As with all investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you are unsure investing is the right choice for you, please seek financial advice.

February was a very strong month for risky assets, with the American economy continuing to perform well, driving the rest of the world, while inflation and monetary policies remain always important, albeit less explosive than in the last two years. The earnings season in the USA ends with great strength, with Nvidia, once again, surprising on the upside. China, on the other hand, continues to suffer, being the only major question mark for global growth, with the government’s latest measures helping stocks to marginally recover, but they do not seem to reassure markets about the economy’s fragility in the medium and long term.

Overall, stocks are soaring, with global stocks up +4.3% and the USA at +5.4%. Bonds and commodities hold up. Cryptocurrencies continue their rally, showing how investor sentiment remains very much risk-on.

5,000 days like this

From a macro perspective, February did not come as a surprise. The United States continues to experience a very favorable period, with high employment markets and growth, although the manufacturing sector remains, according to PMIs, in restrictive territory, and inflation remains above the target.

The latter seems to have regained some upward momentum, which, however, does not overly frighten the markets for now, although it has, as mentioned, led to an upward spike in interest rates. The core measure year-on-year printed at 3.86%, while the nominal number fell to 3.1%, continuing to oscillate around 3% as of June 2023.

Certainly, the very tight labor market and the strong economy still represent an inflationary threat, but we do not expect a second wave. Simply put, if the economy were to continue to perform so well, the decrease from 3% to 2% could simply be a bit tougher than expected.

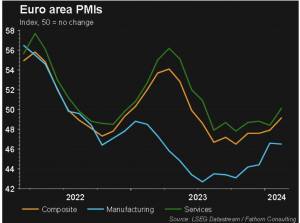

Meanwhile, Europe continues to suffer, with Germany in particular seeming unable to break free from growth difficulties (the latest HCOB Manufacturing PMI at 42.3 against an expected 46.1), although other countries, at least looking at PMIs, appear to be rebounding from the lows of the summer. The ECB does not seem concerned about growth or impressed by improvements in the inflation rate (nominal year-on-year at 2.8% and core at 3.3%), and only the March 7 meeting will provide answers regarding a possible cut before the expected June timeframe.

In the meantime, the market enjoys the favourable moment, with the S&P 500 surpassing the 5000 level. It took about 2 years and 9 months to climb from 4000.

Nvidia, a nasty beast?

The standout of the month, however, can only be Nvidia once again. In recent weeks, bearish voices on the stock had begun to emerge, with strong doubts about the company’s ability to beat expectations again after an extraordinary 2023.

Despite the strong performance since the beginning of the year, market sentiment had deteriorated to such an extent that in the two days before earnings were published, the company had plummeted by 10%, capturing skepticism about the prospects of strong fundamentals.

Once again, however, the chip producer surprised everyone, beating earnings by 11.24% and bouncing back by 16% on February 22nd. Needless to say, the positive data gave new strength to the general market rally, renewing the hype surrounding Artificial Intelligence developments and showing how betting against inevitable human progress can backfire. For now, Nvidia has managed to support its valuations with incredible earnings growth and increases in earnings expectations. The current macro context does not seem to suggest that things may change in the short term, but we always suggest a well-diversified approach when investing.

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.