Why invest in ETFs?

Exchange Traded Funds (ETFs) bundle together selected securities, such as stocks, bonds or commodities, and are bought and sold in stock exchanges at a price determined by the market, just like ordinary shares. Typically, the goal of an ETF is to track the performance of a market index, such as the FTSE 100 or S&P 500. ETFs are created by asset management firms and are available for purchase at brokerage firms or through independent investment companies such as Moneyfarm.

ETFs are a great investment option for those investors who look to spread risk across different assets classes and geographical regions. There has been significant growth in ETFs popularity over the recent years, especially within the retail investor community. ETFs offer a number of key benefits relative to mutual funds or single stocks:

- Efficiency and access – ETFs are listed on stock exchanges and are traded in the same way as an ordinary stock, it is easy for retail investors to adjust their investment.

- Cost effectiveness – ETFs often have lower costs than other types of investment funds. More significantly for UK investors, ETF’s also offer tax advantages over other types of fund as it is free from Stamp Duty charges.

- Diversification – ETFs provide access to a wide range of investment options, covering a broad range of asset classes, sectors and geographies. This can help investors to spread risk and reach an optimum balance of risk and return.

- Transparency – ETFs provide investors daily visibility as to what securities the fund holds, how it is performing and how much it is costing.

- Liquidity – For asset classes such as corporate bonds, which trade over-the-counter (OTC) rather than on an exchange, the growth of it’s ETF market has increased the trading volume and improved the liquidity condition of these markets.

The story so far in 2016

The price of an ETF is usually aligned with the collective price of the its underlying securities, therefore the performance of the ETF generally reflects the relevant market it is tracking.

Equity Market

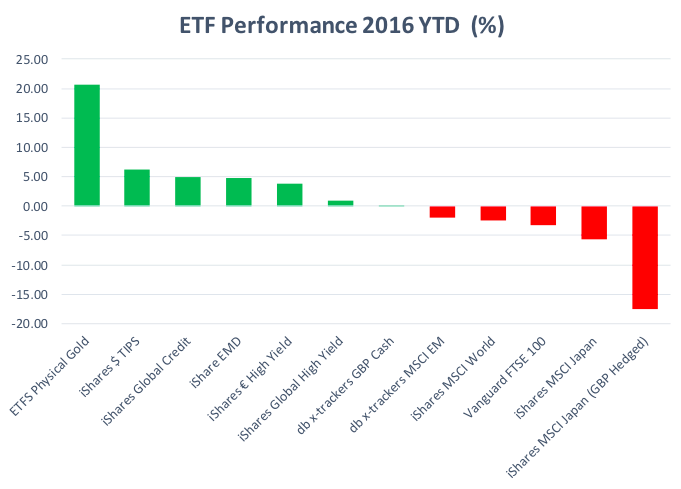

Global equity markets have had a disappointing start of the year with all major equity ETFs showing negative year-to-date performance. In the developed market space, we have seen some dramatic downward price movements, notably in European and Japanese markets, due to weak oil prices and sluggish global growth prospects.

On the other hand, emerging market equities appear to be more resilient with a loss of less than 2% so far. More recently equities have recovered some earlier losses thanks to the prospect of more quantitative easing by the European Central Bank (ECB) next month.

It is important to note the effect of currency risk on ETF performance. As shown in the chart, there is a significant difference in performance between the Japan equity ETF (-5.6%) and its currency hedged version (-17.5%) due to the drastic depreciation of the Pound against Yen this year. Investors with exposure to non-base currency market are not only subject to asset prices movement, but also the currency risk embedded in the ETF.

Global government bond

Government bonds (particularly in the US and Germany) are generating some sizable gains, reflecting strong demand for safe assets by global investors during a turbulent market. The year-to-date performance of the US Treasury ETF is currently at a gain of 6.2%. Emerging market government bonds are also showing positive performance, mainly due to the effect of depreciating of sterling against emerging market currencies.

Investment grade corporate bond and High Yield Bond

These assets have proven to be more resilient as global investors’ demand for high quality fixed income assets continues to grow amid weak equity performance and the relatively attractive valuation of high yield bonds. The positive year-to-date performance of the ETFs are also a result of the favourable currency movement from a Sterling investor prospective (depreciating vs USD and EUR).

Gold

Gold ETF is the best performing ETF so far this year with a year-to-date performance of 20% from Sterling investors’ prospective. This is largely due to the overall high volatility in the markets pushing investors to seek a safe haven for their money. If equity markets recover in the near futures and market volatility dials down, we are likely to see this gain on Gold ETF to reverse.