Markets have pulled back a little in recent days and, while we don’t think the moves are especially significant, we wanted to take stock.

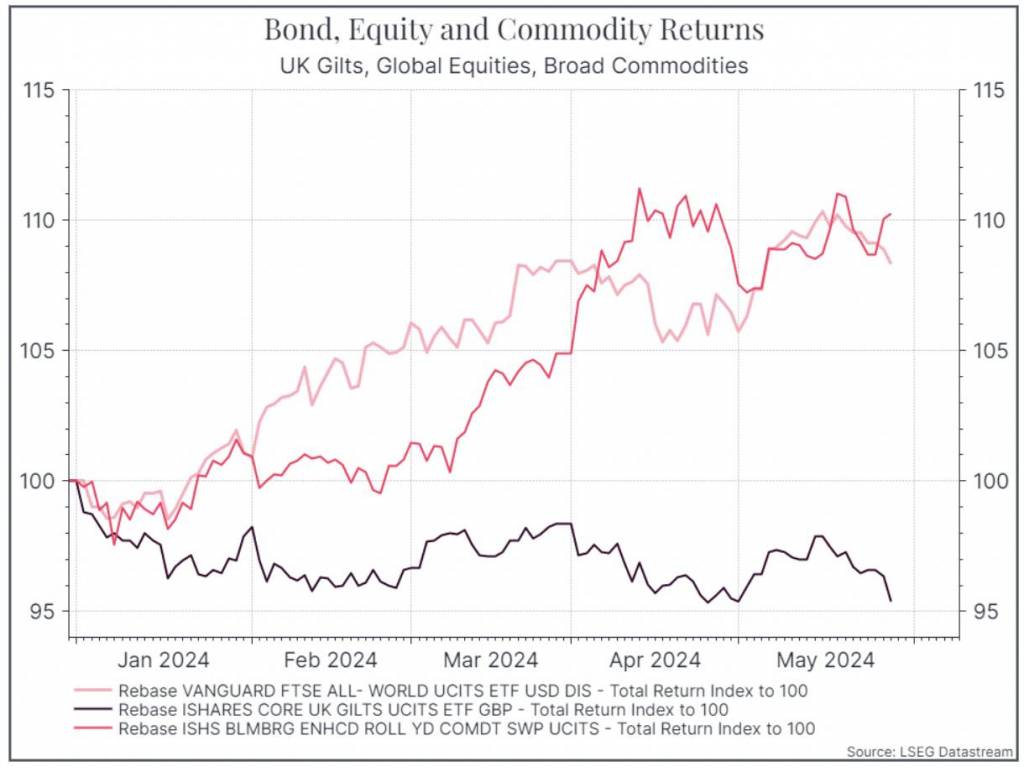

First, let’s see where we are. The chart below shows returns for Global Equities, UK government bonds and broad commodities since the start of the year. As we noted before, equities have rolled over a little in recent days. Government bonds have had a tough few months including the past week or so, while commodities continue to hold up fairly well.

As is often the case, there’s a lot of focus on Central Bank policy. US central bankers continue to send a conservative message on inflation and interest rates. Most recently Fed Governor Kashkari reminded everyone that while it might not be his base case, it’s still possible that policy rates could rise again from here.

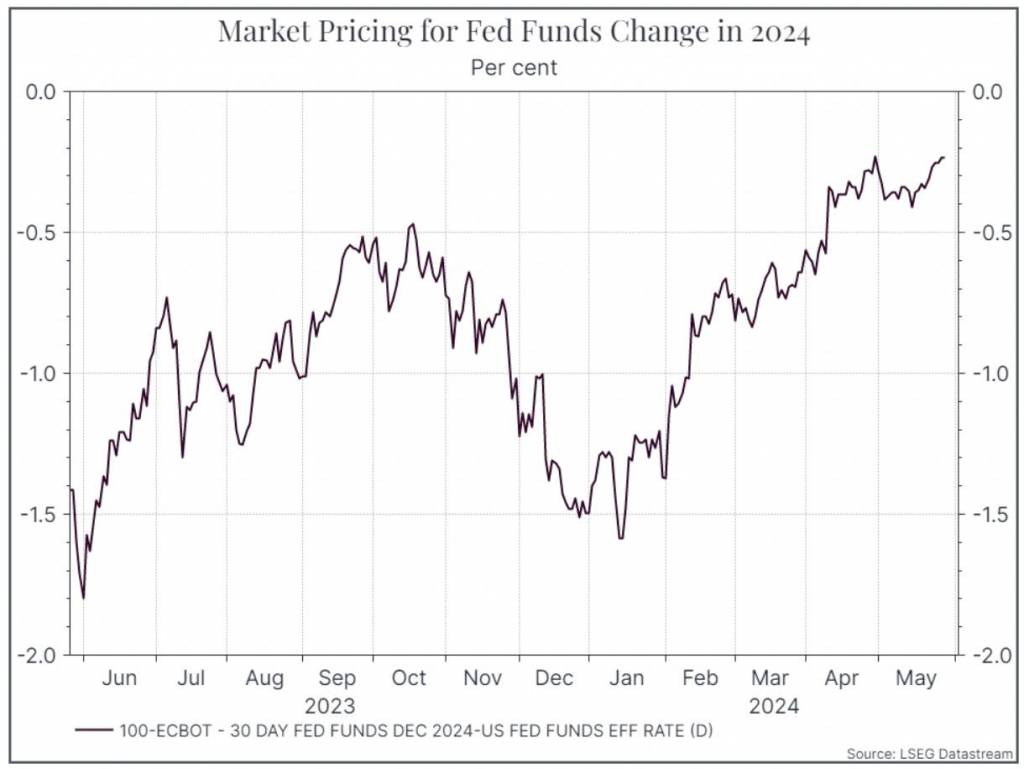

Expectations for rate cuts this year in the US continue to diminish. The chart below shows how much market expectations have moved. At the start of the year, investors expected the US policy rate to be 1.5% lower at the end of 2024. Now, the expectation is for only one rate cut this year (0.25%).

But we don’t think that’s the whole story. One popular way of thinking about the investment world is in terms of four different scenarios – in which growth and inflation are either accelerating or decelerating. The first prize is when growth is accelerating and inflation is decelerating. In that case, equities and bonds could do well in theory. The weakest scenario is one where inflation is accelerating, and growth is decelerating. Most financial assets struggle in that case.

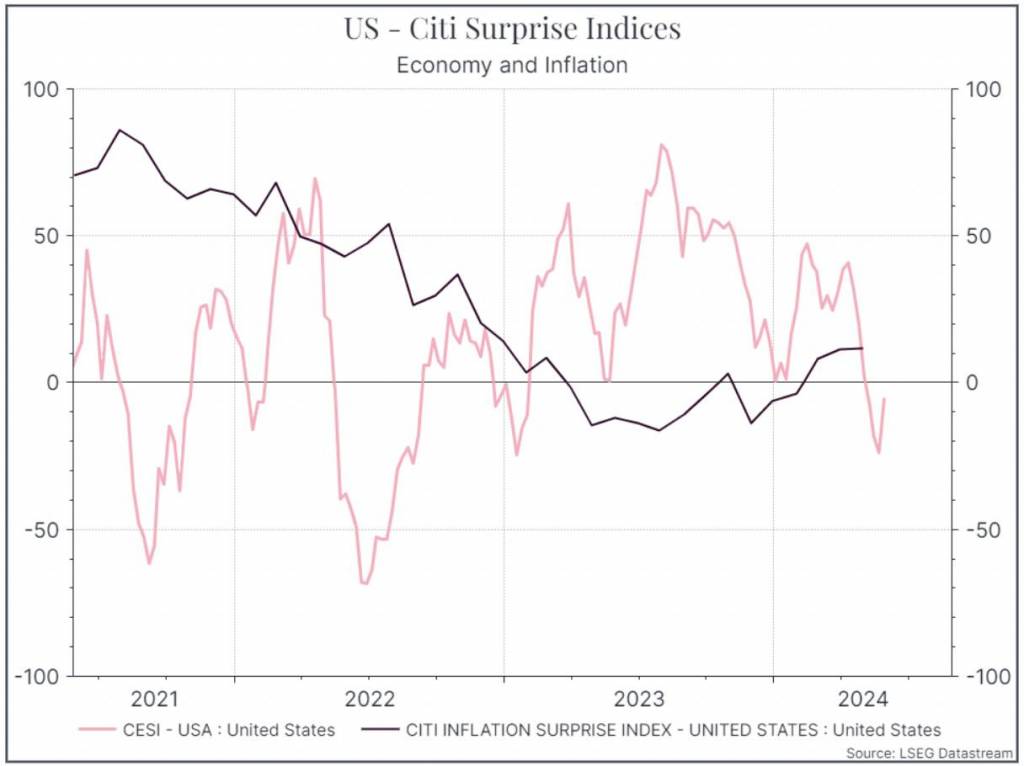

The chart below tries to capture where we are. It shows two “surprise” indices. They aggregate forecasts for different measures of growth and inflation, and then compare those forecasts to the actual results. Better-than-expected growth shows a positive number, as does higher-than-expected inflation. What we can see is that growth expectations for the US have tipped into negative territory – results were decent but just not as good as analysts had expected. In contrast, inflation figures had begun to come in a bit higher than analysts had forecast.

We’d argue that the combination of lower-than-expected growth and higher-than-expected inflation has put some pressure on markets over the past few days.

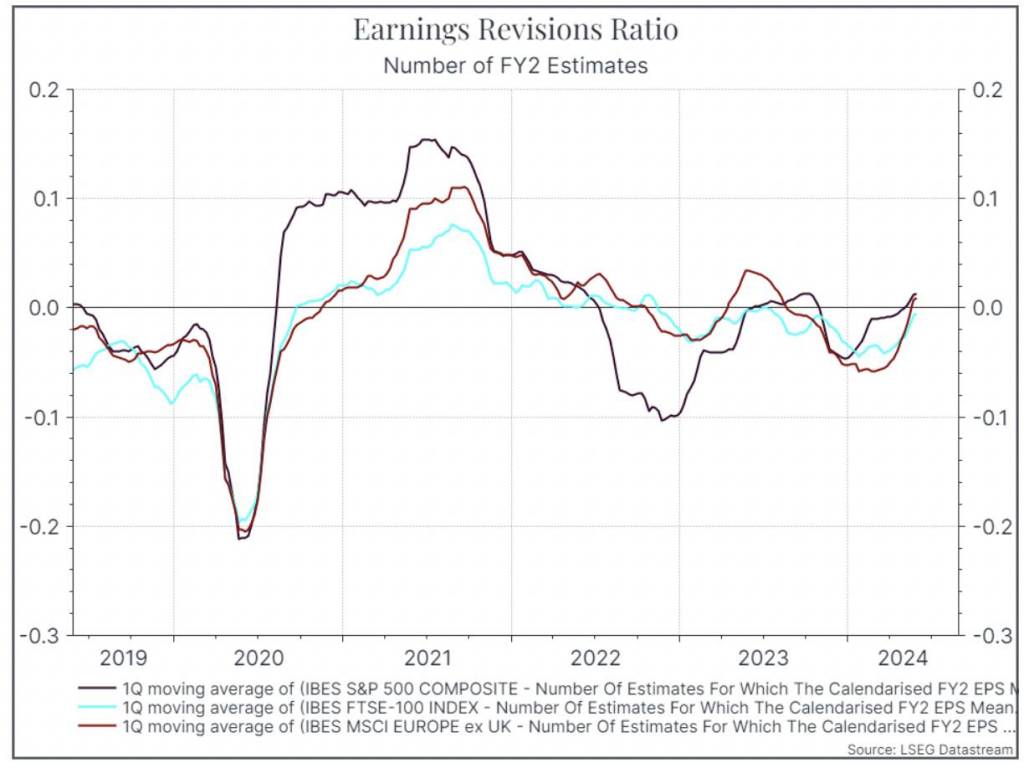

But we’re not just concerned with macro data. We also want to understand how companies are performing. On that front, the news is pretty good. The chart below shows an Earnings Revisions Ratio for the UK, US and Europe. It looks at forecasts across those equity markets and shows whether, in aggregate, more analysts are increasing or reducing their profit forecasts.

What we see is, broadly speaking, an improvement in estimates. We’re just about seeing more estimates increasing – for the first time since mid-2023.

Where does this get us? There are a few points to highlight. First, we think the recent weakness isn’t just about policy rates in the US staying higher for longer. Rather, it’s the combination of sticky inflation and signs of slower growth that might be causing concern. Second, even if we’ve seen some disappointment in macro data, the overall picture in the US remains pretty good. The economy is holding up quite well and inflation, we think, should continue to drift lower over time. Third, the picture from listed corporates still looks quite solid, with more analysts raising their forecasts. Finally, we should remember that the US isn’t the only story. We’d expect that the ECB will feel comfortable lowering rates, albeit carefully, over the next couple of months.

So, while we’ll keep a close eye on the macro data over the coming months, we haven’t seen anything that would prompt us to change our positioning.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.