A few months ago, we cautiously commented on the extraordinary performance of European equities. The stock market in the old continent had indeed outperformed other major geographies decisively. However, in our view, the economic and geopolitical risks that remained in the background still suggested caution when investing heavily in this asset class. Starting in June, the trend seems to have reversed, with European stocks losing ground compared to other developed geographies (-6.4% compared to the USA and -10.9% against Japan as of September 8). In this article, we will attempt to analyse the factors influencing the performance of European equities to understand what the prospects for this asset class might be going forward.

Challenges and risk factors

We believe that European equities are currently facing numerous challenges that have weighed on their performance in recent months. Let’s start with the most pressing geopolitical issue: the war in Ukraine and Europe’s energy dependence on Russian imports.

The war in Ukraine does not appear to be nearing a conclusion, and Europe has not yet found reliable and cost-effective alternatives to Russian energy imports (investing substantial resources in debt to mitigate the burden on businesses and consumers). This situation creates a series of potential problems, especially with winter approaching. Even though the situation on the conflict front currently seems “stable,” Europe must confront the possibility of disruptions in energy supply, which could have serious consequences for the economic stability of the region.

Another significant challenge is represented by the economic crisis in China. The Asian country is facing a slow post-Covid reopening and a real estate crisis that is causing difficulties in the sector. This situation has a direct impact on the prospects of many European companies that rely heavily on Chinese demand. Key sectors for the composition of European indices, such as luxury goods and automotive, which are already feeling the effects of the economic slowdown, could suffer if China fails to revive its economy in a timely manner.

In the background, there is an economic situation that is slowing down more quickly than in the United States. European macroeconomic data has consistently disappointed expectations in recent months. The chart shows the economic surprise index, which compares published macroeconomic data with expectations. As we can see, this data, which is a fairly reliable indicator of earnings direction, is at its lowest compared to the average of the last 10 years (which is slightly positive at 5.8) and well below the results of emerging markets and the United States.

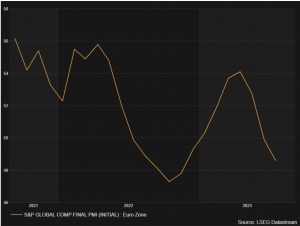

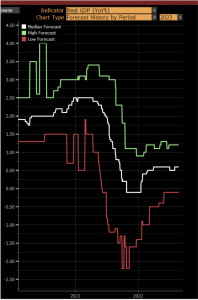

Looking at more current data representing the present, the Manufacturing Purchasing Managers’ Index (PMI) shown in the chart has fallen below 50, indicating negative territory. Although GDP growth expectations (shown in the second chart) for 2023 remain slightly positive, it is clear that there are many uncertainties.

Furthermore, inflation has proven to be more resilient than expected, making an immediate change in course by the European Central Bank (ECB) unlikely. This implies that the coming months could be challenging for this asset class, and the ECB will need to carefully balance inflationary pressures with the need to support economic growth.

A final consideration needs to be made regarding the sectoral composition of European indices. In recent weeks, European equities have been able to benefit to a more limited extent from the boom in the technology sector and growth companies in general. This is a potential diversification element that can be useful when entering a cyclically adverse phase, as demonstrated by the performance of American stocks.

Opportunities for European Equities

Despite these challenges, we believe there are still reasons to be optimistic about this asset class, especially when looking at the medium and long term.

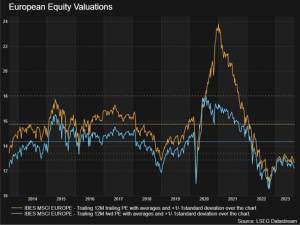

One of the strengths of European equities lies in their attractive valuations. European stocks are trading at prices that suggest many of the mentioned concerns may already be priced in. Current and expected price-to-earnings (PE) ratios are currently below the 10-year average by more than 1 standard deviation.

Earnings and earnings expectations have proven surprisingly resilient despite adverse macroeconomic data. This suggests that the markets may have already discounted the expected economic slowdown in the coming months. At the end of last year, one-year earnings expectations for European companies grew significantly, even surpassing those of their U.S. counterparts. Twelve-month earnings (both past and prospective, as shown in the second chart) also exhibit an upward trend since China reopened, while U.S. data is still recovering from mid-2022. Profit margins show a similar situation, although American companies remain more profitable.

In conclusion, European equities are currently facing significant challenges. While the geopolitical and economic context remains uncertain, attractive valuations and strong corporate earnings results suggest that long-term investment opportunities may emerge. We maintain our cautious stance on this asset class, which we adopted last year. We believe that, with a medium-term perspective, this component can contribute within a diversified strategy. Continuous attention to geopolitical and economic developments remains crucial for making informed investment decisions in this region. In a world characterized by complexity and rapid changes, prudence and flexibility are the keys to investment success.

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.