By Moneyfarm’s Chief Investment Officer, Richard Flax

Every August the Federal Reserve Bank of Kansas City hosts an economic symposium in Jackson Hole, Wyoming. It’s an idyllic location. So idyllic, in fact, that the Kansas City Fed makes it a point to mention that the event facilities themselves are quite austere, still open to the public, and do not include a spa. Over the years, the symposium, and particularly the keynote speech from the Federal Reserve Chair, have gained increasing attention from investors looking for guidance on the outlook for monetary policy. This year was no exception.

In the end, Chair Powell gave the speech you might expect from a responsible Central Banker. He acknowledged progress on bringing down inflation, stressed that the battle hadn’t yet been won, and highlighted that we’ll need to see weaker growth for some time to get inflation back towards 2%.

If Powells goal was to show that the Fed is committed to low inflation without surprising anyone too much, it’s probably fair to call the speech a success. Analysts viewed the message as “hawkish” – even if government bond yields didn’t move particularly sharply. Market expectations for the first Fed cut moved a little bit further out, but also not dramatically so (currently the first cut is expected in the middle of 2024)(1).

The Jackson Hole Symposium came against a backdrop of stronger-than-expected US economic growth so far in 2023. But the most recent data suggests that tighter monetary policy is beginning to have an effect. So far this year we’ve seen a divergence between services and manufacturing, with the service sector reporting fairly robust growth and manufacturing lagging. In the most recent releases, however, we’ve begun to see some signs of weakness in the service sector.

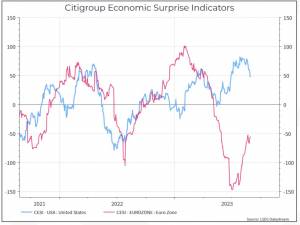

The chart below shows Economic Surprise Indicators for the US and the Eurozone. These look at aggregate macroeconomic data and compare the results with analysts’ forecasts. We can see here that after a period of better than expected data, the US indicator is weakening a bit. The Eurozone, in contrast, has been through a period of much worse than expected data, but that’s gradually normalising.

Powell also stressed that the Fed would be data dependent – adjusting monetary policy to reflect the latest data and the Fed’s outlook (2). At first glance this seems to make sense – who wouldn’t consider the latest data? But it does raise some questions. First, we know that monetary policy operates with “long and variable lags” – which is another way of saying that you know it’ll have an impact, you just don’t know how big an impact and when it’ll occur. That should make Central Bankers wary about ascribing too much significance to a specific data point. In an ideal world, Central Bankers would have a strong model about how the economy works, and could use that to calibrate policy even before seeing the data. Unfortunately, we don’t live in that world. Being “data dependent” might not be ideal, but it’s probably the only option given the limitations of economic forecasting.

The Jackson Hole symposium is much more than just the Fed Chairs speech. The speech from ECB President, Christine Lagarde, was probably more interesting in terms of highlighting the challenges that policymakers will continue to face going forward as they try to assess a broad range of issues including near-shoring, the green transition and the digital transition. Unsurprisingly, precise answers to these questions were hard to come by.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

Sources:

(1) “Getting inflation sustainably back down to 2 percent is expected to require a period of below-trend economic growth as well as some softening in labor market conditions”.

(2) “At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.