Over the span of decades, fewer and fewer people have the luxury of having a defined benefit pension set up with their employer, whereby, upon retirement, an employee will receive a guaranteed income for the rest of their life. For the majority of people in the UK, the onus of preparing for one’s retirement is well and truly placed on the individual, which can make preparation for retirement a daunting task.

More often than not, it is easy to put off retirement savings in favour of more immediate life events, like purchasing the dream home, helping your children through university, or finally getting around to taking that trip around the world you’ve always talked about. I’m sure you’re all too familiar with phrases like “starting early is key” and “always make regular contributions”, but it is important to be aware of the potential risks which could hinder any financial freedom available to you later in life.

Having a realistic and well-defined plan will therefore be the cornerstone of any successful goal. Naturally, each person’s goal or desired retirement lifestyle is subjective and unique to each individual. One person’s reverie may be a quiet countryside abode, filled with time spent strolling the countryside; whilst alternatively, others could seek out numerous long-haul flights a year, sitting on white sandy beaches, and staying in 5-star hotels. Consequently, it’s imperative to cancel out the noise and focus on what matters most so that you can effectively plan ahead.

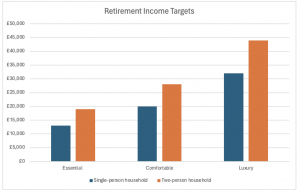

Income targets

The first thing to do is to understand what expenditures you expect once you retire. Some earmark two-thirds of your final salary as being a realistic figure to base your plans off, but fortunately market researcher Which? has set out some good initial targets to set yourself.

Source: Which? research based on responses from 5,231 retired and semi-retired Which? members as of March 2023.

Here an essential retirement lifestyle will cover basic needs like household-related payments like council tax and energy bills, as well as basic day-to-day spending habits; a comfortable retirement lifestyle will have the odd holiday abroad and more recreational activities added to this; whilst a luxury retirement lifestyle will cover things like private healthcare and exclusive club memberships.

This will invariably differ depending on the region where you live and unfortunately is not an exact science, but it will nonetheless act as a good starting point in mapping out any future plans.

The state pension

Despite rumours that the UK government will look to extend the state pension age to 71, the current age at which you can gain access to your state pension is 66 (although this is increasing to 67 between 2026 and 2028). At present the full state pension which someone can receive for the 2024-25 tax year is £11,502, or £221.20 a week.

The glaringly obvious thing to point out here is that for a single-person household, this falls short of the benchmark set out above for the essential target retirement income, although it does just above cover the threshold for a two-person household. For many years the average UK pensioner has had an overreliance on the state pension as a source of income, so if expected expenditure requires anything over and above this, then having sufficient provisions put away in both workplace and private pensions will be crucial to improve living standards in later life.

Rather worryingly changing demographics in the UK have called into question the longevity of the state pension, with some beginning to wonder whether it will still be in place in years to come. The latest ONS data tells us the UK is 7th in the world for centenarians (those living to 100), with wealthy countries worldwide expecting exponential growth in this number by the year 2050. It’s thought that for the years 2023-24 spending on the state pension costs the UK government 5.1% of national income, or £132 billion, but with people living longer and retiring earlier, this will make continuous funding for the state pension a monumental challenge. Indeed, spending on state pensions and other benefits is projected to rise by £100 billion a year by 2070.

Laws are of course never set in stone, so in the event we see any changes to the state pension, properly planning and having a clear position on your workplace and private pensions will become increasingly crucial.

Auto-enrolment

Each employer is legally bound to contribute at least 3% of your salary towards a workplace pension. Since its introduction in 2012, this has been well received by many, but it hasn’t removed the problem by any stretch and many are still not saving enough for their retirement.

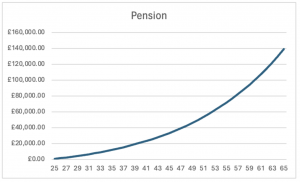

To demonstrate this point, let us look at a very basic example. If someone aged 25 starts work with a £25,000 salary, is set at the 3% minimum auto-enrolment pension contribution level, receives a 2.5% salary increase each year and they see a 5% annualised return on their pension. At the age of 65, this would leave them with a workplace pension pot of £139,139.93.

Source: Moneyfarm research. Projections are never a perfect predictor of future performance, and are intended as an aid to decision-making, not as a guarantee. Calculations based on gross projections.

Source: Moneyfarm research. Projections are never a perfect predictor of future performance, and are intended as an aid to decision-making, not as a guarantee. Calculations based on gross profit projections, net of fees.

If we assume that they live until the age of 81 this would leave them with £8,699.62 each year, which coupled with the full state pension kicking in at 67, would leave them with a grand total of £20,200.62 as an annual income.

Of course, these are very rudimentary examples, but the main point to make here is that auto-enrollment alone won’t guarantee the dream retirement. In order to maximise your pension’s potential, it’s worth checking in with your employer to see if they will match any increases to contributions going into the pot.

Other risk factors to consider

Costs of care

According to market researcher Laing Buisson, the cost of care in residential care homes skyrocketed from 2021-22 to 2022-23 by 19%. Whilst these institutions have not been immune to an increase in energy and staff costs, this has serious implications for the affordability of care. The total cost will vary depending on what type of care is received, for example, if a nursing home is needed over regular residential care, as well as the availability of care in your region.

Another thing to consider is that even though we are living longer, it’s not guaranteed that everyone can remain in work for as long as the state would hope. The Institute for Fiscal Studies maintains that 35% of men and 40% of women in their late 60s are considered disabled (with longstanding health issues affecting daily activities), meaning that this can reduce people’s abilities to maintain working habits towards the tail end of their careers. It may mean that personal savings will need to be used to cover any income shortfalls with a less-than-generous working-age benefit system.

Pension risk profile

Many workplace pensions will adhere to an investment strategy called ‘lifestyling’, which may not be the best solution for everyone. This is a process whereby the fund provider will taper off the overall risk profile with your pension as you approach workplace retirement.

If we assume that people are living significantly longer, then having a conservative risk profile with your pension too early will mean that you may not capitalise on many years of growth in the market. As such, this may mean that this brings down the level of income you have once you begin taking benefits from your savings pot, in other words, making it an unsuitable option for your retirement plans.

Having a clear idea of your position is of paramount importance, and it’s always best to seek financial guidance to understand whether this is applicable to you and if this is the best option.

Housing – renting vs owning

The number of private renters (a tenant to a private landlord) in the UK has risen by 73.64% from 1982 to 2022, according to research by Statista. Younger adults will have a heavy weighting to this figure, with many struggling to get onto the housing ladder as house prices rise at a faster rate than wages. Usually, those who own their own property will have paid off their mortgage by the time they come around to retirement, but if mortgage start dates start later, or people remain private tenants for the rest of their lives, this can significantly eat into any retirement savings built up throughout the years.

Private renters will also not have the luxury of the capital injections of house downsizing or through property equity release. If you find yourself in the position stated above, then maximising pension contributions wherever possible, and as early as you can, certainly help reduce the burden of prolonged housing costs later in life.

Where does this leave us?

The best thing you can do is to start visualising what you would hope to see for yourself in later life. Having a clear outline can then determine what steps need to be taken in order to reach your goals. As always, it is recommended that you seek professional guidance so if you are uncertain about your next steps please book an appointment with one of our consultants using the link here.

Peter Rice: Peter is an Investment Adviser at Moneyfarm having joined in October 2021 as a Junior Investment Consultant. Having held numerous client-facing roles over a span of many years, he currently helps customers achieve their financial goals, conducts portfolio reviews, and provides assistance in the creation of content pieces for the company. Peter holds the Investment Advice Diploma with the CISI, as well as an MA in International Business Management from Heriot-Watt University and a MSc in Finance from the University of Edinburgh.

Peter Rice: Peter is an Investment Adviser at Moneyfarm having joined in October 2021 as a Junior Investment Consultant. Having held numerous client-facing roles over a span of many years, he currently helps customers achieve their financial goals, conducts portfolio reviews, and provides assistance in the creation of content pieces for the company. Peter holds the Investment Advice Diploma with the CISI, as well as an MA in International Business Management from Heriot-Watt University and a MSc in Finance from the University of Edinburgh.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.