What are we talking about? China Evergrande – a large and very indebted Chinese property company – has been causing worries in financial markets, with concerns that the business could collapse. The consensus view seems to be that the Chinese government is keen to teach property developers a lesson about excessive leverage but won’t permit Evergrandes problems to infect the financial system more broadly. And that seems like a reasonable conclusion, despite the significant challenges, given how much control the government can exercise over the banking system. Assuming that view is correct, there’s still an important question about how, and how quickly, China will grow in the future.

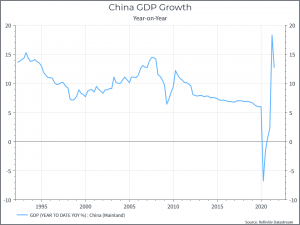

Chinese growth: Chinese GDP growth over the past thirty years has been impressive (as the chart below shows) and it’s been a real focus for the government. More recently, however, we’ve seen a shift in tone – with an increasingly emphasis on more sustainable growth, rather than the absolute level of growth. The government is paying more attention to inequality (encapsulated in the phrase “common prosperity”) and high debt levels in the Chinese economy, along with various social initiatives such as reducing video game use among teens.

What does it mean for the markets and the economy? Some of these measures have hit the Chinese equity market – notably among big technology platforms, casinos and for-profit education. And it seems clear that Chinese equities will be particularly impacted by policy measures, in what looks like a more active regime than perhaps we’ve seen previously. That might also be true for developed market equities, which have benefited from a range of policy measures, particularly since 2009.

On the macro side, the impact of all this (if it’s sustained) is likely to be slower headline Chinese growth than we’ve seen in the past and that has global implications. Between 2010 and 2019 it’s estimated that China accounted for around 1/3 of global growth, so it’s not a big leap to conclude that slower Chinese growth would mean slower global growth. As a starting point, slower global growth could negatively impact employment, income and corporate earnings.

But digging a bit deeper, you can argue that slower, more sustainable Chinese growth would be a positive for the global economy, particularly if you take the view that some of that historical growth was “forced” by excessive construction. That might have a negative impact in the construction sector

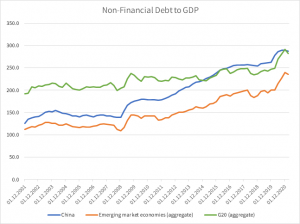

It also seems reasonable to argue that Chinese growth came at the expense of rising leverage. The chart below (from the BIS) shows non-financial debt to GDP for China, overall Emerging Markets and the G20. The increase in leverage in China stands out.

A slower growth environment could translate into less leverage, and a safer financial system. In a similar vein, if the focus shifts away from “growth at any cost”, we may see better capital discipline and potentially better profitability in China. The chart below suggests that the Return on Equity in China has been drifting down for some time. It’s a tricky point, because even if that’s true you can’t guarantee that shareholders will be able to realise those benefits.

Where does this get us? Today it looks like the Chinese government is moving towards a slower growth trajectory. In the short-term we can see the potential for challenges, as corporates and institutions in China react to this new, developing, paradigm. So you still need to accept the assumption that the government will be able to effectively manage that transition. But from a longer term perspective, we can see a number of positives for the global economy in terms of more sustainable and potentially more balanced growth.