With Covid-19 still rampant across Europe (and, indeed, the world), many countries are in the midst of another lockdown to slow down the spread as we await the impact of the vaccines. The UK locked down for a third time earlier this month, with Boris Johnson announcing a stay-at-home message that extends until at least the start of February.

Covid-19 and the measures taken to fight it have affected just about every aspect of our lives. Most of the world is in varying degrees of lockdown and we’re all finding our habits changing as we adapt to the ‘new normal’. We examined how people’s spending habits changed over the course of 2020, with different schedules, priorities and circumstances all making a difference.

Saving outweighs spending

With the help of Opinium, we conducted a nationwide survey of people’s saving and spending habits during the first Covid-19 lockdown. Across 2,000 UK adults, we built a picture of how stay-at-home laws and temporary closures of businesses affected spending across the country.

For those fortunate enough to see no significant change to their incomes during the lockdown, the period actually became an opportunity to save. Limited spending options and more time at home meant that, for a lot of people, monthly outgoings were heavily reduced. Nearly a third of those we surveyed were able to put away more money than usual during the lockdown months, compared with just 19% that saw their saving take a hit.

Our goals have changed

This circumstantial change in spending habits has happened alongside a shift in priorities. Covid-19 has affected just about every area of our lives, from how we interact with our loved ones to how we shop. It is also, it seems, impacting how we view the future, at least in the short to medium term.

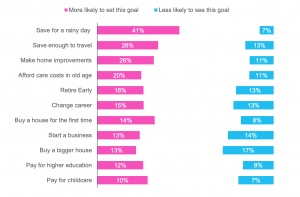

Our research found that people in the UK are putting a much greater emphasis on saving and security than they are on major life changes or landmark purchases. The clearest shift in behaviour is towards ‘saving for a rainy day’. An overwhelming 41% of people said that they’re now more likely to set emergency savings as a goal, with only 7% less likely.

Other reasons to put away money that have soared in popularity are ‘saving enough to travel’ and ‘making home improvements’ – it’s not difficult to see why one might be more inclined to make their home more comfortable, or why you might be keen to spend more on travelling post-pandemic.

Compare these with the number of people saying they are now less likely to be saving for a bigger house, or to start a new business, and you build a picture of changing priorities in a time of instability. People are, it seems, seeking greater stability as the world outside becomes more difficult to predict.

How to approach a second lockdown

So, with millions of us set to go back into a second lockdown that will last for at least a month, how can we be sure we’re using our money right? If we’re saving on travel and leisure costs, it’s only right that something good comes from it – here are our top three tips for making lockdown work for you.

Put money away

As we’ve seen, time spent at home means lower spending for a lot of people. If you’re fortunate enough to be one of them, now could be a perfect time to put money away for the future. Whether you’re new to long-term saving or you just want to up your contributions during the lockdown, now is the time to get any spare cash working for you.

Take time to set or adjust your goals

For a lot of us, long-term finances are, understandably, a bit of an afterthought. During the first lockdown, we encouraged people to take time to think about them, adjusting financial goals and setting new ones accordingly. With clear goals laid out, investing for the future becomes a lot less daunting and a lot more manageable. We’re all going to need activities to keep ourselves busy as we stay at home, so why not make them beneficial to your long term future?

Make sure your investments are working

Part of taking the time to assess your finances is analysing whether or not your existing investments are performing as they should be. For those who prefer to have experts manage their investments, it’s easy to assume that performance is taken care of, but that’s not always the case. Take time to do some research, look at the performance of your assets relative to the performance of other wealth managers and consider switching if they’re not up to scratch.

Similarly, if you use the opportunity to plan for your long-term future, take a look at Moneyfarm’s retirement calculator. By putting in some simple information, you can see how much you should be saving each month to reach your long-term goals, which is a big part of making and adjusting plans going forward.

Thinking both short term and long term

While you’re taking the time to think about your finances, both in the short and long term, it’s worth keeping one eye on the calendar. As we enter the last couple of months of 2020, the financial world is already gearing up for the end of the tax year in April – you should be too.

The close of the tax year is when personal investment allowances are reset. The ISA allowance of £20,000, for example, operates on a ‘use it or lose it’ basis, meaning there’s no rollover into the next tax year if you don’t make full use of yours. Every year, we’re taken by surprise as the end of the tax year creeps upon us – with a November lockdown in place, now is a great time to get your finances in order ahead of the busy financial period.

Of course, not all of us will have the time to get our finances in order over lockdown. Many will still be working, looking after children, or simply relaxing to get through what can be a difficult time. If you do find the time, though, grappling with your finances can go a long way to making for a more secure financial situation going forward. Either way, we hope you stay safe and happy during the coming month.