By Michele Morra, Moneyfarm Portfolio Manager

Data and investor preferences refute pessimism

As with all investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. You should seek financial advice if you are unsure about investing. The views expressed here should not be taken as a recommendation, advice or forecast.

Many people have discussed the declining enthusiasm for ESG investment over the last two years, but we find it unjustified, from both quantitative and qualitative perspectives.

Although not quite at the exponential rates seen in 2020/21, the ESG world has continued to grow in terms of assets. Globally, in 2023, the percentage of ESG ETFs stood at around 7.4% of total assets, compared to 7.2% in 2022, for a total amount of $600 billion compared to approximately $100 billion in 2019 (+500%).

Data on Moneyfarm’s client preferences confirm this trend. Assets invested in ESG portfolios in 2023 grew by +30% compared to 2022, and ESG portfolios opened in 2023 accounted for 37% of the total (compared to 35% in 2022).

From a qualitative perspective, criticisms of ESG investments have led to a significant evolution in investment strategies and changes to the regulatory landscape that investors can leverage to improve their ESG investments both financially and sustainably.

In 2024, the dynamics of interest rates could create a favourable environment for this type of investment, which generally benefits more when monetary policy is loosened.

“The past two years have highlighted the limits, bright spots and dark corners of responsible investments, creating the perception of a diminishing enthusiasm for the world of ESG. Furthermore, some investors have begun to question the merit of the environmental and social responsibility of their investments, spurred by the extraordinary performance of the fossil fuel industry and the anti-ESG movement in the US, which has even influenced some global investment giants. In my opinion, these doubts are also fueled by the excessive media exposure of an ecosystem that was not yet, and I would say inevitably, mature from a regulatory and technical standpoint.

The truth is that the ESG world has continued to grow and evolve, and despite a slowdown compared to the pace of 2020/21, it has still attracted investors’ interest. Bloomberg data indeed show that globally, assets invested in ESG ETFs increased from 7.2% at the end of 2022 to 7.4% at the end of 2023, totalling $600 billion in assets in 2023 compared to approximately $100 billion in 2019. So, yes, there has been a slowdown, but certainly not a reversal.

Moneyfarm client data preferences confirm this trend. From our latest survey, it emerged that assets invested in ESG portfolios in 2023 saw a growth of +30% compared to 2022, reaching 16% of the total. Since the launch of socially responsible portfolios in the second half of 2021 until now, they have continued to grow at double digits, demonstrating that for Moneyfarm’s clients, this type of investment is not a passing trend but an opportunity to seek long-term returns, considering their sustainability preferences. Additionally, ESG portfolios opened on Moneyfarm in 2023 accounted for 37% of the total, increasing compared to 2022 (35%), further confirming that we do not observe any signs of investors’ enthusiasm diminishing.

From a demographic perspective, it is interesting to note a significantly higher interest in socially responsible investments among our female clients: in the UK, 22% of women have opened at least one ESG portfolio today, compared to 16% of men. However, when we look at ESG adoption data according to age, we can see that the youngest cohort, Gen Z (those 28 and below) show the most interest, accounting for 25% of Moneyfarm ESG clients. The next-highest group of ESG adaptors was Millennials at 18%, and the trend continues throughout the age groups until we see the lowest adoption rate of 12.5% for clients aged 77 and above.

A qualitative evolution as well as a quantitative one

In addition to these quantitative considerations, there is the qualitative evolution of the ESG landscape, which has continued to progress with an active and critical approach on various fronts. From a regulatory standpoint, especially in Europe, practical solutions have been sought to address issues such as the lack of data, the absence of uniformity in investment techniques, or greenwashing. For example, to extend sustainability reporting obligations to as many companies as possible, starting from 2025, the number of companies subject to the CSRD (Corporate Sustainability Reporting Directive) regulation will be progressively expanded. In parallel, the scope of activities regulated by the European Taxonomy is also expanding, aiming to standardise definitions of sustainable environmental activities. Additionally, to counter greenwashing, with the entry into force of the SFDR (Sustainability Financial Disclosure Regulation), efforts have begun to standardise definitions of ESG investment, providing investors with greater transparency regarding the type of strategy adopted by the manager.

It’s important to note that investment techniques have also made significant strides, with the launch of innovative strategies focused on asset classes that were previously overlooked, such as government bonds. For managers, it remains crucial to constantly update portfolios with the latest available ESG techniques in the market: in 2023, for example, in response to the expansion of the offering and improvement in the quality of ETFs on thematic bonds.

Performance yes, but socially responsible performance

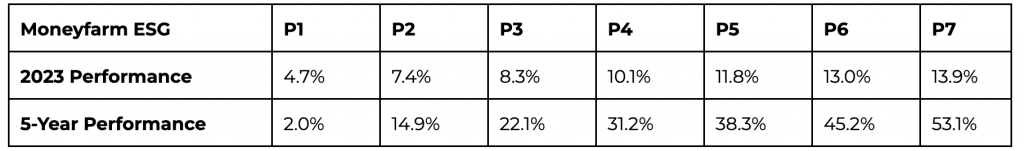

From a performance perspective, in 2023 Moneyfarm’s ESG model portfolios generated returns ranging from 4.7% to 13.9%, depending on the risk level, without significantly deviating from the performance of traditional portfolios (see table below). The ESG ETFs we use to invest in the S&P 500 have outperformed the generic index, while for other regions, such as Emerging Markets, the equity performance, although positive, has been lower than the traditional counterpart. But beyond the fluctuations that occur within a single year, primarily driven by contingent factors, investors should focus on the long-term prospects of this type of investment and meeting their own sustainability requirements.

Performance of the model portfolio as of 31/12/2023. The 5-year performance of the portfolio was simulated prior to the launch date on 01/10/2021. The data is presented for illustrative purposes only, and past performance is not a reliable indicator of future results. All data provided shows gross returns.

However, looking ahead to 2024, it is true that a potential escalation of geopolitical risks could impact the energy market and therefore favour sectors and commodities excluded from some socially responsible investments. But it is also true that the dynamics of interest rates can create a favourable environment for this type of investment, which tends to suffer greater losses compared to general indices when rates rise, but generally benefits more when monetary policy loosens.”

Michele Morra: Michele Morra is a Senior Portfolio Manager and Head of ESG Investments at Moneyfarm. He is a member of the Investment Committee and teaches the ESG Investing seminar at the University of Milano-Bicocca. He holds a Master’s degree in Quantitative Finance from the University of Milano-Bicocca and a Master’s degree in Data Analytics from Queen Mary University of London, with a thesis on derivatives pricing and deep learning.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.