In this article, we’ll try to answer this key question by analysing a multi-asset approach to portfolio diversification and its advantages.

2022 was the fifth year since 1929 in which the correlation between stocks and bonds led major indices of both these asset classes into negative territory. This led many investors to wonder: does it still make sense to talk about multi-asset portfolios with both equity and bond components?

You may have also heard an expert, or someone claiming to be one, saying that investing your entire wealth in a single stock index (e.g. the S&P 500) is the key to investment success. Buy stocks, set them aside and enjoy the returns.

Unfortunately, the story is a bit more complicated: this type of advice does not take into account the fact that each of us has a different risk tolerance. The goal of investing is not to maximise returns in absolute terms, but to maintain a level of volatility that is desirable for the investor. For most people, this means finding a way to limit the portfolio’s level of risk while minimising the potential return as little as possible.

At Moneyfarm, the strategy we use to control risk in portfolios is diversification. Diversification means spreading your investment across a wide range of assets. This approach brings several crucial advantages:

In a well-diversified portfolio, extreme and episodic performances cancel each other out, providing a more predictable (median) result for the investment.

Not only that but diversification allows for the modification of expected volatility by increasing or decreasing the percentage of riskier investments.

Finally, by carefully calibrating the correlations between various asset classes, we can better protect against protection can be obtained in case of extreme market conditions situations.

Multi-asset exposure pays off

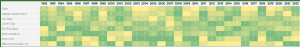

When we look at the historical performance of different asset classes, the advantages of a broad multi-asset exposure become evident. As shown in the table, if we classify the annual performance (since 1992, in USD) of each asset class, there is no clear winner every year.

For example, stocks and bonds are historically characterised by a negative correlation. This means that in periods when stocks tend to perform better, on average, bonds perform worse. The bond asset class also has historically lower volatility than stocks. This allows for risk modulation in portfolios, offsetting the volatility of stocks with the bond component.

Diversification in our portfolios does not stop at this level. We also diversify the bond and equity components according to geography, risk segments, currencies, and other factors. We also add other asset classes such as commodities or credit. Furthermore, we rebalance the portfolios daily to ensure that the asset allocation remains optimal and does not change over time as a result of varying different performances.

But let’s go back to the initial question. Does a multi-asset portfolio still make sense today? For us, the answer is yes. In 2022, both stocks and bonds declined, which is historically very rare. The main cause was inflation. When inflation is too high, central banks react quickly to increase interest rates, and sometimes this reverses the correlation between stocks and fixed income.

Our expectation is a normalisation of the correlation between stocks and bonds in line with historical data. Furthermore, after over a decade in which it has contributed modestly to performance, the bond component of the portfolio now has rather high expected returns compared to recent history, and we believe this will benefit investors across the risk spectrum.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.