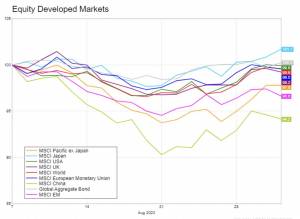

August has been a turbulent month. Both the stock and bond markets have shown negative performance. The Fed has reaffirmed its tough stance on inflation, dampening the optimism of recent months and slowing the markets down. Additionally, the Chinese real estate market has returned to the spotlight with the failure to pay two bond coupons by the developer Country Garden and the collapse of Evergrande, once again highlighting the fragile foundations of Chinese growth over the last decade. Europe, on the other hand, continued to slow down, certainly not helped by the Chinese slowdown. In short, many of the risks we had highlighted in recent months have come to fruition, as can be seen from the chart showing negative performance for the main asset classes. However, we still believe there are reasons to be positive.

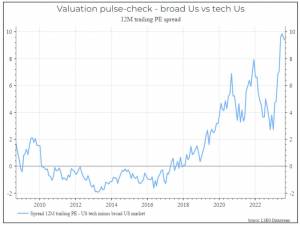

Moving on to the analysis of various asset classes, August has been characterised by a significant rise in interest rates (11 basis points on the 10-year US Treasury yield at the end of the month, with a peak of 30 basis points in mid-August). Consequently, it has been challenging for stocks, especially for sectors with a high duration profile (tech, in particular), while expectations related to artificial intelligence are normalising.

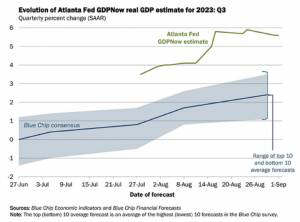

On the positive side, the American economy remains strong and is relatively unaffected by rising interest rates and the situation in China. Even though the labour market has surprised negatively this month, the US continues to perform well and maintains a high likelihood of a soft landing, which certainly remains the base case scenario for the markets.

It’s too early to start celebrating

The month started off poorly for the US, with the credit rating agency Fitch downgrading American debt, primarily due to the “dysfunctional” political situation and the challenging sustainability of the debt itself. Shortly after, the release of the Fed’s minutes added even more pressure on American interest rates, revealing that most participants in the central bank’s monetary policy decisions remain concerned about inflation, thus pushing money markets to price in another rate hike for November. The determination and the need to continue the fight against inflation were also reiterated during the annual meeting of bankers in Jackson Hole, postponing the prospects of a rate hike to early 2024.

The sentiment was confirmed by the very solid data coming from the American economy, which continues to perform well in 2023, far above the most optimistic expectations, with a projected GDP growth for Q3 of as much as 5.6% (according to the Atlanta Fed). Furthermore, the earnings season has been particularly positive, with 79% of companies beating expectations.

In short, a resilient economy, persistently high inflation (4.7% core year-on-year), and historically low unemployment rates seem to promise higher interest rates for a longer duration. Signs of a slowdown in the labour market, with JOLTs new job openings falling below expectations by almost 650,000, remain too weak to convince that a soft landing is not the base scenario.

On the positive side, the yield curve has steepened, suggesting that at the very least, recessionary expectations have diminished, and there is hope for a new rally if inflation were to be tamed.

Profits to make Nvidia proud

Overall, the earnings season has been positive for the S&P 500, with 79% of companies surpassing expectations, exceeding the 10-year average (73%). Regarding revenues, 63% of companies have beaten expectations, in line with the 10-year average. The technology sector performed even better, with 92% of companies surpassing earnings expectations. One of the standout performers, as expected, was Nvidia. The company greatly exceeded expectations with a year-over-year profit growth of 429%, projecting third-quarter sales of $16 billion, and, most notably, signalling strong optimism to the markets with the announcement of a $25 billion buyback program.

However, the market’s response has been modest. The price movement for companies that beat expectations averaged only +0.5% in the two days following the quarterly reports, compared to a five-year average of 1%. Looking at the tech sector, the numbers are even more surprising, with a negative reaction of -1.5% in cases of positive surprises, which are normally associated with positive price reactions. Not even Nvidia’s data was enough, as the company’s 3.3% jump did not translate to the rest of the NASDAQ on the day of the announcement.

In short, even though the wave of enthusiasm generated by AI seems to be fundamentally justified, valuations remain elevated (Nvidia’s price-to-earnings ratio is at 244.9 compared to the S&P’s average of 20.7), and to continue to see growth, sustained earnings growth will be necessary in the medium term.

Currently, the markets are pricing in earnings growth for the S&P of 0.5% and 8.2%, respectively, in the next two quarters, and a quintupled earnings growth for Nvidia in the next 12 months. These numbers will need to continue to be exceeded to support these price levels. We believe the likelihood of this happening is certainly higher than a few months ago, but we still see potential downside risks, especially due to quantitative measures and credit restrictions, and therefore, we maintain a slightly conservative position.

The fragile foundations of the Chinese dream

One of the risk factors affecting our assessment is the crisis related to the failure to pay certain coupons by Country Garden and the collapse of Evergrande, a construction company that made headlines at the end of 2021 due to its extravagant management and high levels of debt. Although the crisis effectively began two years ago, with new government regulations aimed at reducing the banking sector’s exposure to the real estate sector and, in essence, the leverage of the real estate sector, these new cracks are worrisome because they appear to conceal greater vulnerabilities.

Country Garden is indeed considered a builder with a much stronger balance sheet compared to Evergrande, and the failure to make payments seems to reflect something more than just reckless financial management. Chinese homebuyers have lost confidence in the ability of builders to complete their homes on time, often paid in advance, and the resulting slump in sales is putting pressure on the liquidity of developers who were relying on new “advances” to pay off debts and complete ongoing projects. Overall, The Guardian has estimated that companies responsible for 40% of property sales in China have encountered difficulties in servicing their debts since the introduction of the “three red lines” policy. According to Bloomberg, the amount of debt held by property groups at risk of default is even equivalent to 12% of China’s GDP.

So far, the Beijing government appears willing to “sacrifice” some builders in the name of transitioning to an economy less dependent on real estate, but this trend could reverse if the crisis takes on a systemic nature.

The Chinese real estate crisis unmistakably highlights certain limitations of the Dragon’s economy: demographic problems, limited diversification, an overgrown real estate sector and inefficiencies in local governance. Financial assets have also suffered, historically struggling to reap the benefits of the country’s economic growth.

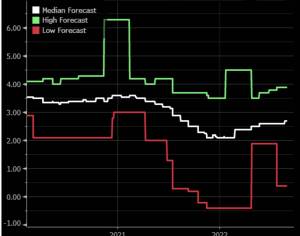

Overall, the global economy today appears strong enough to withstand it, as demonstrated by the ongoing rise in average global growth expectations gathered by Bloomberg (as shown in the chart below). We believe that China has all the resources to avoid a severe crisis, at least in the short term. However, in pursuit of long-term objectives, it seems prepared to bear a cost, both economic and political, which could impact Chinese growth prospects and, to some extent, global ones as well.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.