What a year 2024 has been for financial markets. The (market) boost generated from the outcome of the US election added some icing on an already delicious cake for investors.

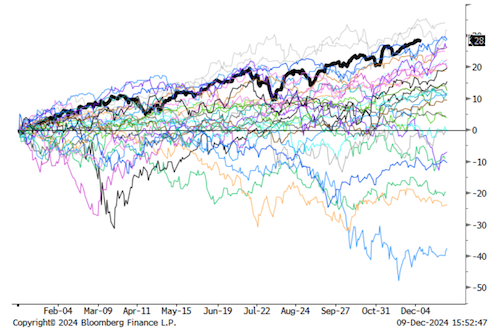

The S&P 500, the key US index, has had one of the best years for returns in recent history as you can see below (up until 9th December – the black line is this year and all other lines are the performance of individual years since 1991):

This has been a result of a resilient economy (in the US), excitement about AI, inflation coming down and expectations of rate falls.

Is this sustainable? Too good to be true?

Probably but also probably not. As we see above with the US markets, this year ranks among one of the highest in history and last year wasn’t far behind – so to get a 3rd and perhaps 4th in a row would be really unusual. But on the flip side, this is not like 2021, when markets were driven by people with excess lockdown money punting on loss making companies in a bubble creating frenzy that was then to burst badly in 2022. Yes, AI probably has a lot to live up to, but this has been a stock market growth that has been backed up by some serious earnings growth. Particularly in the large tech companies, these companies have continued to grow rapidly and their earnings look very robust.

But it wouldn’t be much of a surprise if we saw the US markets take a bit of a breather in the next year or two, perhaps with a period of market slide – as we saw a little hint of this week. But this is part and parcel of the journey and nothing to be alarmed about.

So whilst it’s great to have positive markets, it’s important to stick to your plan. Very often we see clients increasing their risk levels when markets are going strong and essentially buying more risk later in the market cycle, which can be just as costly as de-risking your investments when markets are falling.

However, conversely, we see other clients trying to time the markets and decreasing their risk. This again, proves to be a fool’s game. Every study shows that investors trying to time the markets always massively underperform the markets in the long run, as being right twice (selling and then rebuying again at the right points), when markets can move so quickly, is nigh on impossible.

Value of diversification

We always focus a lot on the US, mainly because they are the biggest region present in our portfolios – which is a decision that has, thankfully, been validated.

However it’s important to stress that the US is not the only region present and that when people talk about markets potentially overheating this refers almost exclusively to the US.

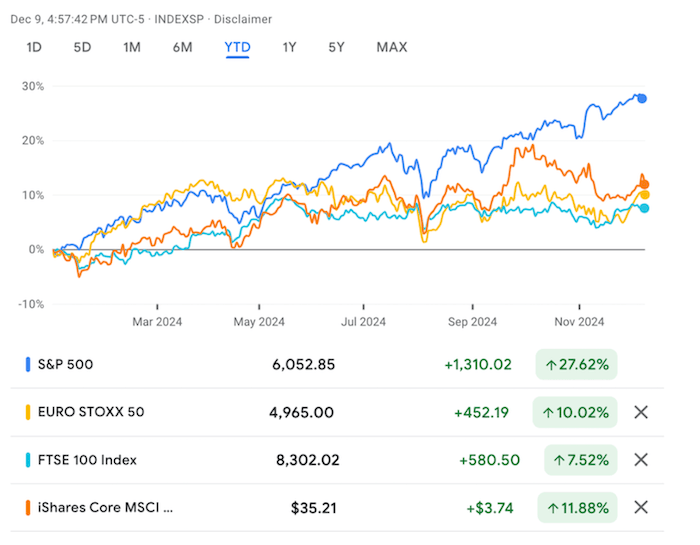

In the chart above, you can see returns of the US markets (S&P 500 in blue) vs Europe (Eurostoxx index in yellow), the UK (FTSE 100 in turquoise) and Emerging markets (ishares MSCI EM ETF in orange) – all up until the 9th of December. You can see that whilst the other regions have had positive years, it’s nothing compared to that of the US.

This is also reflected in the expected returns coming in our strategic asset allocation review, which we will share soon, but in these geographies, valuations are actually lower vs history and there is a lot of value there still in the long run. These regions are not without their issues in the short run, with China working hard to get their economy going again and the two biggest European economies having governments on the receiving end of no confidence votes. However this is all baked into the prices already and this is to show that not everything is moving completely in tandem – which is always a good sign for a portfolio manager.

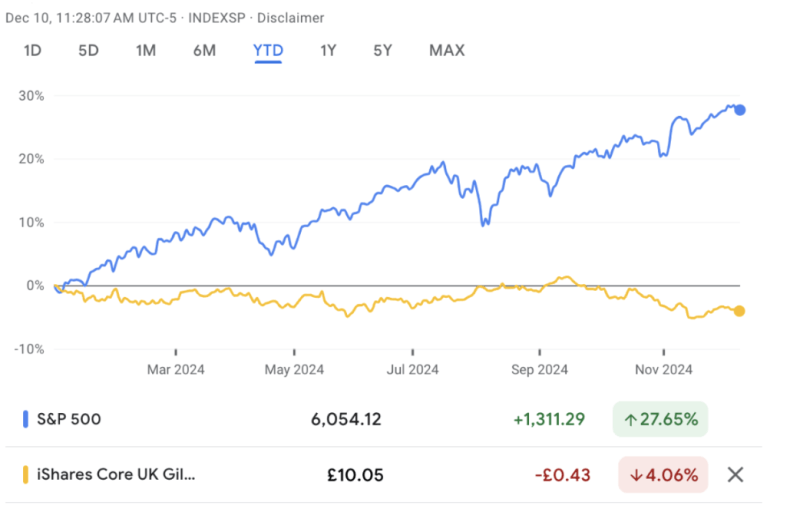

Similarly if we look across asset classes, and compare the S&P 500 vs bond market (here looking at UK government bonds through an ETF). Not only is there a difference in magnitude (obviously different risk levels) but the direction of travel is different.

Again, bond markets are wary of inflationary challenges ahead, particularly after the budget in the UK and the election result in the US. But this is in the price and further evidence that historic prices are much more reasonable outside of US equities. This is where we are confident that in the medium run, our diversified approach will help.

So we see plenty of value in the market place, whilst we still maintain a short term view that’s more heavily weighted to the US, should we see that being an issue, there are plenty of places that we can turn to.

What should you do now?

As always the guidance is to stick to the plan, a well diversified allocation that is fitting to your time horizon and risk appetite. On your investment journey you will have positive years and negative years (historically many more positive) and this has been one that we can enjoy. For the many clients who stuck to their plan through 2018 and 2022, the two negative years in recent history, this recent really is obviously great gratification of sticking to the plan.

But just as we said in those periods not to panic and that good times will be ahead, I think it’s our duty to manage your expectations and tell you that not all years will be like this as the market moves in cycles. Knee jerk reactions near the top of the market are just as harmful as those at the bottom.

Having said this, it’s certainly not all doom and gloom, our expected returns for the future are lower than they were at the start of this year, however still very much positive, with a combination of strong expectations of US earnings (company profits) and rest of the world having relatively lower valuations as drivers of future growth. So, whilst there will be some bumps in the road, there will also be future great years – these are all natural parts of the investing journey. As always, by investing your capital is at risk but we believe investing in the right portfolio is still the best option to reaching your long term goals. Particularly as interest rates on cash and low risk money markets continue to come down.

If your goals and objectives have changed, then there are a variety of other products available, particularly for the short term. So if you need to discuss these, or you would like a more in depth conversation with our team about our view on markets and what to expect in your portfolio, please book a call with us and we would be more happy to help.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.