As with all investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you are unsure investing is the right choice for you, please seek financial advice.

As we embark on a new tax year, Moneyfarm Investment Adviser Peter Rice outlines the key takeaway for savers and investors this tax year. Discover how you could boost your savings over the coming year as new rules announced by the Chancellor take effect.

Changes to tax allowances

As you may well already be aware, the final reduction in tax allowances set out in the 2022 autumn Budget has finally come into effect. Capital gains allowance has gone down from £6,000 to £3,000; dividends allowance from £1,000 to £500; but the Personal Savings Allowance (PSA) remains unchanged. Naturally this will have great consequences to any investment which sits outside a tax-wrapper.

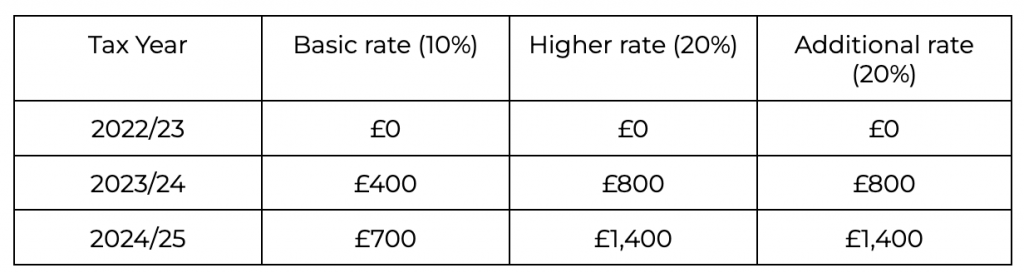

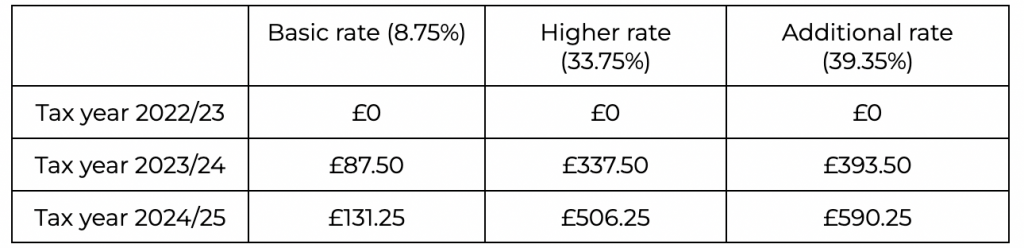

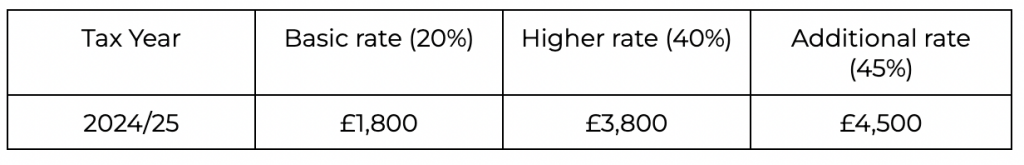

This is the second allowance cut in consecutive years, with the capital gains allowance being at its lowest point since 1982. As a result, the likelihood of surpassing the allowance threshold for both capital gains and dividends tax, and thereby incurring a tax liability, has significantly increased. Accordingly, it’s vital that tax-efficient vehicles are not forgotten about when organising your savings so that you can increase your financial well-being. To demonstrate what the new structure looks like in practice, a few hypothetical situations are set out below:

£10,000 incurred as a capital gain

£2,000 received in dividends

£10,000 earned as income through interest

A lot of my day to day involves speaking to clients regarding their Moneyfarm investments, yet on many occasions I’ve heard clients being surprised when HMRC have informed them that they owe tax on interest earned in savings accounts. Rates have been at historic lows for many years now, but the swift transition to a higher interest rate environment has tipped people over and above their PSA. The Financial Times reports that markets are now anticipating a reduction of 0.44 percentage points in 2024, down from 1.72 points at the start of the year. This reinforces the “higher rates for longer” narrative, prolonging the likelihood of sustained tax liabilities.

ISAs

Changes made to ISA rules for the current tax year should, in theory, follow the UK government’s aim in simplifying ISA rules. UK consumers are now able to subscribe to more than one of the same type of ISA in the same tax year. By way of example, that means someone can open two stocks and shares ISAs or two cash ISAs in the 2024/25 tax year. This opens the door to either capitalise on more generous rates of interest with alternative cash ISA providers, or being able to trial different types providers for stocks and shares ISAs.

Despite the main goal being to simplify the ISA set up, it may in actual fact lead to more complications for investors. Each investment service will carry a different fee structure, with varying costs including the management of assets, custody of assets, or trading fees to name but a few. Through investment consolidation there are of course many benefits.

- Reduced costs

Many providers will set their fee structure depending on the total amount invested with a given provider, usually rewarding those with a higher amount invested with a cheaper fee. If investments are spread amongst numerous providers then it may result in paying a higher percentage to a number of institutions.

2. Clarity on total fees paid

Knowing exactly what you are paying for each service becomes a lot easier to manage too. Due to subtle differences with each provider, it’s easy to lose track of where there’s an extra custody fee for your assets, whether there’s an exit cost if you decide to transfer before a certain time period, or anything else similar to this – especially if you’re investing with 3 or 4 providers. Understanding what the fees are under a clear and simple fee structure will hopefully help you manage investment expenses.

3. Streamlined reporting

Instead of sifting through many account documents in order to find the crucial bit of information you are looking for, having it all housed in one place will alleviate the administrative burden on your part, giving you greater peace of mind and saving a bit of time during the day.

But aside from greater choice for your ISA contributions, the ISA allowance remains frozen at £20,000 – an allowance which has remained the same since 2017. Adjusted for inflation using the Consumer Price Index (CPI), this would be equivalent to £25,740.95 in today’s terms. Taking into account the tax regime favouring cuts in the same timeframe, it’s crucial to maximise all tax-free savings at your disposal. Jeremy Hunt’s proposal in the spring Budget to introduce the British ISA, offering an additional £5,000 for investment in UK securities, might appear appealing at first glance. However, it has been met with much scepticism due to the comparative underperformance of UK equities against global peers and clear fiscal alternatives that would bolster investment in UK businesses.

The British ISA is still at the consultation stage with full details yet to emerge on what this will look like in practice, but rest assured that we will have a solution ready in place should it be launched.

Pensions

The biggest consideration regarding pensions in the new tax year is the abolishment of the lifetime allowance, meaning that there are no tax charges applicable to your pension above the previous allowance of £1,073,100 when taking benefits. Government’s main goal here, coupled with an increased pension allowance of £60,000 introduced in the previous tax year, is to get over 50s to return to the workforce. However, the maximum tax-free lump sum across all of your pensions is £268,275 with the rest being subject to your marginal tax rate at the point of drawdown (not considering previous lifetime allowance protections in place).

The other notable change concerns the death benefits of a pension. The Lump Sum and Death Benefit Allowance (LSDBA) concerns the maximum of tax-free benefits which can be paid out on an individual’s pension before marginal tax rate charges apply. The limit for this sits at £1,073,100, although it should be mentioned this may be higher if you already have lifetime allowance protection. There are a few different situations where this may arise and if you believe you may be affected then please get in touch with us.

Aside from the regulatory points raised above, the high-interest rate environment adds further food for thought for retirees. Quite commonly we will see those reaching minimum retirement age immediately wanting to access their 25% tax-free lump sum, with the frequent destination being a high interest bearing savings account. Keeping in mind that the Bank of England’s base rate is likely to stay higher for longer this will, in turn, push more people well over their PSA and diminish the attractiveness of rates offered by high street banks.

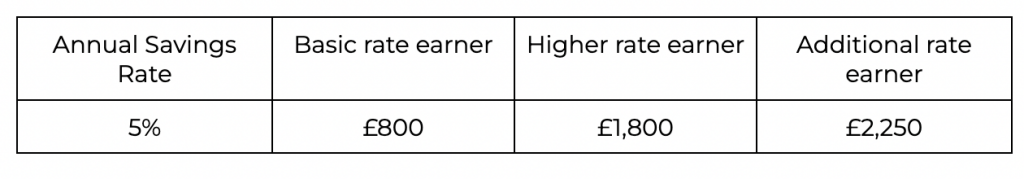

To illustrate this point, let’s consider a hypothetical example of someone drawing £100,000 as a tax-free lump sum. If they were to put this into an easy-access savings account earning 5%, the tax implications are as follows:

I do understand the sentiment of having ‘the money there ready should I need it’, but if the lump sum amount is not needed for many years to come then negative tax consequences may arise and you may miss out on years of positive market growth. The 25% tax-free is a defined percentage, so if in 5 years’ time the value of your pension has grown then a higher tax-free amount will be available to you when you do eventually need to draw from the pension. It’s crucial to keep in mind that a pension not only protects investors from paying taxes on capital gains, dividends, and interest earned along the way but also keeps these funds separate from an individual’s estate, thus exempting them from inheritance tax.

Peter Rice: Peter is an Investment Adviser at Moneyfarm having joined in October 2021 as a Junior Investment Consultant. Having held numerous client-facing roles over a span of many years, he currently helps customers achieve their financial goals, conducts portfolio reviews, and provides assistance in the creation of content pieces for the company. Peter holds the Investment Advice Diploma with the CISI, as well as an MA in International Business Management from Heriot-Watt University and a MSc in Finance from the University of Edinburgh.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.