By Giorgio Broggi, Quantitative Analyst, Moneyfarm

Please remember that when investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Forecasts are not a reliable indicator of future performance. The views expressed here should not be taken as a recommendation, advice or forecast. If you are unsure investing is the right choice for you, please seek financial advice.

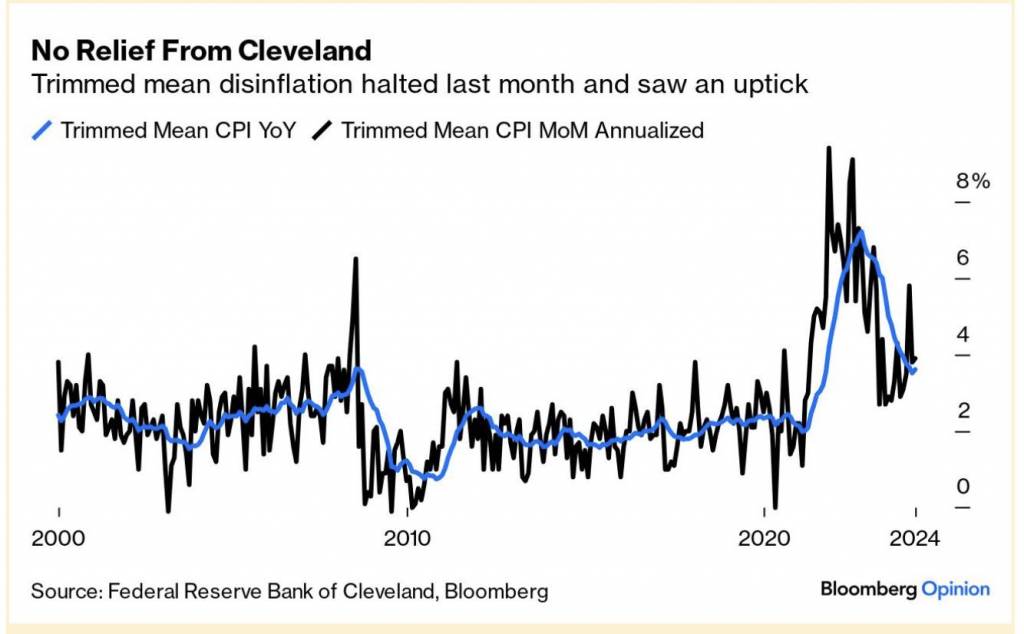

This week has seen inflation fears return to the markets after the latest American data. The increase in prices has indeed surprised on the upside, albeit slightly compared to expectations, and remains above the target level. Not only are the absolute numbers above the 2% target but also the measures preferred by the Fed (such as the super core) and those “cleaned” from outliers seem to point to upward momentum.

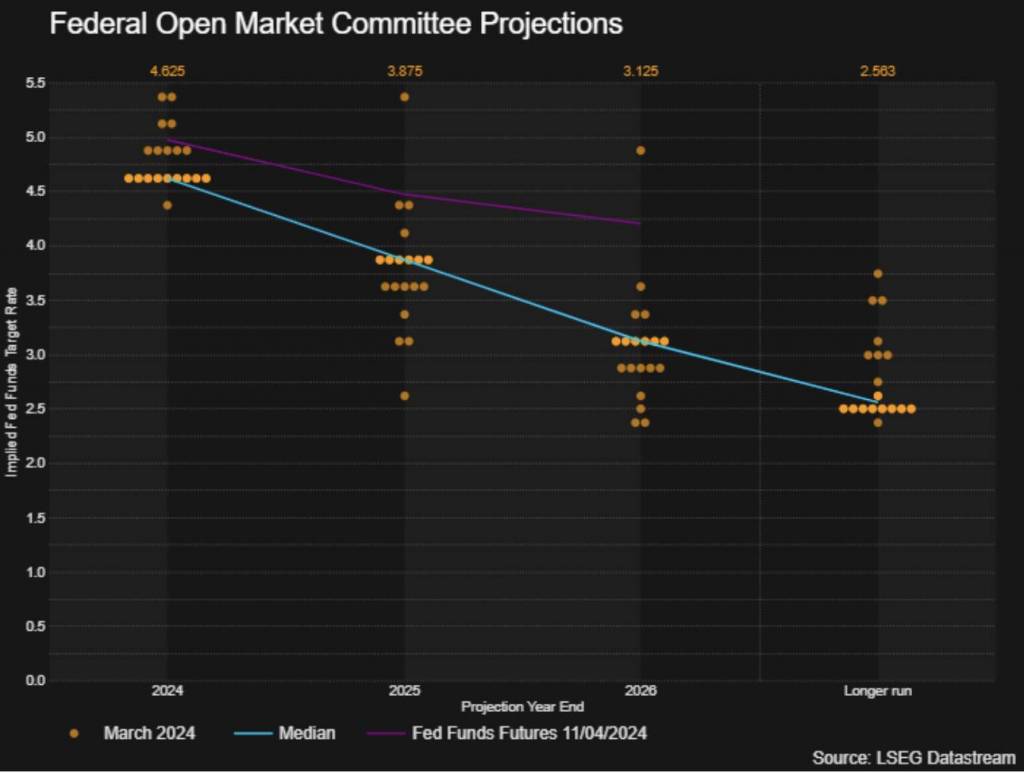

The markets reacted negatively, with the S&P 500 index falling by almost 1% in dollars on Wednesday at the time of the data release; and, above all, a strong repricing on the rates side, with the yield on the U.S. ten-year Treasury back above 4.5% (which hadn’t happened since November). The number of rate cuts by the Federal Reserve priced in by the markets for 2024 has now even dropped to two, down from the approximately seven estimated at the beginning of the year and below the expectations of the Fed itself, as represented in the dot plot, the chart published quarterly by the Federal Reserve to summarise the forecasts of the various members on the trajectory of rates.

(Source: John Authers’ Bloomberg newsletter)

However, already on Thursday, 11 April, we saw the markets rebound, and the S&P 500 itself remains about 1% higher than a month ago and even above the beginning of the week.

The message from the markets is very clear: the fundamentals of the economy and companies are strong enough to offset the increased inflation concerns. This week marks the beginning of earnings season, and if companies were to show positive outlooks, the trend is very likely to continue.

Also this week, on the other side of the ocean, the European Central Bank (ECB) maintained a very cautious tone in its latest meeting, keeping rates unchanged as expected. President Christine Lagarde reiterated that, although there have been some initial positive signs, it is too early to declare victory, although the first rate cut could come as soon as the data from now until June were to be positive.

Markets are betting on it in a challenging European macro context despite low unemployment and peripheral and fiscal risks continue—for now quietly—to persist. The risk that the ECB is making a mistake is there, and if the economy were not to continue to exceed expectations, especially for Mediterranean countries, the risk of a spread widening could return strongly. The recommendation remains to avoid concentrating too much risk on individual bond issuances, even government ones, and instead to prefer a well-diversified approach.

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.