support for the global economy and b) an effective vaccine would emerge far faster than in the past – and that ultimately proved to be the case. Equity markets proved quite prescient.

So, the long-term perspective on geopolitical events and the more recent experience of COVID both argue for a swift recovery in equity markets, even ahead of improving fundamentals.

Alternative views: Inevitably, there are some different views on the current topic.

First, you might reasonably argue that equity markets don’t reflect the situation on the ground. The conflict continues at great human cost, and the possibility of a protracted struggle seems fairly high, even if the two sides continue to negotiate. That has been reflected, as we’ve noted before, in reduced expectations for growth and higher expectations for inflation in the Eurozone. The longer the conflict continues, goes this argument, the greater the impact on the European economy. And, even if we do see swift end to military conflict, the on-going sanctions against Russia have potential consequences that will only emerge over time.

Second, when we look back at the COVID experience, we see an unprecedented level of policy support delivered with unprecedented speed. That’s probably not going to be the case this time around. As we saw last week, Central bankers are feeling the pressure to tighten policy and Fed Chair Powell, in particular, was keen to say that the US economy is strong enough to tolerate higher interest rates. The Bank of England, as we noted last week, sent a slightly more reserved message (with one MPC member voting for no change), but it’s difficult to see how monetary authorities can provide too much support when inflation is the highest in a generation. The fixed income market expects another 6 (or more) rate hikes in the US over the next twelve months – if that proves to be correct (and we don’t think it’s likely), we’d guess that US growth expectations will come down.

Where does this get us? The turnaround in European equities has been swift, and highlights again the challenge of trying to time markets. But we remain wary of looking too closely at the COVID experience as a guide. We think that the policy environment is different from what we saw in the early days of the pandemic – and we won’t see the same level of support, given the economic recovery we’ve seen and the current level of inflation. We think that means we could see higher volatility going forward than we’ve seen over the past year or so. That argues for slightly more conservative positioning than we’ve had over the past eighteen months or so, with a broad range of risk exposures, but as we’ve seen over the past week or so, exiting markets entirely can be a risky proposition.