Throughout 2020, countries across the world have been in various stages of lockdown as part of the fight against Covid-19. It’s affected all of us in myriad ways, from the way we socialise to the way we work.

One area that’s seen significant change for a lot of people is their finances, with many seeing both their income and their outgoings go down to varying degrees. Part of this has been due to changes in spending habits, with lockdown shuffling our priorities and closing off opportunities for more frivolous spending.

To get an idea of just how big a change we’ve seen to our spending habits over lockdown, we asked 2,000 UK adults about everything from their utility bills to their savings. With another lockdown just beginning in the UK and the potential for more down the line, it’s worth examining how your spending habits have changed and thinking about how you can benefit.

We’re spending more on utilities

Probably the most predictable habit to change has been the amount we spend on utilities and groceries to support ourselves at home. Sitting in a heated or air-conditioned office is something a lot of us took for granted – having to regulate your own home can be expensive when it’s all day, every day.

Over the period of the first UK lockdown, 28% of people said that they’d spent more on utilities, while an overwhelming 74% said they were spending more on groceries. Those free office snacks and coffees can make a difference, while grabbing some food on the go might not be factored into a lot of people’s grocery budgets.

Importantly, if you’re self-employed, you can claim living costs as part of your business expenses. This primarily applies to utility bills, but it can make a real difference at the end of the tax year and is something any self-employed people who largely work from home should look into.

We’re saving more

One aspect of being home more is that we’re spending less on leisure activities – while this may be a financial positive, we’d be reluctant to label it a ‘good thing’. The reality, though, is that we simply have fewer outgoings during periods of lockdown than we ordinarily do.

For most of us, even if we spend more on utilities and on stocking the fridge, the savings made by not going out with friends or going on holiday are significant enough to be an overall positive for our balance sheets. Around three in 10 (29%) of those we asked said they were able to save more over lockdown, of which over half (54%) expect to be able to keep up this level of saving.

The key for savers is finding smart ways of using that extra cash. Our research found that Brits were slightly more proactive with their investment accounts during the first lockdown, a trend we expect to see continue into the current one. An increase in disposable income can mean an increase in contributions to savings accounts, a sensible step to take during a period of high uncertainty.

See how you could use the lockdown as a period for financial fine-tuning.

Our leisure spending has changed

Another key feature of lockdown has been the restrictions on personal travel. Stay-at-home orders and international travel bans have meant that, for most of us, we’ve been spending much less time out of the house than we would have under normal circumstances.

This has led to a surge in spending on home entertainment. Games consoles have been difficult to get your hands on and Netflix added a record 15.77 million new paid subscribers to the platform in the first quarter of 2020, according to MarketWatch. Our report found that, of the 2,000 UK adults we surveyed, 31% spent more on media and entertainment over the first lockdown.

This has coincided with a severe drop in the amount of money spent on travel during the lockdown period. With the likes of Ryanair dealing with refund logs that stretched for months and UK rail travel down 92% year-on-year for the period of April to June, the amount the UK population is spending on travel has plummeted. Couple this with a lot of people saving on their commutes into work – an average of just over £66 a month for UK workers – and the overall cost of getting around has been slashed.

Our priorities are shifting

One side effect of the uncertainty caused by Covid-19 has been that a lot of people are thinking more about financial security. With no clear end to the pandemic in sight and difficulties arising in the job market, having a rainy day fund has never been more important.

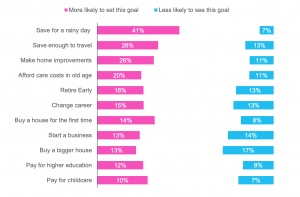

This is reflected in our findings below. Of the UK adults we asked, 41% said they were more likely to set saving for a rainy day as a financial goal. By contrast, starting a business and buying a bigger house are the two areas that actually became less popular as goals across the course of the pandemic.

It’s unsurprising that, in times of uncertainty, more ambitious plans like upsizing your home or starting your business venture are put on the back burner. It’s important to point out that over a quarter (27%) of the people we spoke to expect their financial situation to be worse in 2021.

It’s more important than ever that people are smart with their money and make sure they have that all-important ‘rainy day’ fund in place, with smart investments in place for a more secure long term future.