As expected, the US Federal Reserve left its policy rates unchanged this week. And doing more or less what “everyone” expected was enough to get some equity investors excited. Why? We think that part of the answer lies in the quarterly forecasts that the Fed provided. The Fed doesn’t just make predictions about the economy – growth and inflation – at which it struggles just like the rest of us. Fed policymakers also make predictions about what they themselves will do, specifically around interest rates – and there’s often a wide range of opinion among the participants. In this case, the Feds projections were particularly interesting because they came out after two months where inflation had come in higher than expected. Investors were interested in whether these inflation releases had impacted Central Bank thinking.

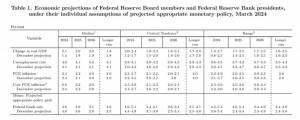

So what did the Fed say? The table below provides the detail (but doesn’t include the footnotes). It also helpfully compares these March 2024 forecasts with those provided last December.

We can see that Fed economists have raised their forecasts for economic growth for the next couple of years – particularly in 2024. That’s good news. At the same time, they barely touched their inflation forecasts, which we’d also argue is positive.

In terms of interest rate policy, the Fed collectively thinks it will make three 25 bps interest rate cuts this year – as it did in December. Policymakers think the policy rate will stay higher for longer in 2025 and 2026 – which maybe isn’t such a surprise, given the stronger growth outlook.

So, what does all this detail actually mean? We think it shows a pretty benign scenario, at least for now. Growth forecasts go up and inflation forecasts don’t really move – what’s not to like? Interest rates still come down in 2024, albeit not so much in 2025, but the Central Bank believes that the economy can weather those higher rates quite well. And that scenario has been enough to keep equity investors optimistic.

Is it plausible? Well, so far it’s fair to say the US economy has held up pretty well and inflation has come down – that’s been a better outcome than many had expected. If anything, at the moment, the greater concern might be that a cut in interest rates could actually help to re-accelerate inflation. That wouldn’t be our base case at present, but it’s something to keep in mind. Another complication is the US election cycle. Central bankers might be independent, but they are human – and the closer we get to the election, the more difficult it might be to change course in either direction.

Nothing is certain, as ever, but the message from the US central bank is a cautiously optimistic one – and that’s probably the most you’ll ever get.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.