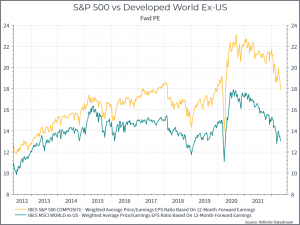

What are we talking about? Equity valuations have de-rated over the past few months, but US equities still trade at a premium relative to the rest of the world. The chart below illustrates the point: it shows the forward price/earnings ratio of the S&P 500 compared to the same metric for the rest of the Developed World. As we’ve noted before, Developed equities ex-US are below their long-term average forward P/E.

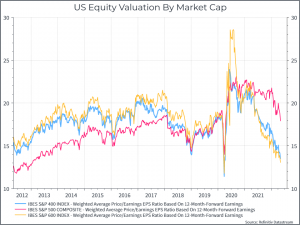

But this isn’t a regional difference, so much as a question of size. The chart below shows the forward P/E for the S&P 500 compared to a mid-cap index (S&P 400) and a small-cap index (S&P 600). The mid and small cap indices in the US are also trading below their long-term average valuations, while large-cap US stocks continue to trade at a premium.

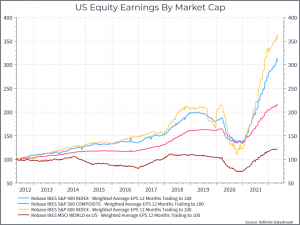

Let’s take a look at long-term earnings. The chart shows trailing twelve-month earnings for each of these indices (and a Developed Equities ex-US) going back a decade. US large caps have generated lower earnings than their smaller peers, at least on this data.

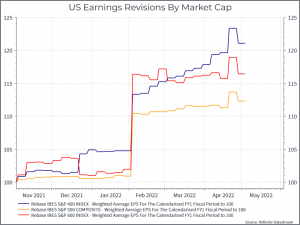

We could take a shorter-term perspective and look at current year earnings expectations. Here again, we see that US earnings remain pretty resilient – even if we might think there are some downside risks here. In any event, the mid / small cap universes continue to hold up pretty well, compared to their large cap peers.

Where does this get us? We often hear the US is highly rated compared to the rest of the world. That’s true for US large-caps, but doesn’t hold up when you go down into mid and small caps. Now, in the event of a growth slowdown, you might expect the earnings of smaller companies to suffer more – and that could explain some of the de-rating. But, from a long-term perspective, the valuation case for this part of the US equity market has improved.