What are we talking about? In a difficult environment value stocks have outperformed. It’s been a long time coming. But we wanted to dig into this a little bit more.

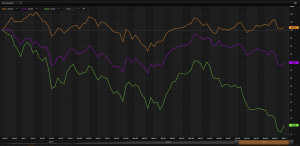

First some context: The first chart shows the performance of three ETFs year-to-date. The top line is a global value ETF, the middle line represents a Developed Market equity ETF and the bottom line shows the Nasdaq. Global value is still in positive territory year-to-date, in contrast to the more growth-oriented parts of the market.

We should highlight, of course, that if you look at the same ETFs over a five-year view, the lines are reversed – even accounting for the sharp sell-off in the Nasdaq.

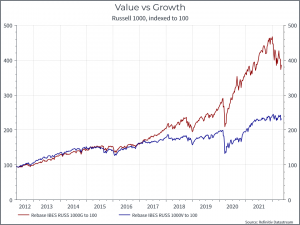

Let’s dig a bit deeper: For this comparison, we’ll use the Russell 1000 growth and value indices – representing relatively large-cap stocks in the US. The chart below shows 10-year relative performance.

This chart shows the forward P/E ratio for the two indices

And for sake of completeness, here’s the relative forward P/E of Growth compared to value (just growth P/E divided by the value P/E). We can see the sharp re-rating of growth stock valuations since 2016.

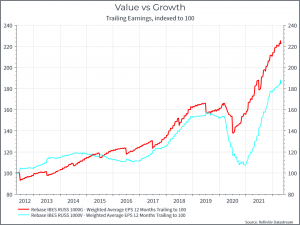

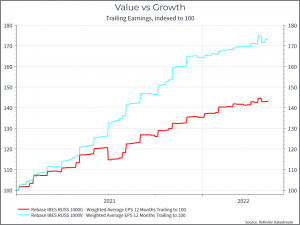

Finally, let’s look at earnings. The chart below shows trailing earnings for the two indices, indexed to 100. As you might expect, growth stocks have seen stronger earnings growth over the past 10 years – and we saw much more resilience during early 2020.

But if we look at a shorter time-horizon, the situation is a bit different. Since, the end of 2020, we’ve seen Russell 1000 Value earnings recover faster than for the Growth index, as earnings have normalised.

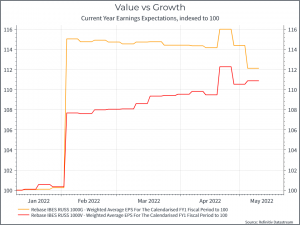

And finally, if we look at current year earnings expectations – we see that the expectations for growth stocks are still a bit higher, but the gap is closing as earnings expectations for growth stocks are revised down.

Where does this get us? It seems clear that the valuation gap between “growth” and “value” has begun to shrink, and that growth de-rating has been quite painful. But these charts suggest that it’s not just a valuation story. The earnings growth in “value” has proven quite robust over the past eighteen months and that, we’d argue, has provided some support.