As a new tax year approaches, many investors naturally focus on where to allocate their capital next. While timing markets and chasing recent winners can be tempting, long-term wealth creation depends on something far more durable: the ability to perform across different market regimes.

Periods of expansion, inflation shocks, monetary tightening, market corrections, and recovery phases all test investment strategies in different ways. A trusted investment partner is not defined by performance in a single year, but by discipline, diversification, and resilience across cycles.

At Moneyfarm, our approach is built around this principle – constructing portfolios designed to deliver consistent outcomes through changing market conditions, helping investors pursue both short- and long-term goals with confidence.

Building portfolios designed for different market environments

Market leadership changes over time. Asset classes that outperform in one cycle may lag in another. This is why diversification, cost discipline, and active portfolio oversight remain central to our investment philosophy.

Our portfolios are designed to support investors at every stage of their financial journey through:

Tax-efficient investing – portfolios can be held in wrappers such as Stocks and Shares ISAs, Junior ISAs, Cash ISAs, and SIPPs;

Diversified portfolio construction – allocations built to manage risk across equities, fixed income, and other asset classes;

Flexible account structures – including General Investment Accounts and combinations of tax wrappers;

DIY investment capabilities – access to a broad and growing investment universe;

Human expertise alongside technology – investment professionals available to support decision-making when needed.

Rather than attempting to predict short-term market movements, our focus remains on portfolio durability across economic cycles.

Measuring performance across market regimes

Evaluating investment performance requires independent, cycle-aware benchmarking. This is why we work with Asset Risk Consultants (ARC), a specialist in portfolio performance analysis that provides independent and unbiased comparative data.

ARC benchmarks allow us to assess how portfolios perform relative to peers across multi-year periods that include both favourable and challenging market conditions.

While past performance is not a reliable indicator of future results, longer-term data can provide insight into how investment strategies behave through different environments.

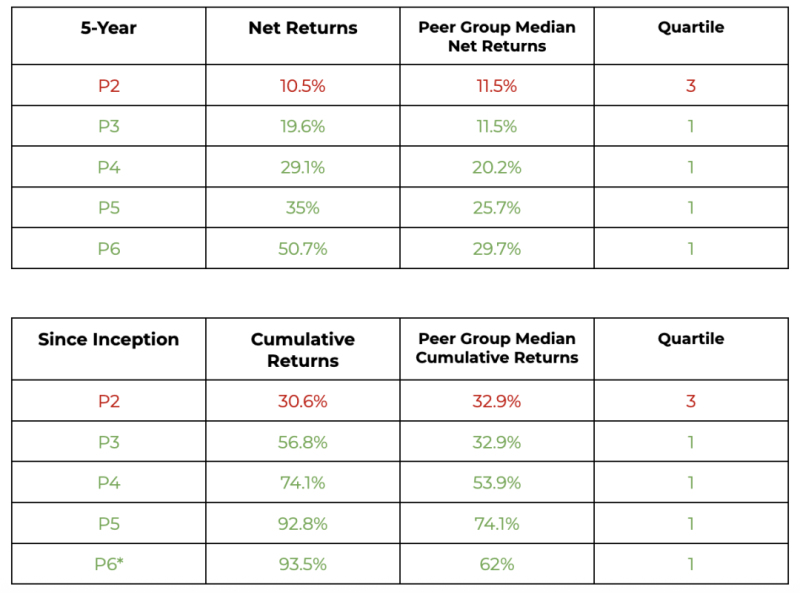

Our latest figures from ARC as of December 2025

These results reflect portfolio behaviour across a period that included pandemic-driven market volatility, rapid interest-rate increases, inflation shocks, equity market recoveries, shifting bond market dynamics.

Performance across such varied conditions highlights the importance of maintaining a disciplined investment process rather than reacting to short-term headlines.

Growth built on discipline, not market timing

Consistency in investment outcomes is supported not only by portfolio construction, but also by organisational strength and long-term commitment to investors.

Today, Moneyfarm serves more than 170,000 investors across Europe and manages £6.3 billion in assets. Between 2019 and 2022, net revenues grew by 176.9%, driven by investors seeking structured, long-term approaches to wealth management rather than short-term speculation.

Recent recognitions in 2026 include: Best Investment ISA (medium portfolio) & Best ESG Investment Platform by YourMoney.com Investment Awards; Best for Ready-made Solutions, Best for Low-cost ISA Funds & Shares, Best for Low-cost Advice by Boring Money Awards; Digital Wealth Management Provider of the Year by Moneyfacts Consumer Awards.

These milestones reflect continued investment in portfolio design, client experience, and financial guidance.

Strengthening investment solutions for long-term investors

Over the past year, we have introduced new products and services aimed at supporting investors in making informed financial decisions. These include:

Cash ISA, which provides easy access to your money with a competitive interest rate.

All equities portfolio, catering to investors focused on long-term growth and comfortable with market fluctuations.

Liquidity+ money market investment solution, providing options for managing cash reserves efficiently.

DIY Investing platform, offering direct access to over 2,400 financial securities for self-directed investors. Now able to trade directly in US and European shares along with a range of ETFs, Bonds and more specific mutual funds.

Guidance+ offering cashflow scenario analysis. This service provides clients with analysis of their current investments, providing insights into how they are tracking towards achieving their goals and giving guidance which gives clarity to their specific situation.

New Pension Administrator: We are in the process of moving pension administrators; something we are very excited about. This will mean greater flexibility for our clients, something which is very welcome in the complicated and daunting process of retirement.

Each of these developments is part of a broader objective: helping investors remain invested, informed, and confident across market cycles.

Looking ahead

Markets will continue to evolve, and new regimes will inevitably emerge. What remains constant is the importance of diversification, long-term thinking, and disciplined portfolio management.

Our focus remains on supporting investors through changing conditions – not just during strong markets, but throughout entire investment cycles.

Because ultimately, investment success should be judged not by isolated periods of outperformance, but by the ability to deliver consistently across time.

By making an investment, your capital is at risk. The value of your Moneyfarm investment depends on market fluctuations outside of our control and you may get back less than you invest. Past performance is no indicator of future performance. The tax treatment of a Moneyfarm Stocks and Shares ISA and a Moneyfarm Pension depends on your individual circumstances and may be subject to change in the future. You should seek financial advice if you are unsure about investing.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.