When investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up, and you may get back less than you invest. Past performance is not a reliable indicator of future performance. If you are unsure investing is the right choice for you, please seek financial advice.

Make no mistake, the current savings environment is very attractive. Interest rates across most developed economies have risen sharply as central banks grapple with the highest levels of inflation seen since the early 1970s. What this means for savers is that banks have been able to pass on favourable savings rates over and above anything seen since the late noughties. On the other hand, investments and financial markets have suffered greatly – with the abrupt rise in interest rates affecting both the more and less volatile components of a traditionally diversified portfolio.

When rates are high it greatly increases the cost of borrowing for organisations, reducing their capacity to explore research and development and invest in future projects, something which diminishes demand for investment in companies. On top of this bonds share an inverse relationship with interest rates, so as rates rise the value of bonds fall. Where this leaves us is in a position of high uncertainty on a short-term basis.

As a result of the change in monetary policy, however, the use of cash or cash alternative products has greater importance in financial planning. The usual recommendation is that people should have enough of a cash buffer to help provide liquidity in urgent situations, such as unexpected tax bills or significant life events. People will of course have varying expenditures, income levels, or indeed risk tolerances, but the usual recommendation is to have at least 3-6 months of total expenditure to hand. Coincidentally, those with short time horizons, say 1 to 2 years, can take advantage of secure and low volatility vehicles.

To that end, at present there are a plethora of options available. For example the average one-year bond savings account and fixed-term cash ISA returns 5.34% and 3.89%*, respectively, whilst our own Liquidity+ which invests in money market funds currently yields over 5.3% (without any lock in). It is important to note though that cash and cash alternatives carry strength in the short-term, whilst investment returns provide greater expected returns on a medium to long term basis. In fact, JPMorgan research suggests that a traditional 60/40 equities and bonds portfolio will outperform cash and inflation by 4.1% and 4.5% annually over the next 10 years.

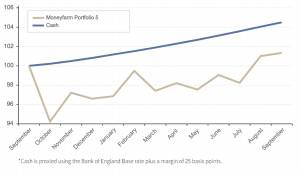

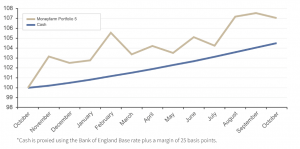

But to demonstrate the power of cash and the unpredictability of markets on a 12 month basis, I will set out two examples below: one starting in September 2022 and one starting in October 2022.

Moneyfarm Portfolio 5/7 vs Cash September 2022 – September 2023

Moneyfarm Portfolio 5/7 vs Cash October 2022 – October 2023

Despite being only one month apart in their start dates, the gap in returns is stark (+5.69% if you started in October as opposed to September). This is ultimately the best confirmation of how, in the short term, the entry point into financial markets can carry significant bias in the returns you receive. Cash or cash alternatives though offer dependability and means the nominal value of your money will not fall.

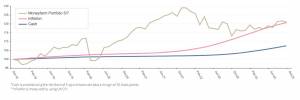

And we can see that at play at the moment. Over a short timeframe most savings rates will be competitive with inflation prints, but historically the longer you opt for cash savings the more your money will be eroded by the impact of inflation. The current level of inflation presently stands at 6.70%, so any return beneath this loses out in real terms.

Moneyfarm Portfolio 5/7 vs Cash over 5 years

Please note, investments carry risk and the value will fluctuate so your capital is at risk and you may get less than put in.

Despite investments working in a negative market for around 18 months, when taking a step back and looking at the performance of a diversified portfolio over a 5 year period we can see that a balanced investment approach holds up more strongly to the impact of inflation. If we look at the graph above we see how the performance of our portfolio 5 (a reflection of a traditionally balanced 60/40 portfolio) has outperformed cash and inflation.

As with any form of investment there are no absolute guarantees but one of the key benefits of an investment portfolio is that although you see short-term falls in times of market stress, it capitalises on periods of high growth. Naturally it goes without saying that past performance is not an indicator of future performance, but history tells us that holding a diversified portfolio can give you an edge over a medium- to long-term time horizon in both real and nominal terms.

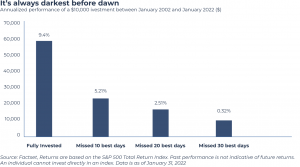

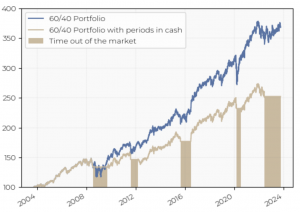

One of the comments I commonly hear from clients is that “I will go to cash for the time being whilst markets are volatile and reinvest when things are looking a bit better”. Again what history tells us is that this usually is a very costly strategy which has great detriment to long-term returns.

But does this mean cash savings holds no value? Of course it doesn’t, savings accounts provide a guarded solution to those with a short time frame where one cannot afford to take a high degree of risk. But to quote the great economist Milton Friedman, “inflation is taxation without legislation”, and as evidenced here, over a long time span cash can fail victim to the harmful effects of rising prices. There is no absolute panacea when it comes to investment returns, but patience in the face of adversity and within the parameters of a risk profile that one can tolerate certainly gives you an advantage in the pursuit of generating sustainable long-term growth. As ever, it is always recommendable to receive financial guidance to make sure your capital is working as effectively for you as possible.

Peter Rice: Peter is an Investment Adviser at Moneyfarm having joined in October 2021 as a Junior Investment Consultant. Having held numerous client-facing roles over a span of many years, he currently helps customers achieve their financial goals, conducts portfolio reviews, and provides assistance in the creation of content pieces for the company. Peter holds the Investment Advice Diploma with the CISI, as well as an MA in International Business Management from Heriot-Watt University and a MSc in Finance from the University of Edinburgh.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.